What Is a Cypher Harmonic Pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Cypher Harmonic Pattern kya hai?

Cypher Harmonic Pattern ek aisi price pattern hai jo chart par dikhaata hai ke moomkin hai trend reversal ho raha hai. Trading signals tab confirm hote hain jab Cypher Harmonic Pattern banne ke shartein milti hain.

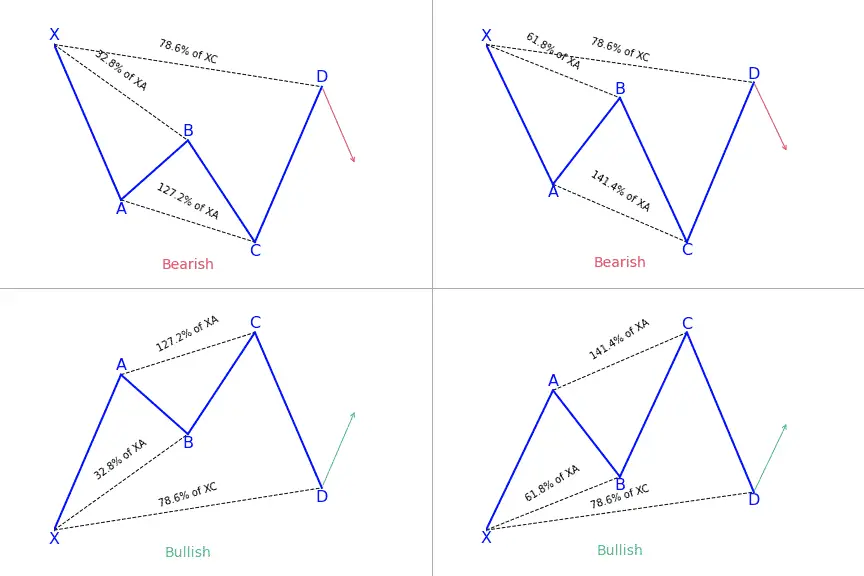

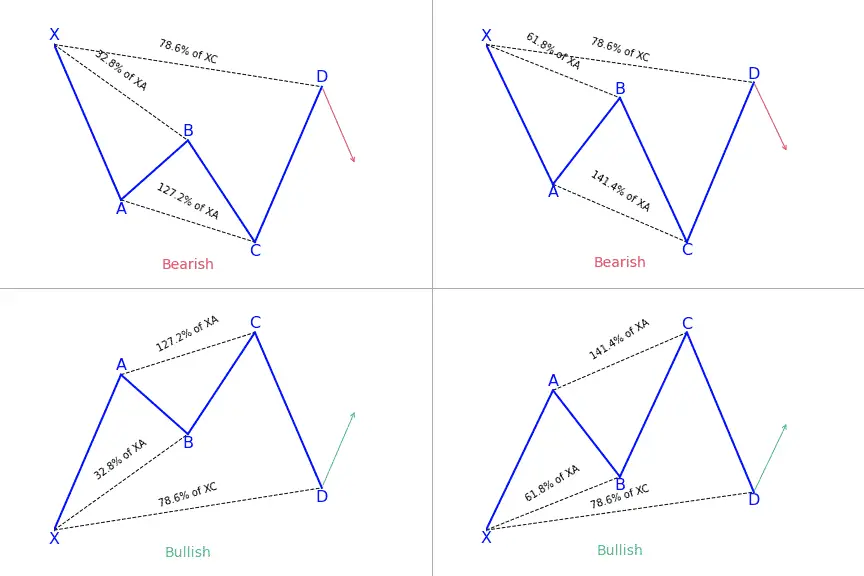

Cypher Harmonic Pattern dusre XABCD Harmonic Patterns (Butterfly, Gartley, Bat, aur Crab) ke muqable mein khaas hai iske legs ke reverse position ki wajah se. Aam taur par pehle wing ki position zyada sharp hoti hai lekin Cypher Harmonic Pattern mein doosre wing ki position zyada sharp hoti hai.

Bullish version mein, doosra wing (point C) pehle wing (point A) se zyada ooncha hota hai. Barabar, bearish version mein doosra wing pehle wing se zyada neeche hota hai.

Point C point A se zyada sharp hota hai, yeh ishara hai ke leg ke swing ki wajah se price XA leg ke trend ki taraf dobara slide hogi jab price CD line tak retrace hogi.

Iski khaasiyat ki wajah se Cypher Harmonic Pattern doosre XABCD Harmonic Patterns ke muqable mein zyada rare hai. Lekin iske inventor Darren Oglesbee ke mutabiq, iski accuracy level sabse zyada hai.

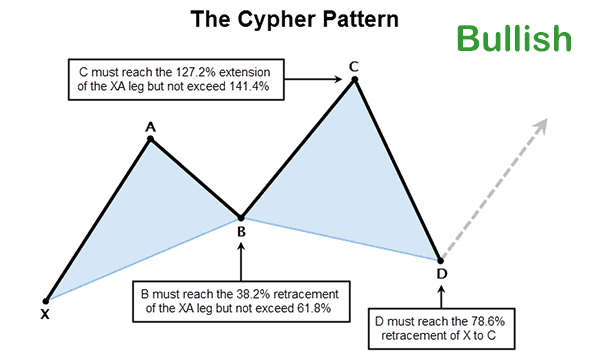

Cypher Harmonic Patterns ki basic rules:

1. Bullish version mein, XA leg lowest price point se draw hota hai jo significantly high price (swing low) tak jaata hai. Ulta, bearish version mein XA leg significant swing high se draw hota hai.

2. Line AB Fibonacci retracement 0.382 se 0.618 hoti hai XA leg ke foot se.

3. BC line Fibonacci 1.272 se 1.414 hoti hai XA leg ke foot se.

4. Last leg (CD) XC swing ki 0.786 retracement hoti hai.

Islaahiyat ke liye ideally, ye regulations saare sahi tarah se milti hain taki trading signals ki accuracy zyada ho. Lekin amli tor par, Fibonacci retracement mein thoda sa hilawat hosakti hai jiski wajah se signal ki accuracy kam ho.

Trading Strategy Cypher Harmonic Patterns ke saath:

Harmonic Cypher pattern ko sabhi timeframes aur har qisam ke Forex pairs par apply kiya ja sakta hai. Lekin novice traders ko chahiye ke ise lower timeframes se pehle H4 ya Daily jese medium timeframes par pehchanein. Taki signal ki accuracy zyada ho aur false signals ka khatra kam ho.

GBP/USD (H4) chart mein, Harmonic Cypher Pattern ne successfully bullish reversal (girte hue se barhne) ki soorat mein ishara kiya, walaum legs requirements ko pura nahi kiya gaya tha. Lekin kam se kam is pattern ki characteristic thi ke point C (doosra wing) point A se ooncha tha.

Aap Cypher Harmonic Pattern trading signal ka istemal karke position khol sakte hain jab price 0.786 retracement of XC swing ke qareeb aati hai. Image mein dikhaya gaya hai ke price ne retracement ki requirements ke last leg tak pohanchne se pehle hee rukh badal liya. Ye normal hai kyun ke market chart par dikhaye gaye pattern ke basis par nahi balki supply aur demand ki dynamics ke mutabiq move karti hai.

Reversal ko pesh kiye jane mein deri na hone ke liye, reversal candlestick patterns ka bhi mutala karein. Maqsad ye hai ke candlestick kisi khaas price point par band hone par trend reversal ko confirm kare. For example, GBP/USD chart mein bullish reversal ko Morning Star candlestick pattern banne se pata chalta hai.

Cypher Harmonic Pattern trading signal se position kholne ke baad, profit target (TP) aur stop loss (SL) set karna bhi zaroori hai jo risk management ka ek hissa hai. Stop Loss limit point X ke qareeb set kiya ja sakta hai, jabke TP Risk/Reward Ratio ke mutabiq adjust kiya ja sakta hai. GBP/USD chart ke example mein, Risk/Reward Ratio 2RR hai jisme SL ki distance 200 pips aur TP 400 pips hai. -

#3 Collapse

INTRODUCTION:

Cypher Harmonic Chart Pattern forex trading aur technical analysis mein aik special pattern hai jo common hai. Iska structure butterfly pattern ke jaisa hota hai. Yeh pattern jab create ho jata hai toh traders ko price action ka strong signal miljata hai. Is pattern ke rules mein, first leg ka high ya low point ko identify kiya jata hai aur phir second leg ko ess point se counter trend mein move hone diya jata hai. Jab second leg extreme position par pohanchta hai toh third leg create hone lagti hai. Third leg first leg ke starting point se move karti hai aur fourth leg third leg ki extension ban jati hai. Fourth leg second leg ke extreme position ky near hoti hai.

DESCRIPTION:

Market mein Cypher Harmonic Chart Pattern ko identify karna traders ke liye kafi easy hai. Is pattern ke use se traders ko strong trading signals milte hain. Cypher Harmonic Chart Pattern ki trading strategy ko implement karna traders ke liye asan hai. Is pattern ke use se traders ki risk management improve hoti hai. Cypher Harmonic Chart Pattern ki accuracy par depend karta hai. Agar traders ne pattern ko sahi tarah se identify nahi kiya toh trading results negative ho sakte hain. Is pattern ke use se traders ko trades place karne se pehle aik detailed analysis karni hoti hai. Agar traders is analysis ko skip karte hain toh trading results negative ho sakte hain. orex trading risky hoti hai aur pattern recognition ke saath bhi aapko proper risk management aur is kay ilawa technical analysis ki zaroorat hoti hai. Lehaza, forex trading mein kam shuru karne se pehle, yad say ek acchi tarah se study aur practice karne chehye.

TECHNICALITIES:

Dear friends market mein trading kerty houy Agar traders ne Cypher Harmonic Chart Pattern ko sahi tarah se identify karliya hai toh wo is pattern ke saath trading kar sakte hain.Traders Cypher Harmonic Chart Pattern ki trade entry point, stop loss aur take profit levels tayyar karte hain. Trade entry point, pattern completion level se kareeb hota hai. Stop loss level traders ki risk management strategy par depend karta hai aur take profit level Cypher Harmonic Chart Pattern ke structure par depend karta hai.Es leye yeh pattern traders ko trading mein kafi helpout ker sakta hy.

-

#4 Collapse

What Is a Cypher Harmonic Pattern?

Cypher Harmonic Pattern: Ek Taqatwar Chart Pattern

1. Taaruf (Introduction):

Cypher Harmonic Pattern ek technical analysis concept hai jo financial markets mein istemal hota hai. Ye pattern market trends ko identify karne mein madad karta hai aur traders ko potential reversal points par guide karta hai.

2. Kya Hai Cypher Harmonic Pattern?

Cypher Harmonic Pattern ek specific chart pattern hai jise traders price action aur Fibonacci retracement levels ki madad se identify karte hain. Ye pattern market mein potential trend reversal ko indicate karta hai.

3. Takhliqat (Formation):

Cypher pattern ki formation kuch steps par mabni hoti hai. Ye steps Fibonacci retracement levels aur extension levels par base hoti hain. Is pattern mein market ki volatality aur price swings ko consider kiya jata hai.

4. Khasiyat (Characteristics):

Cypher Harmonic Pattern mein key characteristics shamil hain, jese ke specific Fibonacci ratios aur geometric shapes.

Is pattern mein traders ko market mein hone wale possible reversals ka andaza hota hai.

5. Kaise Identify Karein (Identification):

Cypher Harmonic Pattern ko identify karne ke liye traders ko market ke price swings aur Fibonacci levels ko closely monitor karna hota hai. Is pattern ki sahi pehchan karne mein practice aur experience ki zarurat hoti hai.

6. Trading Mein Istemal (Application in Trading):

Traders Cypher Harmonic Pattern ko apni trading strategy mein shamil karke market movements ka better anticipation kar sakte hain. Is pattern ki sahi samajh traders ko trading decisions mein madad karti hai.

7. Nuqta-e Nazar (Conclusion):

Cypher Harmonic Pattern ek powerful tool hai jo traders ko market trends aur reversals ka advance indication deta hai. Lekin, har trading strategy ki tarah, isko istemal karne se pehle thorough research aur analysis ki zarurat hoti hai.

Is pattern ki sahi samajh aur istemal se traders apni trading skills ko improve kar sakte hain aur market movements ko behtar taur par samajh sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#5 Collapse

What Is a Cypher Harmonic Pattern?

Cypher Harmonic Pattern: Ek Taqatwar Chart Pattern

1. Taaruf (Introduction):

Cypher Harmonic Pattern ek technical analysis concept hai jo financial markets mein istemal hota hai. Ye pattern market trends ko identify karne mein madad karta hai aur traders ko potential reversal points par guide karta hai.

2. Kya Hai Cypher Harmonic Pattern?

Cypher Harmonic Pattern ek specific chart pattern hai jise traders price action aur Fibonacci retracement levels ki madad se identify karte hain. Ye pattern market mein potential trend reversal ko indicate karta hai.

3. Takhliqat (Formation):

Cypher pattern ki formation kuch steps par mabni hoti hai. Ye steps Fibonacci retracement levels aur extension levels par base hoti hain. Is pattern mein market ki volatality aur price swings ko consider kiya jata hai.

4. Khasiyat (Characteristics):

Cypher Harmonic Pattern mein key characteristics shamil hain, jese ke specific Fibonacci ratios aur geometric shapes.

Is pattern mein traders ko market mein hone wale possible reversals ka andaza hota hai.

5. Kaise Identify Karein (Identification):

Cypher Harmonic Pattern ko identify karne ke liye traders ko market ke price swings aur Fibonacci levels ko closely monitor karna hota hai. Is pattern ki sahi pehchan karne mein practice aur experience ki zarurat hoti hai.

6. Trading Mein Istemal (Application in Trading):

Traders Cypher Harmonic Pattern ko apni trading strategy mein shamil karke market movements ka better anticipation kar sakte hain. Is pattern ki sahi samajh traders ko trading decisions mein madad karti hai.

7. Nuqta-e Nazar (Conclusion):

Cypher Harmonic Pattern ek powerful tool hai jo traders ko market trends aur reversals ka advance indication deta hai. Lekin, har trading strategy ki tarah, isko istemal karne se pehle thorough research aur analysis ki zarurat hoti hai.

Is pattern ki sahi samajh aur istemal se traders apni trading skills ko improve kar sakte hain aur market movements ko behtar taur par samajh sakte hain.

-

#6 Collapse

What Is a Cypher Harmonic Pattern?

Cypher Harmonic Pattern: Ek Taqatwar Chart Pattern

1. Taaruf (Introduction):

Cypher Harmonic Pattern ek technical analysis concept hai jo financial markets mein istemal hota hai. Ye pattern market trends ko identify karne mein madad karta hai aur traders ko potential reversal points par guide karta hai.

2. Kya Hai Cypher Harmonic Pattern?

Cypher Harmonic Pattern ek specific chart pattern hai jise traders price action aur Fibonacci retracement levels ki madad se identify karte hain. Ye pattern market mein potential trend reversal ko indicate karta hai.

3. Takhliqat (Formation):

Cypher pattern ki formation kuch steps par mabni hoti hai. Ye steps Fibonacci retracement levels aur extension levels par base hoti hain. Is pattern mein market ki volatality aur price swings ko consider kiya jata hai.

4. Khasiyat (Characteristics):

Cypher Harmonic Pattern mein key characteristics shamil hain, jese ke specific Fibonacci ratios aur geometric shapes.

Is pattern mein traders ko market mein hone wale possible reversals ka andaza hota hai.

5. Kaise Identify Karein (Identification):

Cypher Harmonic Pattern ko identify karne ke liye traders ko market ke price swings aur Fibonacci levels ko closely monitor karna hota hai. Is pattern ki sahi pehchan karne mein practice aur experience ki zarurat hoti hai.

6. Trading Mein Istemal (Application in Trading):

Traders Cypher Harmonic Pattern ko apni trading strategy mein shamil karke market movements ka better anticipation kar sakte hain. Is pattern ki sahi samajh traders ko trading decisions mein madad karti hai.

7. Nuqta-e Nazar (Conclusion):

Cypher Harmonic Pattern ek powerful tool hai jo traders ko market trends aur reversals ka advance indication deta hai. Lekin, har trading strategy ki tarah, isko istemal karne se pehle thorough research aur analysis ki zarurat hoti hai.

Is pattern ki sahi samajh aur istemal se traders apni trading skills ko improve kar sakte hain aur market movements ko behtar taur par samajh sakte hain.

-

#7 Collapse

What Is a Cypher Harmonic Pattern?Cypher Harmonic Pattern: Fikri Aur Takneekiy Tijarat Ka Raaz

Fikri aur takneekiy tijarat mein barh-chadh kar aagay badhne walay traders aur investors ke liye, Cypher Harmonic Pattern aik ahem taraqqi hai. Yeh ek khaas qisam ka pattern hai jo technical charts ki duniya mein apni pehchaan bana raha hai, jo natural tabdile aur sangeet ki samajh par mabni hota hai.

Cypher Harmonic Pattern ko Harmonic Trading ka hissa samjha jata hai, jo keemat aur waqt ke darmiyan hamwarun talluqat ko khoobsurti se darust karta hai. Yeh pattern mukhtalif qeemti aur waqt ke hamwarun talluqat ko zahir karta hai jo trading charts par nazar aata hai.

Cypher Harmonic Pattern ka ahem pehlu yeh hai ke yeh qeemtiyon ke darmiyan talluqat ko khoobsurti se zahir karta hai aur traders ko mumkin mudaakhilat aur nikalne ke mauqay mein rehnumai faraham karta hai. Yeh mukhtalif harmonic patterns mein se aik hai jo traders ko apne tijarat ke amal mein sahi tarteeb dene mein madad karta hai.

Aam Harmonic Pattern ki ek qisam, jise Cypher Harmonic Pattern kehte hain, teen mukhtalif qeemti ya tootay gaye maqamat ko zahir karta hai jin mein koi ham ahangi mojood hoti hai. Yeh pattern mukhtalif indicators aur harmonic theories par mabni hota hai jo trading charts par dikhaya jata hai.

Cypher Harmonic Pattern ka istemaal technical analysis mein mukhtalif maqamat par kiya ja sakta hai. Yeh traders ko mukhtalif qeemtiyon aur tareekhi data par mabni charts ka tajzia karne mein madad deta hai taki woh sahi tarteeb mein tijarat ke amalat kar sakein.

Cypher Harmonic Pattern ke tashkeel mein sangeet aur technical analysis ka aapas mein mutabaqat ka asar milta hai. Yeh traders ko market ki harkat ko samajhne mein madad karta hai aur unhe mukhtalif maqamat par sahi faislay karne mein madad faraham karta hai.

Yakhni, Cypher Harmonic Pattern ek aisa taraqqi hai jo technical analysis mein sangeet aur umeed ka asar milata hai. Yeh traders ko market ke harkat ko samajhne mein madad karta hai aur unhe sahi mudaakhilat ke mauqay par sahi faislay karne mein madad deta hai.

Akhir mein, Cypher Harmonic Pattern traders aur investors ke liye aik nayi raahnumai hai jo technical analysis mein sangeet aur umeed ko jama kar raha hai. Yeh pattern market ke tabdile aur sangeet ki samajh ke zariye traders ko apne tijarat ke karwaiyon mein sahi tarteeb dene mein madad karta hai.

-

#8 Collapse

Cypher Harmonic Pattern ek technical analysis tool hai jo foreign exchange market mein future price movements predict karne ke liye istemal hota hai. Ye forex trading mein ek relatively new concept hai, jo harmonic aur fractal geometry ke elements ko combine karta hai taki traders ko market trends par ek unique perspective mil sake.

Cypher Harmonic Pattern ka base yeh principle hai ki market ek cyclical pattern mein move karta hai, aur ye cycles mathematical principles ka istemal karke identify aur analyze kiye ja sakte hain. Ye pattern uske creator, trader Daniele Cypher ke naam par rakha gaya hai, jo ne late 1990s mein is concept ko develop kiya.

Cypher Harmonic Pattern ek series of harmonic ratios aur fractal shapes se bana hai jo potential price movements ko identify karne mein istemal hote hain. Ye ratios aur shapes Fibonacci sequence par base hote hain, jo numbers (0, 1, 1, 2, 3, 5, 8, 13, 21, etc.) ko add karke generate hoti hai.

Cypher Harmonic Pattern ka istemal kai alag harmonic ratios, jaise Golden Ratio (1.618), Silver Ratio (1.272), aur Bronze Ratio (1.444), ke sath hota hai. Ye ratios potential price movements ko identify karne aur future price action ko predict karne mein istemal hote hain.

Cypher Harmonic Pattern alag alag fractal shapes ka bhi istemal karta hai, jaise Gartley Pattern, Butterfly Pattern, aur Bat Pattern. Ye shapes potential price movements ko identify karne aur future price action ko predict karne mein istemal hote hain. Gartley Pattern, for example, ek four-point reversal pattern hai jo Golden Ratio par based hai. Isme char price points hote hain jo ek pattern banate hain jo letter M ya letter W ki tarah dikhta hai. Butterfly Pattern ek five-point reversal pattern hai jo Silver Ratio par based hai. Isme paanch price points hote hain jo ek butterfly ki tarah dikhta hai. Bat Pattern ek three-point reversal pattern hai jo Bronze Ratio par based hai. Isme teen price points hote hain jo ek bat ki tarah dikhta hai.

Cypher Harmonic Pattern ka istemal future price movements predict karne ke liye iske harmonic ratios aur fractal shapes ke beech ke relationships ko analyze karke hota hai. Traders is pattern ka istemal potential reversals aur continuations ko identify karne mein karte hain.

Cypher Harmonic Pattern forex trading mein ek relatively new concept hai, jo abhi bhi traders aur analysts ke dwara study aur refine kiya ja raha hai. Kuch traders ne is pattern ka istemal future price movements predict karne mein success report ki hai, jabki kuch skeptical bhi hain. Ye pattern abhi bhi ek relatively complex aur advanced concept mana jata hai, aur ise traders dwara wide scale par istemal nahi kiya jata hai.

Cypher Harmonic Pattern ka ek mukhya fayda ye hai ki ye traders ko market trends par ek unique perspective deta hai. Harmonic ratios aur fractal shapes ke beech ke relationships ko analyze karke traders market ka deeper understanding gain kar sakte hain aur informed trading decisions le sakte hain. Ye pattern versatile bhi hai aur ise alag alag currency pairs aur timeframes par apply kiya ja sakta hai.

Lekin, Cypher Harmonic Pattern ka istemal karne mein kuch potential drawbacks bhi hote hain. Ye pattern abhi tak relatively new aur untested hai, aur iski effectiveness ko support karne ke liye empirical evidence ki kami hai. Kuch traders ne report kiya hai ki is pattern ko interpret aur apply karna mushkil ho sakta hai. Iske alawa, ye pattern abhi bhi ek relatively complex aur advanced concept hai, aur ye sabhi traders ke liye suitable nahi ho sakta.

Cypher Harmonic Pattern ko effective taur par istemal karne ke liye traders ko harmonic ratios aur fractal shapes ka solid understanding hona chahiye. Unhe alag alag patterns aur unke istemal ko predict karne ke liye pata hona chahiye. Traders ko is pattern ke potential drawbacks aur limitations ke bare mein bhi pata hona chahiye, aur ise dusre technical analysis tools aur strategies ke sath istemal karna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#9 Collapse

What Is a Cypher Harmonic Pattern?

A Cypher harmonic pattern is a specific type of price pattern observed in financial markets, particularly in forex trading. It is categorized as an advanced harmonic pattern and is based on Fibonacci ratios. The Cypher pattern was developed by Scott Carney and is designed to identify potential trend reversals with a high degree of accuracy.

The Cypher pattern consists of four distinct price swings within the overall price structure. These swings are labeled XA, AB, BC, and CD. Each swing is associated with specific Fibonacci ratios, typically the 0.382 and 0.618 retracement levels. The pattern is completed when the CD leg retraces between 0.786 and 1.272 Fibonacci extension of the XA leg.

The key characteristics of a Cypher harmonic pattern include:- XA leg: This is the initial price move in the pattern, representing the first swing. It can be either an upward or downward movement.

- AB leg: The AB leg is a retracement of the XA leg, typically ranging between the 0.382 and 0.618 Fibonacci retracement levels.

- BC leg: The BC leg is the next move after the AB retracement. It typically retraces between 0.382 and 0.886 Fibonacci retracement levels of the AB leg.

- CD leg: The CD leg is the final move in the pattern. It extends beyond the XA leg and typically retraces between 1.272 and 0.786 Fibonacci extension levels of the XA leg.

- Potential reversal zone (PRZ): This is the area where the CD leg completes its retracement. It is calculated based on Fibonacci extension levels and serves as a potential reversal point.

Traders look for Cypher patterns to identify potential trading opportunities. When a Cypher pattern forms, traders may look to enter long positions near the completion of the pattern if it's a bullish Cypher, or short positions if it's a bearish Cypher. Stop-loss orders are typically placed beyond the PRZ, and profit targets are set based on Fibonacci extension levels or other technical analysis tools.

It's important to note that while Cypher patterns can be highly accurate, they are not foolproof, and traders should always use proper risk management techniques when trading any pattern or strategy.

- CL

- Mentions 0

-

سا0 like

-

#10 Collapse

Cypher Harmonic Pattern forex trading mein ek technical analysis pattern hai jo market trends aur reversals ko identify karne ke liye istemal hota hai. Yeh pattern Fibonacci retracement levels aur geometric ratios par based hota hai. Yeh hain Cypher Harmonic Pattern ke mukammal points roman Urdu mein:

Bunyadi Tassur (Foundation):

Cypher Harmonic Pattern Fibonacci retracement aur extension levels par mabni hota hai.

Pahla Impulse Leg (Initial Leg):

Pattern ki shuruaat hoti hai ek clear trend ya impulse leg se, jo price move ko indicate karta hai. Agar uptrend hai, to yeh upward move hoti hai aur agar downtrend hai, to downward move hoti hai.

Dusra Impulse Leg (Second Leg):

Dusra impulse leg pehle wale impulse leg ke against move karta hai. Agar pahli leg up thi, to doosri leg down hoti hai aur agar pahli leg down thi, to doosri leg up hoti hai.

Fibonacci Retracement Levels:

Doosri leg ko analyze karne ke liye Fibonacci retracement levels ka istemal hota hai. Doosri leg typically 0.382 ya 0.618 Fibonacci retracement level tak retrace karta hai.

Extension Leg:

Extension leg doosri leg ke baad hoti hai aur ye bhi Fibonacci levels par based hoti hai. Extension leg usually 1.272 ya 1.414 Fibonacci extension level tak extend hoti hai.

D Point:

Cypher pattern ka completion point D point hota hai, jo extension leg ke end par hota hai. D point typically 0.786 Fibonacci retracement level se milta hai, lekin kabhi kabhi 0.618 bhi ho sakta hai.

Pattern Confirmation:

Cypher pattern ki confirmation ke liye, traders Fibonacci levels ko closely monitor karte hain aur price action ko dekhte hain. Agar D point Fibonacci levels ke sath milta hai aur price action bhi confirm karta hai, to pattern complete maana jata hai. Cypher Harmonic Pattern ek advance level ka pattern hai aur iski sahi pehchan aur istemal ke liye trading experience aur technical analysis ki zarurat hoti hai. Is pattern ke istemal se pehle mukammal training aur practice zaroori hai.

-

#11 Collapse

Cypher Harmonic Pattern: Forex Trade Mein Kya Hai?

1. Introduction:

Cypher Harmonic Pattern, forex trading mein ek mahatvapurn technical analysis tool hai jo traders ko market ke movements ko samajhne aur trading decisions lene mein madad karta hai. Ye ek pattern recognition system hai jo Fibonacci retracement aur extension levels ko istemal karta hai.

Forex trading ke is dynamic aur volatile environment mein, traders ko accurate aur reliable tools ki zaroorat hoti hai jisse wo market trends ko analyze kar sake aur profitable trades execute kar sakein. Cypher Harmonic Pattern ek aisa tool hai jo traders ko potential trading opportunities provide karta hai jab market specific price movements follow karta hai.

2. Cypher Pattern Ki Tareef:

Cypher pattern, technical analysis mein ek specific price pattern hai jo market ke trend reversals ko predict karne mein madad karta hai. Ye pattern Fibonacci retracement aur extension levels par based hota hai aur traders ko specific entry aur exit points provide karta hai.

Cypher pattern ko recognize karne ke liye kuch specific rules hote hain jinhe follow karke traders market mein potential trading opportunities identify kar sakte hain. Is pattern ka primary aim market ke swings ko capture karna hai aur traders ko un swings mein se profit kamane ka mauka provide karna hai.

3. Cypher Pattern Ka Origin:

Cypher pattern ka concept H.M. Gartley ne develop kiya tha aur iski origin unke 1935 ke book "Profits in the Stock Market" mein describe ki gayi thi. Gartley ne Fibonacci ratios aur harmonic price patterns ka istemal karke market movements ko analyze kiya tha aur isse Cypher pattern ka concept aya.

Cypher pattern ka naam isliye hai kyunki ismein price ke movements geometric shapes ki tarah hoti hain jaise triangle, rectangle, ya kisi aur shape ki tarah. Ye patterns market mein common hoti hain aur traders in patterns ko identify karke profitable trades execute kar sakte hain.

4. Cypher Pattern Ki Takhleeq:

Cypher pattern ki formation Fibonacci ratios aur harmonic price patterns ke combination se hoti hai. Is pattern mein specific price swings ko identify kiya jata hai jo Fibonacci retracement aur extension levels par based hote hain.

Cypher pattern ki formation mein kuch specific points hote hain jaise X, A, B, aur C points. In points ki positions aur proportions ko analyze karke traders Cypher pattern ko identify karte hain aur potential trading opportunities ko spot karte hain.

5. Cypher Pattern Ki Recognition:

Cypher pattern ko recognize karne ke liye traders ko kuch specific rules aur guidelines follow karne hote hain. In rules aur guidelines ki madad se traders market mein Cypher pattern ki formations ko spot kar sakte hain aur unhe analyze karke trading decisions le sakte hain.

Cypher pattern ki recognition mein Fibonacci retracement aur extension levels ka istemal hota hai jisse traders specific price swings ko identify kar sakein. Iske alawa, X, A, B, aur C points ki positions aur proportions ka bhi dhyan rakha jata hai Cypher pattern ko recognize karne ke liye.

6. Cypher Pattern Ke Elements:

Cypher pattern mein kuch primary elements hote hain jo is pattern ki formation ko define karte hain. Ye elements X, A, B, aur C points hote hain jo specific price swings ko represent karte hain.

X point market mein initial price swing ko represent karta hai, jabki A point initial trend ki direction ko show karta hai. B point ek retracement level ko represent karta hai jo A point se B point tak ki movement mein hota hai. C point trend reversal ko represent karta hai aur final target area ko indicate karta hai.

7. Cypher Pattern Ki Formation:

Cypher pattern ki formation mein price ka movement specific proportions follow karta hai jo Fibonacci retracement aur extension levels se derived hote hain. Is pattern mein price ki movement harmonic ratios ke accordance mein hoti hai.

Cypher pattern ki formation mein X se A, A se B, aur B se C tak ki movement mein specific Fibonacci ratios ka istemal hota hai jisse pattern ki formation determine ki jati hai. Traders ko in proportions aur ratios ko analyze karke Cypher pattern ko identify karna hota hai.

8. Cypher Pattern Ki Validity:

Cypher pattern ki validity confirm karne ke liye traders ko kuch specific criteria follow karne hote hain. In criteria ki madad se traders determine karte hain ke pattern kya sahi tareeke se form ho raha hai ya nahi.

Cypher pattern ki validity confirm karne ke liye traders X, A, B, aur C points ki positions aur proportions ko analyze karte hain. Iske alawa, Fibonacci retracement aur extension levels ko bhi confirm kiya jata hai pattern ki validity ke liye.

9. Cypher Pattern Ke Significance:

Cypher pattern trading mein ahem role ada karta hai kyun ke ye traders ko accurate entries aur exits provide karta hai. Is pattern ki significance ye hai ke ye market mein specific price movements ko identify karta hai jo potential trading opportunities ko represent karte hain.

Cypher pattern ke signals ko follow karke traders accurate entries aur exits plan kar sakte hain jisse wo market mein profit kamane ka mauka pa sakein. Is pattern ki significance ye hai ke ye market mein specific patterns ko recognize karne mein madad karta hai jisse traders apne trading strategies ko improve kar sakein.

10. Cypher Pattern Ke Benefits:

Cypher pattern trading mein kai benefits provide karta hai jaise ke accurate predictions aur high probability trades ki possibilities ko barhata hai. Is pattern ke signals ko follow karke traders market mein profitable trades execute kar sakte hain aur apni trading performance ko improve kar sakte hain.

Cypher pattern ke benefits mein ye bhi shamil hai ke ye traders ko specific entry aur exit points provide karta hai jisse wo apne trades ko effectively manage kar sakein. Iske alawa, Cypher pattern ki accuracy aur reliability traders ko confidence deta hai apne trading decisions ke liye.

11. Cypher Pattern Ki Risks:

Cypher pattern ki interpretation mein galat ho jane ki possibility bhi hoti hai, jo trading ko risky banati hai. Market mein fluctuations aur uncertainties hone ki wajah se, Cypher pattern ko interpret karte waqt traders ko cautious rehna chahiye.

Cypher pattern ki interpretation mein galati hone ki wajah se traders apne trades mein losses face kar sakte hain aur trading performance ko affect ho sakta hai. Isliye, Cypher pattern ko analyze karte waqt traders ko thorough research aur risk management techniques ka istemal karna chahiye.

12. Cypher Pattern Ki Trading Strategies:

Cypher pattern ko utilize karne ke liye traders different trading strategies istemal karte hain. Ye strategies Cypher pattern ke signals ko analyze karne aur unhe trading decisions mein incorporate karne mein madad karte hain.

Kuch traders Cypher pattern ko confirm karne ke liye aur additional indicators ka istemal karte hain, jabki doosre traders sirf Cypher pattern ke signals par rely karte hain. Har trader apne trading style aur preference ke according Cypher pattern ko utilize karta hai.

13. Cypher Pattern Aur Stop Loss Placement:

Stop loss placement Cypher pattern trading mein crucial role ada karta hai kyunki isse traders apne losses ko minimize kar sakte hain. Cypher pattern ke signals ke saath sahi stop loss placement ki madad se traders apne trades ko manage kar sakte hain.

Stop loss placement ki sahi tareeke se karne se traders apne trades ko protect kar sakte hain aur market ke fluctuations se bacha sakte hain. Cypher pattern ke signals aur stop loss placement ko combine karke traders apni risk ko effectively manage kar sakte hain.

14. Cypher Pattern Aur Profit Targets:

Cypher pattern ke trade setups mein profit targets ko set karna bhi ahem hai. Traders ko Cypher pattern ke signals ko follow karke apne trades ke liye specific profit targets set karna chahiye jisse wo apne trades se maximum profit earn kar sakein.

Profit targets ko set karte waqt traders ko market conditions aur volatility ko bhi consider karna chahiye taake wo realistic profit targets set kar sakein. Cypher pattern ke signals aur profit targets ko combine karke traders apne trades ko effectively manage kar sakte hain.

15. Conclusion:

Cypher Harmonic Pattern forex trade mein ek powerful tool hai jo traders ko accurate trading opportunities provide karta hai. Isko samajhna aur sahi tareeqe se utilize karna traders ke liye zaroori hai. Cypher pattern ki recognition aur interpretation ko samajhne ke baad traders market mein potential trading opportunities ko identify kar sakte hain aur apne trading performance ko improve kar sakte hain. -

#12 Collapse

Cypher Harmonic Pattern

Forex trading mein Cypher Harmonic Pattern ek ahem technical analysis tool hai jo traders ko market mein potential trading opportunities dhoondhne mein madad karta hai. Ye pattern market mein reversals ko identify karne ke liye istemal hota hai aur traders ko entry aur exit points provide karta hai.

Cypher Harmonic Pattern Kya Hai?

Cypher Harmonic Pattern ek technical analysis pattern hai jo Fibonacci ratios aur price action ko istemal karke market trends ko analyze karta hai. Ye pattern Elliot Wave theory ki principles par mabni hai aur traders ko market mein potential reversal points ke liye alert karta hai.

Cypher Harmonic Pattern Ki Formation

Cypher Harmonic Pattern ka formation 4 main points par mabni hota hai.

a. XA Leg

Ye pattern ki shuruaati leg hoti hai aur isme price trend ka initial movement hota hai.

b. AB Leg

AB leg XA leg ke opposite direction mein move karta hai aur Fibonacci retracement level 0.382 se 0.618 ke darmiyan hota hai.

c. BC Leg

BC leg AB leg ke opposite direction mein move karta hai aur ye Fibonacci retracement level 1.272 se 1.414 ke darmiyan hota hai.

d. CD Leg

CD leg XA leg ke direction mein move karta hai aur isme Fibonacci retracement level 0.786 hota hai. CD leg AB leg ke 0.786 Fibonacci retracement level tak pohanchne par Cypher Harmonic Pattern complete hota hai.

Cypher Harmonic Pattern Ki Identifications

Cypher Harmonic Pattern ko identify karne ke liye traders ko in steps ko follow karna hota hai.

a. XA Leg ko Identify Karein

Pattern ki shuruaat X point se hoti hai jo price movement ka initial point hota hai.

b. Fibonacci Retracement Levels ka Istemal Karein

AB, BC, aur CD legs ko identify karne ke liye Fibonacci retracement levels ka istemal kiya jata hai.

c. Potential Reversal Point ko Dhundhein

CD leg complete hone par potential reversal point ko identify karein.

Cypher Harmonic Pattern ke Entry aur Exit Points

Cypher Harmonic Pattern ke entry aur exit points ko identify karne ke liye traders ko ye steps follow karne chahiye.

a. Entry Point

Pattern complete hone par, traders long ya short positions enter karte hain, depending on the direction of the pattern.

b. Stop Loss aur Take Profit Levels Traders ko stop loss aur take profit levels ko set karna chahiye taake unka trade risk manage kiya ja sake.

Cypher Harmonic Pattern ke Benefits

Cypher Harmonic Pattern ka istemal karne ke kuch ahem faide hain.

a. High Probability Trades

Ye pattern high probability trades provide karta hai, agar sahi tareeqe se identify kiya jaye.

b. Entry aur Exit Points

Traders ko clear entry aur exit points provide karta hai, jisse unka trading process streamline hota hai.

c. Risk Management

Is pattern ke istemal se traders apne trades ka risk manage kar sakte hain, stop loss aur take profit levels set karke.

Cypher Harmonic Pattern ke Drawbacks

Cypher Harmonic Pattern ke kuch limitations bhi hain jo traders ko yaad rakhna chahiye.

a. False Signals

Kabhi kabhi ye pattern false signals generate kar sakta hai, isliye traders ko aur confirmatory indicators ka bhi istemal karna chahiye.

b. Complex Analysis

Cypher Harmonic Pattern ko identify karna aur uska analysis karna complex ho sakta hai, especially for novice traders. -

#13 Collapse

: Cypher Harmonic Pattern Ka Tajziya"

Forex trading, a global market where currencies are exchanged, has gained immense popularity over the years. Traders employ various tools and strategies to navigate this volatile yet potentially rewarding terrain. One such tool is the Cypher Harmonic Pattern, which has garnered attention for its predictive capabilities in identifying potential reversals in price action.

Cypher Harmonic Pattern, originally conceptualized by renowned trader Scott Carney, is a technical analysis pattern that helps traders spot potential trend reversals in the forex market. It is based on Fibonacci ratios and geometric formations, making it a powerful tool in the hands of seasoned traders.

The pattern typically consists of four distinct points labeled X, A, B, and C, forming specific geometric shapes within the price action. These points adhere to Fibonacci ratios, with point C usually retracing to 0.786 or 0.886 Fibonacci levels of the XA leg. This retracement indicates a potential reversal zone where traders can anticipate a change in market direction.

Understanding the anatomy of the Cypher Harmonic Pattern is crucial for traders looking to capitalize on its predictive abilities. The pattern begins with a strong impulse move, represented by the XA leg, followed by a retracement to point A. From point A, the price reverses and forms leg AB, which retraces to point B. The critical aspect of the Cypher pattern lies in the completion of the CD leg, which extends from point B to point C. This leg typically exhibits a shallow retracement, signaling a potential reversal zone. Finally, the price action reverses once again, confirming the completion of the pattern.

Traders often use additional technical indicators and tools to validate the Cypher Harmonic Pattern and increase the probability of a successful trade. These may include oscillators, moving averages, or support and resistance levels, providing confluence and strengthening the trade setup.

Implementing the Cypher Harmonic Pattern in trading requires patience, discipline, and a thorough understanding of its intricacies. While the pattern can offer lucrative trading opportunities, it is not without risks. Like any trading strategy, it is essential to manage risk effectively by implementing stop-loss orders and adhering to proper risk management principles.

In conclusion, the Cypher Harmonic Pattern is a valuable tool in the arsenal of forex traders, offering a systematic approach to identifying potential trend reversals. By leveraging Fibonacci ratios and geometric formations, traders can gain insights into market dynamics and make informed trading decisions. However, it is imperative to combine the pattern with other technical analysis tools and exercise prudent risk management to maximize its effectiveness in the dynamic forex market.

-

#14 Collapse

Forex ki roshni mein aik mukhtasir mawaqif:

Forex, ya foreign exchange, ek aham ma'ashi tajziya aur sauda hai jahan mukhtalif currencies ka tabadla hota hai. Yeh global market hai jo banks, corporations, governments, aur individual traders ke darmiyan hoti hai. Forex market, 24 ghanton ke doraan, paanch dinon mein khuli hoti hai, jisay asani se dunya bhar ke wakalat se tijarat ki jati hai. Is market ka maqsad currency rates ka determination aur currency exchange ka tajziya karna hai. Ye article Forex ke bunyadi tareeqay, iske faide aur nuqsanat, aur iski mukhtalif strategies ke bare mein maloomat faraham karega. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Cypher ek popular harmonic pattern hai jo traders ke liye trading opportunities identify karne mein madad karta hai. Ye pattern technical analysis ka ek hissa hai jo market ke price movements aur trends ko analyze karta hai. Cypher pattern ki pehchan karke, traders potential reversal points aur trend extensions ko identify kar sakte hain, jisse unko behtar trading decisions lene mein madad milti hai.

Cypher Harmonic Pattern ka Concept

Cypher harmonic pattern ek specific chart pattern hai jo market mein reversals aur trend extensions ko indicate karta hai. Ye pattern typically market ke price structure ke sath sath Fibonacci levels par mabni hota hai. Cypher pattern ki pehchan karne se pehle, traders ko Fibonacci retracement aur extension levels ka istemal karke market ke price movements ko analyze karna zaroori hota hai. Cypher pattern ka concept Fibonacci ratios, price swings, aur retracement levels ke adhar par bana hai.

Cypher Harmonic Pattern ki Formation

Cypher pattern ki formation mein kuch key points hote hain jo traders ko identify karne hote hain:- XA Leg: Cypher pattern ki formation ka pehla leg hota hai XA leg, jo market ke initial price swing ko represent karta hai. Is leg mein price ek high se low ya low se high direction mein move karta hai.

- AB Retracement: AB leg ek retracement leg hota hai jo XA leg ke opposite direction mein move karta hai. Is leg mein price kuch Fibonacci retracement levels par retrace karta hai, lekin generally 0.382 se 0.618 tak ke darmiyan retrace karta hai.

- BC Leg: BC leg ek extension leg hota hai jo AB leg ke direction mein move karta hai. Is leg mein price typically 0.382 Fibonacci extension level tak move karta hai, jisse iska length AB leg ke length se similar hota hai.

- CD Leg: CD leg final leg hota hai Cypher pattern ki formation ka. Is leg mein price XA leg ke initial direction mein move karta hai. CD leg mein price typically 0.786 Fibonacci retracement level tak move karta hai, jo AB leg ke length ke approximately 1.272 Fibonacci extension level ke barabar hota hai.

Cypher Harmonic Pattern Trading Strategies

Cypher harmonic pattern ko trade karne ke liye traders kuch strategies istemal karte hain:- Entry Points: Cypher pattern ki formation ke baad, traders entry points ko identify karte hain jahan se unhe positions leni hain. Typically, traders entry points ko CD leg ke reversal point par set karte hain.

- Stop Loss aur Take Profit Levels: Traders apni positions ke liye stop loss aur take profit levels set karte hain taki woh apne trades ko manage kar sakein. Stop loss typically CD leg ke opposite direction mein set kiya jata hai, jab ke take profit levels Fibonacci extension levels par set kiye jate hain.

- Risk Management: Cypher pattern ko trade karte waqt, risk management bohot ahem hota hai. Traders apni positions ke liye appropriate risk-reward ratio ka dhyan rakhte hain taki unka risk minimized ho sake aur unko zyada profits mil sakein.

Cypher Harmonic Pattern ke Fawaid

Cypher harmonic pattern ke kuch fawaid hain jo traders ko attract karte hain:- Reversal Points ko Identify karna: Cypher pattern traders ko market ke potential reversal points ko identify karne mein madad karta hai, jisse woh behtar trading opportunities capture kar sakein.

- Trend Extensions ko Predict karna: Cypher pattern traders ko trend extensions ko predict karne mein madad karta hai, jisse woh market ke future price movements ka andaza laga sakein.

- Clear Entry aur Exit Points: Cypher pattern traders ko clear entry aur exit points provide karta hai, jisse woh apne trades ko manage kar sakein aur apne trading plan ke mutabiq action le sakein.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:19 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим