Asalam o alaikum

what is stick sandwich patterns

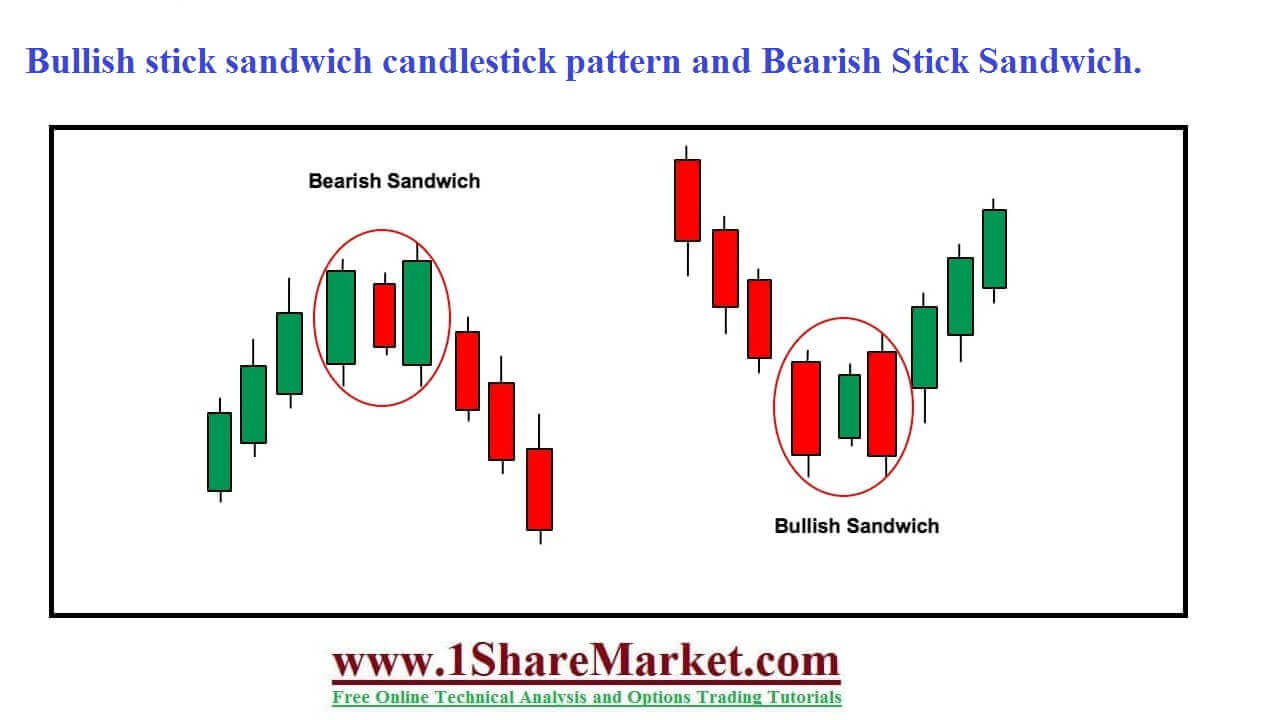

Stick Sandwich, ek technical analysis pattern hai jo candlestick charts mein paya jata hai. Yeh pattern market mein reversal ya trend change ko darust karti hai. Is pattern mein, teen consecutive candles hote hain jinmein middle candle, first aur third candle se choti hoti hai aur overall shape ek sandwich ki tarah hota hai.Stick Sandwich pattern ka tajurba karne ke liye, aapko candlestick chart analysis ki achi samajh aur market trend ke istiqamat ki zaroorat hoti hai. Yahan Stick Sandwich pattern ke key elements aur iske tafseelat hain:

First candle

Stick Sandwich pattern ko pehchanne ke liye, teen consecutive candles ki zarurat hoti hai. Yeh candles ek dusre ke beech mein hoti hain aur middle candle, first aur third candle se choti hoti hai. Is pattern mein middle candle bullish (upward) hoti hai jab ke first aur third candles bearish (downward) hoti hain.Yeh candle downtrend ke doran aati hai aur bearish hoti hai, yani ke iski closing price opening price se zyada hoti hai. Pehli candle downward momentum ko dikhata hai.

middle candle

Third candle

Stick Sandwich pattern ka asal maqsad trend reversal ko point out karna hota hai. Jab market downtrend mein hota hai aur phir Stick Sandwich pattern appear hota hai, to yeh ishara kar sakta hai ke bearish trend kamzor ho raha hai aur bullish trend shuru hone wala hai.Yeh pattern tajiro ke liye ek potential entry point bhi ho sakta hai. Agar tajir is pattern ko dekhe aur iske baad confirmatory signals bhi milen, jese ke price action ya trend indicators ki madad se, to woh long position le sakta hai, yaani ke woh market mein upar ki taraf move ki umeed karega.

Important for stick sandwich patterns

Stick Sandwich pattern ek matloon pattern hai aur isay bilkul akela na dekha jaye. Iski tasdeeq ke liye, tajiron ko doosre technical indicators aur price action signals ka bhi intezar karna chahiye. Market mein risk aur uncertainty hamesha hota hai, isliye prudent tijarat ke liye achi risk management strategy bhi zaruri hai.Is tareeqay se, Stick Sandwich pattern ek ahem tool ban sakta hai jo tajiro ko market trends aur reversal points ka pata lagane mein madad karta hai. Lekin, hamesha yaad rahe ke trading mein risk involved hota hai aur tijarat ke faislay hamesha sahi waqt par aur mazboot analysis ke sath lena chahiye.

what is stick sandwich patterns

Stick Sandwich, ek technical analysis pattern hai jo candlestick charts mein paya jata hai. Yeh pattern market mein reversal ya trend change ko darust karti hai. Is pattern mein, teen consecutive candles hote hain jinmein middle candle, first aur third candle se choti hoti hai aur overall shape ek sandwich ki tarah hota hai.Stick Sandwich pattern ka tajurba karne ke liye, aapko candlestick chart analysis ki achi samajh aur market trend ke istiqamat ki zaroorat hoti hai. Yahan Stick Sandwich pattern ke key elements aur iske tafseelat hain:

First candle

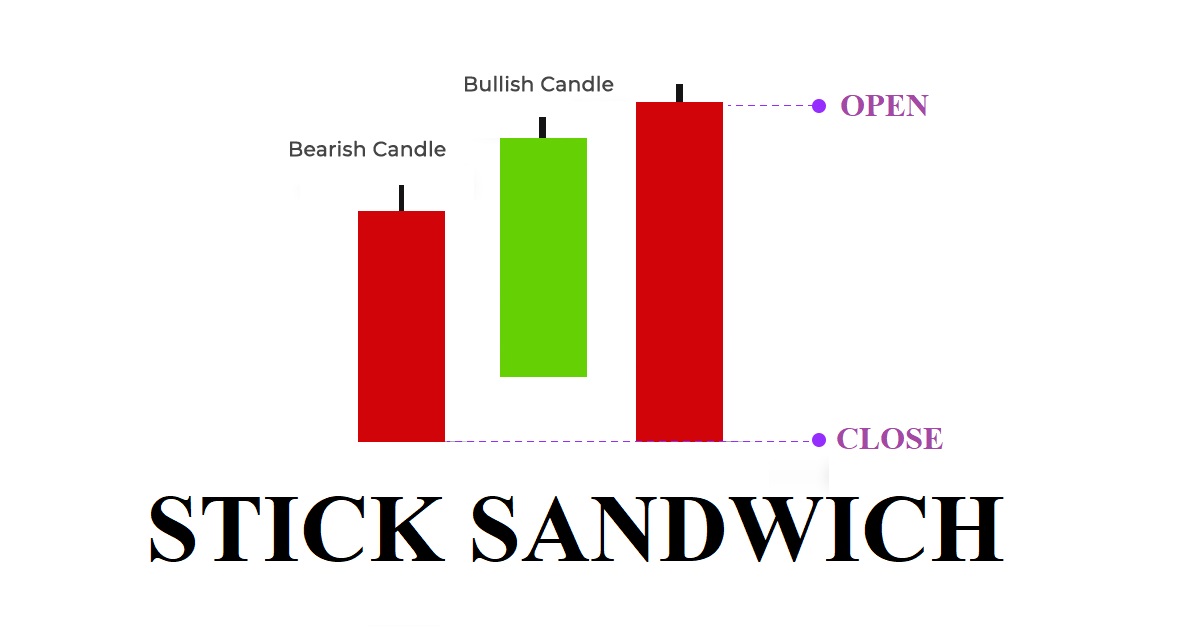

Stick Sandwich pattern ko pehchanne ke liye, teen consecutive candles ki zarurat hoti hai. Yeh candles ek dusre ke beech mein hoti hain aur middle candle, first aur third candle se choti hoti hai. Is pattern mein middle candle bullish (upward) hoti hai jab ke first aur third candles bearish (downward) hoti hain.Yeh candle downtrend ke doran aati hai aur bearish hoti hai, yani ke iski closing price opening price se zyada hoti hai. Pehli candle downward momentum ko dikhata hai.

middle candle

- Middle candle kaafi choti hoti hai aur iski closing price first aur third candles ke close prices ke beech mein hoti hai. Yeh candle market mein indecision ya confusion ko darust karti hai.Teessri candle upar ki taraf move karti hai aur bullish hoti hai, yani ke iski closing price opening price se zyada hoti hai. Teessri candle bullish reversal ko darust karta hai.

Third candle

Stick Sandwich pattern ka asal maqsad trend reversal ko point out karna hota hai. Jab market downtrend mein hota hai aur phir Stick Sandwich pattern appear hota hai, to yeh ishara kar sakta hai ke bearish trend kamzor ho raha hai aur bullish trend shuru hone wala hai.Yeh pattern tajiro ke liye ek potential entry point bhi ho sakta hai. Agar tajir is pattern ko dekhe aur iske baad confirmatory signals bhi milen, jese ke price action ya trend indicators ki madad se, to woh long position le sakta hai, yaani ke woh market mein upar ki taraf move ki umeed karega.

Important for stick sandwich patterns

Stick Sandwich pattern ek matloon pattern hai aur isay bilkul akela na dekha jaye. Iski tasdeeq ke liye, tajiron ko doosre technical indicators aur price action signals ka bhi intezar karna chahiye. Market mein risk aur uncertainty hamesha hota hai, isliye prudent tijarat ke liye achi risk management strategy bhi zaruri hai.Is tareeqay se, Stick Sandwich pattern ek ahem tool ban sakta hai jo tajiro ko market trends aur reversal points ka pata lagane mein madad karta hai. Lekin, hamesha yaad rahe ke trading mein risk involved hota hai aur tijarat ke faislay hamesha sahi waqt par aur mazboot analysis ke sath lena chahiye.

تبصرہ

Расширенный режим Обычный режим