Introduction

forex market mein risk management aik allag kesam ka action hota hey jo keh trader ko trade ka pehlo ka safty frahm karta hey forex market meiin risk ka matlab yeh hota hey keh qabel e qadar wapce ka imkan hey balkeh important losses ka zyada imkan hota hey risk kay kabel hona zyada say zyada faida hasel karna hota hey kese bhe trader kay leyy skill expert hota hey

risk management mein position ka sahi size fix karna or position ko kaim karna bhe shamel hota hey or forex market ke position mein enter honay or exit honay kay ley sahi jazbat ko kaim karna chihay yeh trade kay sab kuch khonay profit hasel karnay kay kabel hona chihay

Appetited risk management

risk kay ley apni bhok par kaim karna sahi hota hey forex mein risk management kay ley central ke he haseyat hote hey or aik trade kitni opening kay ley ready hote hey zyada unstble currency pair kay ley important hote hey jaisa keh kuch obharte hove market forex kay ley es kay elawah forex trading kay ley liquidity aik aisa element hota hey jo keh risk management ko effect kar sakta hey low liquidity currency pair ka matlab yeh hota hey market ke position mein enter hona or out hona sahi hota hey

position size

forex market min sahi position size ko select karna chihay forex market ke trade par ap jetnay bhe lot size laytay hein ap kay account ke care karay ga chance zyada say zyada day ga ap ko apnay stop placement par kam karna ho ga or apnay risk ke percentage ka tayoon karna ho ga

example

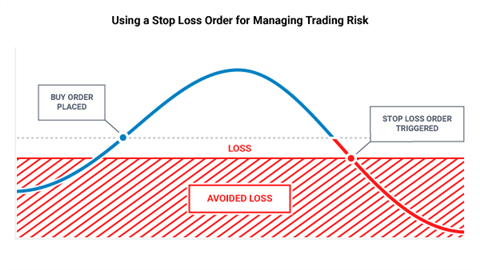

nechay EUR/USD ka chart deya geya he jes mein risk management ap daikh saktay hein jo keh positive hey ap ko forex market mein apni position ko sahi selct karnay kay ley stop loss he kaim karna ho ga jes men ap daikh sakty hein 1:2 ke ratio kaim ke gay he jo keh positive hote hey

forex market mein risk management aik allag kesam ka action hota hey jo keh trader ko trade ka pehlo ka safty frahm karta hey forex market meiin risk ka matlab yeh hota hey keh qabel e qadar wapce ka imkan hey balkeh important losses ka zyada imkan hota hey risk kay kabel hona zyada say zyada faida hasel karna hota hey kese bhe trader kay leyy skill expert hota hey

risk management mein position ka sahi size fix karna or position ko kaim karna bhe shamel hota hey or forex market ke position mein enter honay or exit honay kay ley sahi jazbat ko kaim karna chihay yeh trade kay sab kuch khonay profit hasel karnay kay kabel hona chihay

Appetited risk management

risk kay ley apni bhok par kaim karna sahi hota hey forex mein risk management kay ley central ke he haseyat hote hey or aik trade kitni opening kay ley ready hote hey zyada unstble currency pair kay ley important hote hey jaisa keh kuch obharte hove market forex kay ley es kay elawah forex trading kay ley liquidity aik aisa element hota hey jo keh risk management ko effect kar sakta hey low liquidity currency pair ka matlab yeh hota hey market ke position mein enter hona or out hona sahi hota hey

position size

forex market min sahi position size ko select karna chihay forex market ke trade par ap jetnay bhe lot size laytay hein ap kay account ke care karay ga chance zyada say zyada day ga ap ko apnay stop placement par kam karna ho ga or apnay risk ke percentage ka tayoon karna ho ga

example

nechay EUR/USD ka chart deya geya he jes mein risk management ap daikh saktay hein jo keh positive hey ap ko forex market mein apni position ko sahi selct karnay kay ley stop loss he kaim karna ho ga jes men ap daikh sakty hein 1:2 ke ratio kaim ke gay he jo keh positive hote hey

تبصرہ

Расширенный режим Обычный режим