Forex trading aaj kal bohot se logon ki nazar mein ek lucrative investment ka zariya hai. Yeh market hamesha chalti rehti hai aur ismein kai tajaweez aur tawunat hoti hai. Lekin, agar aap chahte hain ke aapka forex trading successful ho, to aapko numerical analysis ka istemal karna hoga.

Numerical analysis, jo ke statistics, mathematical models, aur algorithms ka aik hissa hai, forex trading mein ek aham role ada karta hai. Yeh aapko market trends, price movements, aur trading strategies ko samajhne mein madad karta hai. Yahan kuch tajaweez hain jo aapko numerical analysis ke istemal mein madadgar sabit ho sakti hain:

Historical Data ka Istemal

Numerical analysis ke zariye aap forex market ki history ko analyze kar sakte hain. Isse aapko market trends aur price movements ka andaza ho sakta hai, jo future predictions ke liye madadgar hota hai.

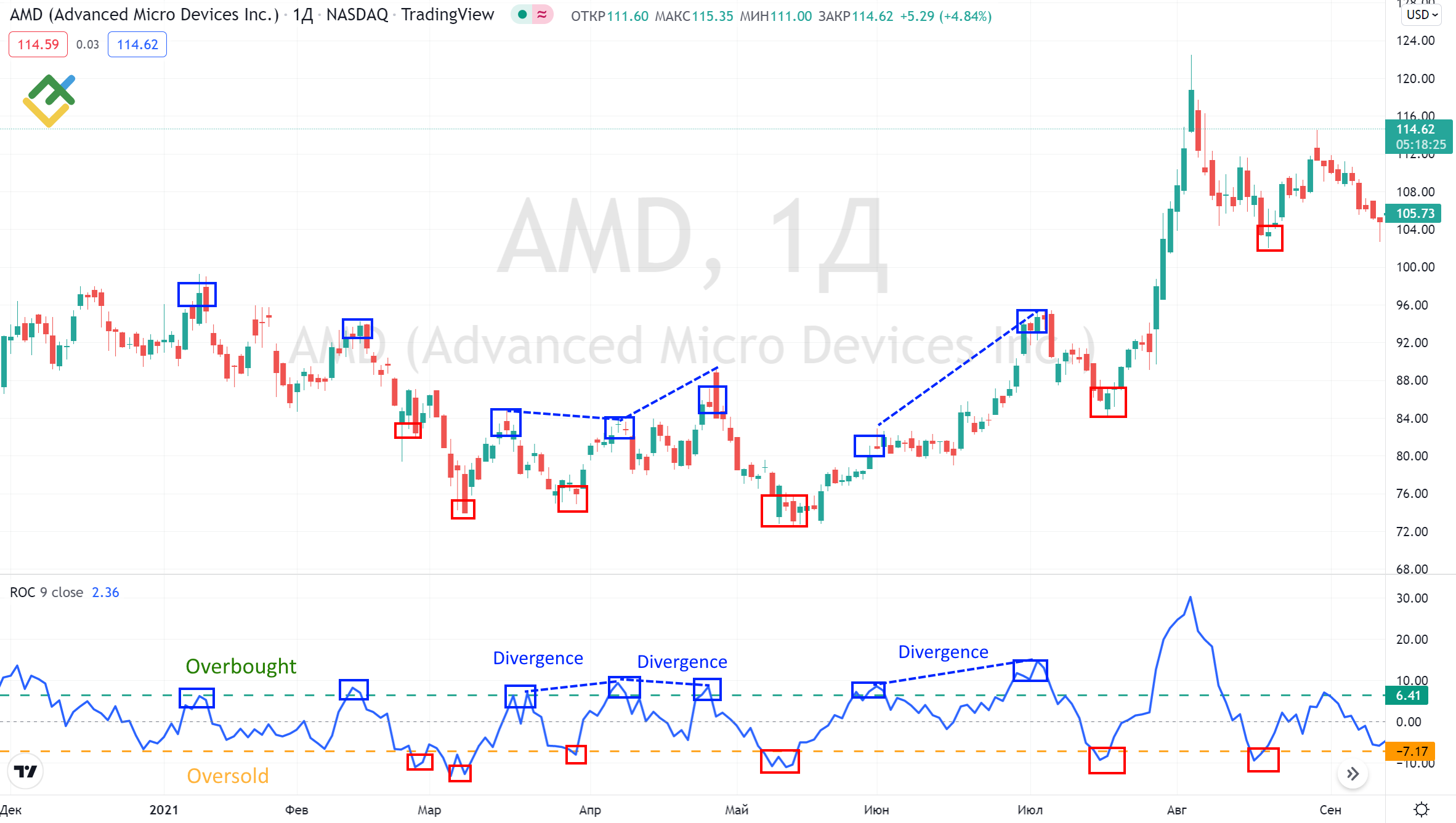

Statistical Indicators

Aap statistical indicators ka istemal karke market ki health aur direction ka pata laga sakte hain. Moving averages, relative strength index (RSI), aur stochastic oscillators jaise indicators aapko trading signals dete hain.

Risk Management

Numerical analysis aapko risk management mein bhi madad karta hai. Aap apne trades ko analyze karke risk-reward ratio ko samajh sakte hain aur apne investments ko effectively manage kar sakte hain.

Algorithmic Trading

Algorithmic trading, jo ke numerical analysis ka aik advanced hissa hai, aapko trading strategies automate karne mein madad karta hai. Isse aap real-time market conditions ke hisab se trades execute kar sakte hain.

Forecasting

Numerical analysis aapko market ka future forecast karne mein madad karta hai. Lekin yaad rahe, market ke unpredictable nature ko bhi mad e nazar rakhte hue, yeh sirf ek tool hai aur guaranteed results nahi deta. Forex trading mein successful hone ke liye numerical analysis ka istemal zaroori hai. Yeh aapko market dynamics ko samajhne mein aur trading strategies ko optimize karne mein madad karta hai. Lekin, hamesha yaad rakhein ke market ke fluctuations ko samajhna challenging ho sakta hai, aur kisi bhi investment decision se pehle thorough research aur analysis karna zaroori hai

تبصرہ

Расширенный режим Обычный режим