What is Fill & Kill In Forex Trading

What is Fill

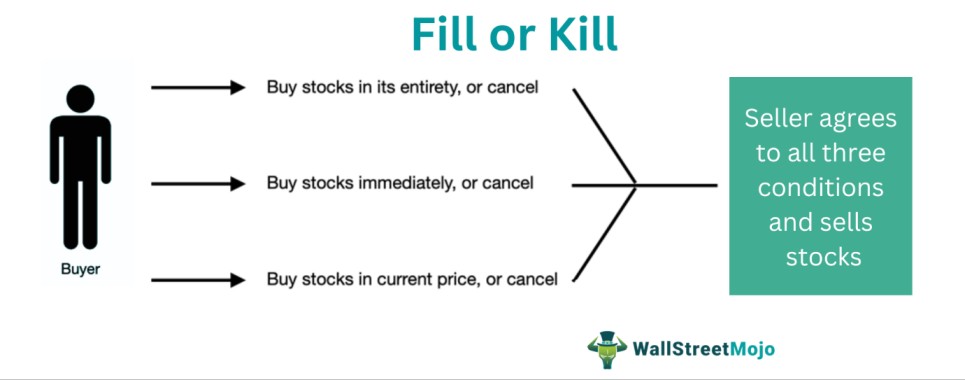

Forex, ya Foreign Exchange, dunya bhar mein mukhtalif currencies ka exchange karne ka market hai. Yahan, traders currencies ko buy aur sell karte hain, tijarat karte hain, aur mukhtalif strategies istemal karte hain. Fill aur Kill (FAK) ek aise term hai jo trading mein istemal hota hai aur yeh traders ko specific instructions deta hai kaise unki trades ko execute kiya jaye.

Fill ka matlab hota hai pura karna. Jab koi trader FAK order istemal karta hai aur wo market price pe nahi chahiye, to usko fill order use karna chahiye. Is order mein trader specify karta hai ki usko pura quantity chahiye, lekin wo specific price pe nahi karna chahta.

Example

For example, agar kisi trader ne 1.2000 rate pe EUR/USD buy karna decide kiya hai, lekin market pe actual rate 1.1995 hai, to usne FAK order use kiya. Is order mein usne specify kiya hoga ki use chahiye 1.2000 rate pe ya better, lekin agar available nahi hai to order execute na kare.

What is Kill

Kill ka matlab hota hai mita dena. Jab trader FAK order use karta hai, to wo specified price pe puri quantity na milne par order mita diya jata hai. Yani agar trader ne 1.2000 rate pe buy karna decide kiya hai, lekin market pe available nahi hai, to uska order mita diya jayega.

Yeh trader ko flexibility deta hai ki wo market conditions ke hisab se decide kar sake ki kya usko specific rate pe trade karna chahiye ya phir wo market price pe execute ho jaye.

How To Use Fill & Kill In Forex Trading

Fill aur Kill orders ka istemal traders ke risk management mein bhi hota hai. Kuch traders prefer karte hain ki unka order specified rate pe hi execute ho, jabki doosre traders ko flexibility chahiye hoti hai aur unhe chahiye ki unka order market price pe execute ho jaye.

Strategy

Is taur par, Fill aur Kill orders forex market mein traders ko apni trading strategies ko customize karne mein madad karte hain. In orders ke istemal se traders apne trades ko better manage kar sakte hain aur market conditions ke hisab se apne decisions adjust kar sakte hain.

Imprtance OF Fill & Kill in Forex

Is terhan se, Fill aur Kill (FAK) orders forex trading mein ek important tool ban gaya hai jo traders ko market ke dynamic environment mein asani se navigate karne mein madad karta hai.

What is Fill

Forex, ya Foreign Exchange, dunya bhar mein mukhtalif currencies ka exchange karne ka market hai. Yahan, traders currencies ko buy aur sell karte hain, tijarat karte hain, aur mukhtalif strategies istemal karte hain. Fill aur Kill (FAK) ek aise term hai jo trading mein istemal hota hai aur yeh traders ko specific instructions deta hai kaise unki trades ko execute kiya jaye.

Fill ka matlab hota hai pura karna. Jab koi trader FAK order istemal karta hai aur wo market price pe nahi chahiye, to usko fill order use karna chahiye. Is order mein trader specify karta hai ki usko pura quantity chahiye, lekin wo specific price pe nahi karna chahta.

Example

For example, agar kisi trader ne 1.2000 rate pe EUR/USD buy karna decide kiya hai, lekin market pe actual rate 1.1995 hai, to usne FAK order use kiya. Is order mein usne specify kiya hoga ki use chahiye 1.2000 rate pe ya better, lekin agar available nahi hai to order execute na kare.

What is Kill

Kill ka matlab hota hai mita dena. Jab trader FAK order use karta hai, to wo specified price pe puri quantity na milne par order mita diya jata hai. Yani agar trader ne 1.2000 rate pe buy karna decide kiya hai, lekin market pe available nahi hai, to uska order mita diya jayega.

Yeh trader ko flexibility deta hai ki wo market conditions ke hisab se decide kar sake ki kya usko specific rate pe trade karna chahiye ya phir wo market price pe execute ho jaye.

How To Use Fill & Kill In Forex Trading

Fill aur Kill orders ka istemal traders ke risk management mein bhi hota hai. Kuch traders prefer karte hain ki unka order specified rate pe hi execute ho, jabki doosre traders ko flexibility chahiye hoti hai aur unhe chahiye ki unka order market price pe execute ho jaye.

Strategy

Is taur par, Fill aur Kill orders forex market mein traders ko apni trading strategies ko customize karne mein madad karte hain. In orders ke istemal se traders apne trades ko better manage kar sakte hain aur market conditions ke hisab se apne decisions adjust kar sakte hain.

Imprtance OF Fill & Kill in Forex

Is terhan se, Fill aur Kill (FAK) orders forex trading mein ek important tool ban gaya hai jo traders ko market ke dynamic environment mein asani se navigate karne mein madad karta hai.

:max_bytes(150000):strip_icc()/dotdash_Final_Order_Definition_Jun_2020-01-572f4776d1674e7a9f3f68890d1f78e7.jpg)

تبصرہ

Расширенный режим Обычный режим