Wedge Outline in Forex Trading

Forex Tijarat Mein Wedge Ka Naqsha

Wedge outline forex trading mein aik technical analysis tool hai jo market ke price movements ko chart par represent karta hai. Yeh pattern wedge shape mein hota hai aur traders ko market trends aur potential reversals ko samajhne mein madad karta hai.

Wedge Outline Ka Tafsili Bayan:

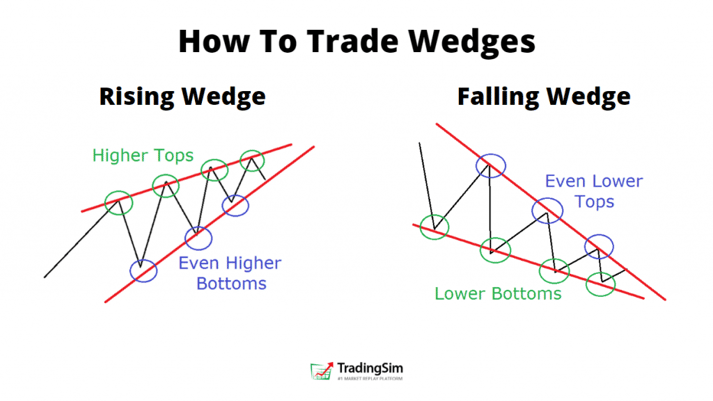

- Falling Wedge (Girte Hue Wedge): Ismein price chart par wedge shape banti hai jismein price highs lower hote hain aur price lows bhi lower hote hain. Falling wedge bearish trends ke baad hone wale potential bullish reversals ko darust karta hai.

- Rising Wedge (Barte Hue Wedge): Ismein price chart par wedge shape banti hai jismein price highs higher hote hain aur price lows bhi higher hote hain. Rising wedge bullish trends ke baad hone wale potential bearish reversals ko darust karta hai.

Wedge Outline Ka Istemal:

- Trend Reversals Ko Identify Karna: Wedge outline ka istemal mainly trend reversals ko identify karne ke liye hota hai. Agar falling wedge pattern form hota hai to yeh indicate karta hai ke downtrend ke baad uptrend hone ke chances hain, aur agar rising wedge pattern form hota hai to yeh indicate karta hai ke uptrend ke baad downtrend hone ke chances hain.

- Breakout Ke Liye Wait Karna: Traders wedge pattern ko dekhte hain aur breakout ka wait karte hain. Agar price wedge ke andar se bahar nikal jata hai, to yeh indicate karta hai ke reversal confirm ho sakta hai.

- Volume Ke Saath Confirmation: Wedge outline ko confirm karne ke liye traders volume ke saath dekhte hain. Agar breakout ke waqt volume bhi zyada hota hai, to yeh confirmatory signal hai.

Wedge Outline Aur Trading Strategies:

- Confirmation Ke Liye Doosre Indicators Ka Istemal: Wedge outline ko confirm karne ke liye traders doosre technical indicators ka bhi istemal karte hain, jese ke moving averages, RSI, ya MACD.

- Fibonacci Retracement Ke Saath Combine Karna: Traders wedge outline ko Fibonacci retracement levels ke saath milake istemal karte hain taki reversal points ko confirm kiya ja sake.

- Multiple Time Frames Par Nazar Rakhna: Wedge outline ko multiple time frames par dekha jata hai taki sahi analysis ho sake aur traders ko accurate signals milein.

Wedge Outline Aur Risk Management:

- Stop Loss Aur Target Levels Ka Tay Karna: Wedge outline dekhte hue traders ko apne stop loss aur target levels tay karna chahiye. Isse risk management behtar hoti hai.

- Confirmation Ke Bina Trade Na Karna: Sirf wedge outline dekh kar bina confirmation ke trade nahi karna chahiye. Doosre technical indicators ka bhi istemal karna important hai.

- Market Conditions Ko Samajhna: Wedge outline ko samajhne ke liye traders ko market conditions aur overall trend ko bhi dhyan mein rakhna chahiye. High volatility ya unexpected news ke dauran is pattern ka asar zyada hota hai.

Wedge outline forex traders ko market trends aur potential reversals ko samajhne mein madad karta hai. Lekin, hamesha yaad rahe ke kisi bhi pattern ko analyze karte waqt risk management ka bhi khayal rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим