Forex trading ek volatile aur dynamic market hai, jahan har second mein currency values mein changes hote hain. Slippage ek term hai jo traders ke liye crucial hai aur iska sahi understanding hona trading success ke liye zaroori hai.

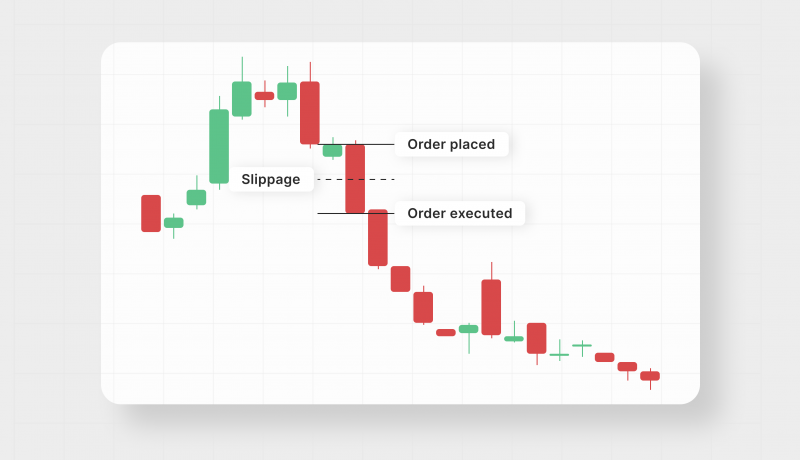

Slippage ka simple meaning hai unexpected price movement ya difference between expected price aur actual execution price. Jab aap trade execute karte hain, aapki intention hoti hai ki aap specific price par trade karna chahte hain, lekin market mein fluctuations ki wajah se aapka trade us exact price par execute nahi ho pata, aur isme thoda sa difference hota hai, jo slippage kehlata hai.

Slippage ka ek common example hai market mein sudden volatility ya news ke time par. Agar aap ek buy order place karte hain aur market mein sudden fall hota hai, to aapka trade expected price se thoda sa lower execute ho sakta hai. Isi tarah, agar market mein sudden rise hoti hai aur aap sell order place karte hain, to aapka trade expected price se thoda sa higher execute ho sakta hai.

Slippage ka impact trading strategies par bhi hota hai. Scalpers, jo market mein short time frame par trades karte hain, slippage ke impact se zyada affected ho sakte hain. Long-term investors ko bhi slippage ka dhyan rakhna important hai, lekin unke liye ye generally short-term traders ke comparison mein kam hota hai.

Slippage se bachne ke liye traders advanced order types ka use karte hain, jaise ki limit orders aur stop orders. Limit orders mein trader specify karta hai ki wo trade sirf specific price par hi execute ho, jabki stop orders mein wo specify karta hai ki trade execute ho jab market ek specific level tak pahunch jaye.

Overall, slippage ka concept aur uske impact ko samajhna zaroori hai, taki traders apne risk ko manage kar sake aur apne trading strategies ko optimize kar sake. Slippage ek inherent part hai Forex trading ka, aur successful trading ke liye iska proper management karna crucial hai.

تبصرہ

Расширенный режим Обычный режим