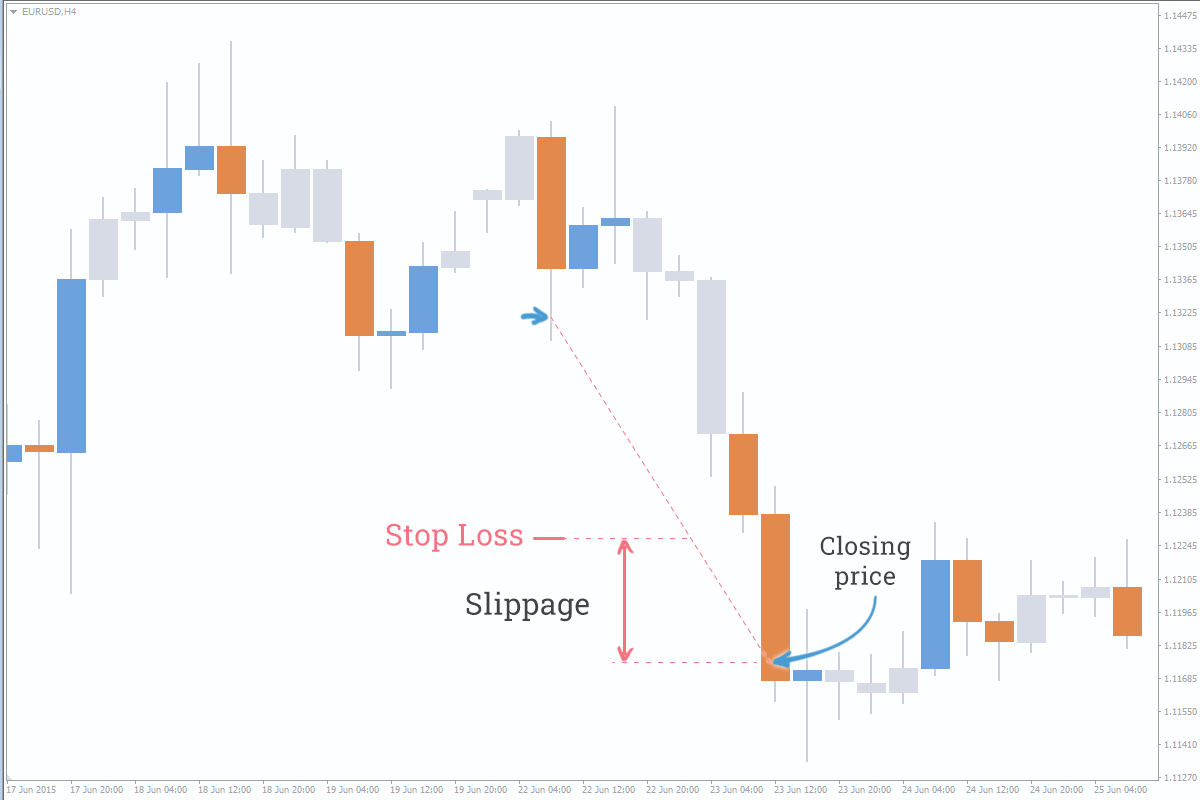

Forex trading mein "slippage" ek aham mudda hai jo traders ke liye ahem ho sakta hai. Slippage ka matlab hai jab aap kisi trade ko execute karte hain, lekin uska actual execution price expected price se alag hota hai. Yani ke, aapne ek specific price par trade enter ya exit karne ka irada kiya hota hai, lekin execution mein kuch farq ho jata hai.

Slippage ka sabse common reason market volatility hoti hai. Jab market mein tez o utar chadhav hota hai, ya kisi important economic event ke waqt, brokers mein order execution mein deri ho sakti hai. Is wajah se traders apne expected price se alag price par trades execute karte hain.

Iske ilawa, liquidity issues bhi slippage ka ek mool karak hai. Agar kisi currency pair mein kam liquidity hai, toh usme slippage hone ke chances badh jate hain. Low liquidity ki wajah se orders ko fulfill karne mein time lagta hai, aur isse slippage ka khatra badh jata hai.

Ek aur slippage ka factor hota hai order type. Market order aur limit order mein difference hota hai. Market order mein aap trade immediate price par karte hain, jabki limit order mein aap specific price par trade karna chahte hain. Market order execute hone mein jyada fast hota hai, lekin isme slippage ka risk bhi badh jata hai

Slippage se bachne ke liye traders ko kuch precautions leni chahiye. Sabse pehle, volatile market conditions mein trading se bachna chahiye, ya phir stop orders ka istemal kiya ja sakta hai. Stop orders, specific price par trade ko execute karte hain, lekin market price jab wo specific price tak pahunchti hai. Isse slippage ka risk kam hota hai.

Lekin yeh important hai ki traders slippage ko puri tarah se avoid nahi kar sakte, kyun ki market conditions hamesha changing hoti hain. Isliye, risk management strategies ka istemal karna bhi zaroori hai. Position size ko control mein rakhna aur stop-loss orders ka istemal karke traders apne trading exposure ko kam kar sakte hain.

In conclusion, slippage ek common phenomenon hai forex trading mein, aur isse bachne ke liye traders ko market conditions ko monitor karna, risk management strategies ka istemal karna, aur order types ka sahi istemal karna zaroori hai.

Slippage ka sabse common reason market volatility hoti hai. Jab market mein tez o utar chadhav hota hai, ya kisi important economic event ke waqt, brokers mein order execution mein deri ho sakti hai. Is wajah se traders apne expected price se alag price par trades execute karte hain.

Iske ilawa, liquidity issues bhi slippage ka ek mool karak hai. Agar kisi currency pair mein kam liquidity hai, toh usme slippage hone ke chances badh jate hain. Low liquidity ki wajah se orders ko fulfill karne mein time lagta hai, aur isse slippage ka khatra badh jata hai.

Ek aur slippage ka factor hota hai order type. Market order aur limit order mein difference hota hai. Market order mein aap trade immediate price par karte hain, jabki limit order mein aap specific price par trade karna chahte hain. Market order execute hone mein jyada fast hota hai, lekin isme slippage ka risk bhi badh jata hai

Slippage se bachne ke liye traders ko kuch precautions leni chahiye. Sabse pehle, volatile market conditions mein trading se bachna chahiye, ya phir stop orders ka istemal kiya ja sakta hai. Stop orders, specific price par trade ko execute karte hain, lekin market price jab wo specific price tak pahunchti hai. Isse slippage ka risk kam hota hai.

Lekin yeh important hai ki traders slippage ko puri tarah se avoid nahi kar sakte, kyun ki market conditions hamesha changing hoti hain. Isliye, risk management strategies ka istemal karna bhi zaroori hai. Position size ko control mein rakhna aur stop-loss orders ka istemal karke traders apne trading exposure ko kam kar sakte hain.

In conclusion, slippage ek common phenomenon hai forex trading mein, aur isse bachne ke liye traders ko market conditions ko monitor karna, risk management strategies ka istemal karna, aur order types ka sahi istemal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим