Hello dear

Transparency in forex Urdu

Forex trading mien transparency) ek ahem mudda hai jo tijarat karne walon ke liye aham hai. Shaffafiyat ka matlab hai ke bazaar mein hone wale tamam transactions, qeemat changes, aur dusre asoolon ka wazeh taur par dikhaya jaye takay tijarat karne walay sahi aur pur-asar faislay kar sakein.

understanding of transparency in forex trading

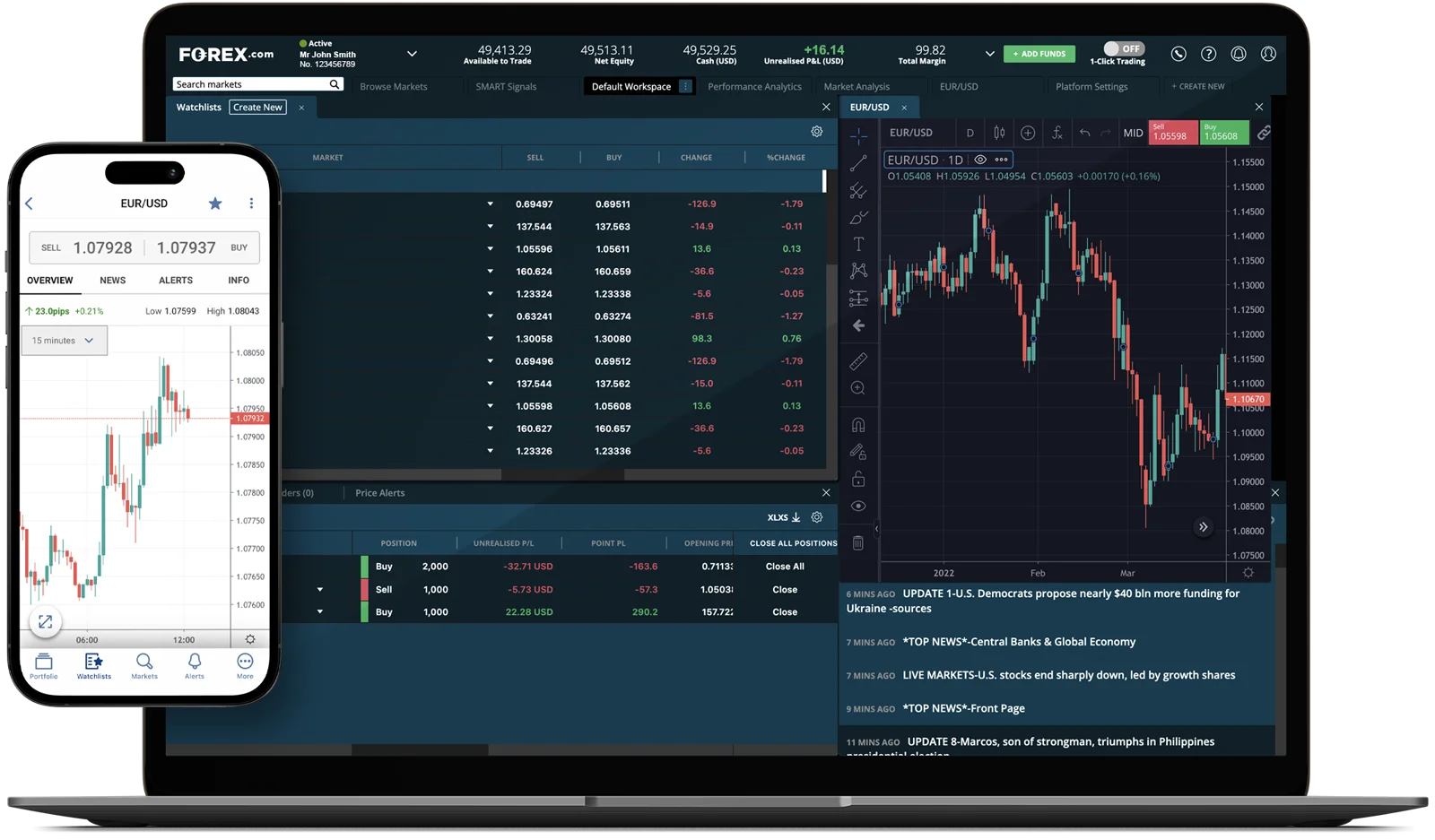

Shaffafiyat ko barqarar rakhne ke liye, forex brokers ko apne clients ko sahi aur mojooda malumat farahem karne mein zimmedar rehna chahiye. Yeh malumat account statements, live price quotes, aur market analysis shamil karti hai. Iske ilawa, shaffaf brokers apne clients ko trading platforms ke zariye real-time market data bhi farahem karte hain.

What is market efficiency

Forex trading mein shaffafiyat ka ek bada hissa market execution hai. Market execution ka matlab hai ke trades turant bazaar mein execute hoti hain, aur traders ko unke diye gaye prices par hi kharid ya bechne ki ejazat hoti hai. Yeh ek transparent process hai jismein traders ko asal market prices dikhai deti hain, aur unki orders bina kisi manipulation ke execute hoti hain.

Supplied offering

Ek aur shaffafiyat ka pahlu spreads hai. Spreads woh farq hai jo buy (kharid) aur sell (bech) prices ke darmiyan hota hai. Shaffaf brokers apne spreads ko kam rakhte hain, jisse traders ko zyada transparent pricing mile. Yeh traders ko yeh bhi pata chalta hai ke woh kitni darust prices par trade kar rahe hain.

Key takeaway

Regulation bhi ek zariya hai jisse shaffafiyat barqarar rakhi ja sakti hai. Aksar mulk bhar mein financial regulatory bodies hain jo forex brokers ko regulate karte hain. In regulatory bodies ka maqsad tijarat karne walon ki hifazati aur shaffafiyat ko barqarar rakhna hota hai. Shaffaf brokers aksar in regulatory bodies se license hasil karte hain, jo unke ethical aur legal business operations ko barqarar rakhne mein madad karti hain.

Making an informed designs

Lekin, shaffafiyat ki mukammal tasdeeq ke liye traders ko apne broker ka chayan karte waqt savdhan rehna chahiye. Broker ka background check karna aur uski reputation ko jaan lena zaroori hai. Online reviews aur regulatory bodies ki websites par jach karke traders apne broker ke baray mein malumat hasil kar sakte hain.

Market integrity

Iske ilawa, traders ko apne trades aur transactions ko monitor karne ke liye bhi tayyar rehna chahiye. Regularly apne accounts ki statements check karna aur market conditions ko observe karna shaffafiyat ka aham hissa hai. Yeh tijarat karne walon ko yakeen dilata hai ke unki malumat asal aur sahi hai.Is tarah, forex trading mein shaffafiyat ek aham bunyad hai jo tijarat karne walon ko azaadi aur bharosa farahem karti hai. Transparent trading environment mein, traders apne faislay sahi malumat par base kar sakte hain aur apne investments ko behtar taur par manage kar sakte hain.

Transparency in forex Urdu

Forex trading mien transparency) ek ahem mudda hai jo tijarat karne walon ke liye aham hai. Shaffafiyat ka matlab hai ke bazaar mein hone wale tamam transactions, qeemat changes, aur dusre asoolon ka wazeh taur par dikhaya jaye takay tijarat karne walay sahi aur pur-asar faislay kar sakein.

understanding of transparency in forex trading

Shaffafiyat ko barqarar rakhne ke liye, forex brokers ko apne clients ko sahi aur mojooda malumat farahem karne mein zimmedar rehna chahiye. Yeh malumat account statements, live price quotes, aur market analysis shamil karti hai. Iske ilawa, shaffaf brokers apne clients ko trading platforms ke zariye real-time market data bhi farahem karte hain.

What is market efficiency

Forex trading mein shaffafiyat ka ek bada hissa market execution hai. Market execution ka matlab hai ke trades turant bazaar mein execute hoti hain, aur traders ko unke diye gaye prices par hi kharid ya bechne ki ejazat hoti hai. Yeh ek transparent process hai jismein traders ko asal market prices dikhai deti hain, aur unki orders bina kisi manipulation ke execute hoti hain.

Supplied offering

Ek aur shaffafiyat ka pahlu spreads hai. Spreads woh farq hai jo buy (kharid) aur sell (bech) prices ke darmiyan hota hai. Shaffaf brokers apne spreads ko kam rakhte hain, jisse traders ko zyada transparent pricing mile. Yeh traders ko yeh bhi pata chalta hai ke woh kitni darust prices par trade kar rahe hain.

Key takeaway

Regulation bhi ek zariya hai jisse shaffafiyat barqarar rakhi ja sakti hai. Aksar mulk bhar mein financial regulatory bodies hain jo forex brokers ko regulate karte hain. In regulatory bodies ka maqsad tijarat karne walon ki hifazati aur shaffafiyat ko barqarar rakhna hota hai. Shaffaf brokers aksar in regulatory bodies se license hasil karte hain, jo unke ethical aur legal business operations ko barqarar rakhne mein madad karti hain.

Making an informed designs

Lekin, shaffafiyat ki mukammal tasdeeq ke liye traders ko apne broker ka chayan karte waqt savdhan rehna chahiye. Broker ka background check karna aur uski reputation ko jaan lena zaroori hai. Online reviews aur regulatory bodies ki websites par jach karke traders apne broker ke baray mein malumat hasil kar sakte hain.

Market integrity

Iske ilawa, traders ko apne trades aur transactions ko monitor karne ke liye bhi tayyar rehna chahiye. Regularly apne accounts ki statements check karna aur market conditions ko observe karna shaffafiyat ka aham hissa hai. Yeh tijarat karne walon ko yakeen dilata hai ke unki malumat asal aur sahi hai.Is tarah, forex trading mein shaffafiyat ek aham bunyad hai jo tijarat karne walon ko azaadi aur bharosa farahem karti hai. Transparent trading environment mein, traders apne faislay sahi malumat par base kar sakte hain aur apne investments ko behtar taur par manage kar sakte hain.

تبصرہ

Расширенный режим Обычный режим