Dow Theory in Forex:

1. Introduction:

Dow Theory ek technical analysis approach hai jo market trends aur price movements ko understand karne mein istemal hoti hai. Charles Dow ne late 19th aur early 20th century mein is theory ko develop kiya tha, aur aaj bhi yeh traders ke liye valuable hai, including those in the forex market.

2. Basic Principles:

Dow Theory ke mool principles three main concepts par tiki hui hain:

Markets Discount Everything: Yeh kehta hai ke saari information already reflected hoti hai current prices mein.

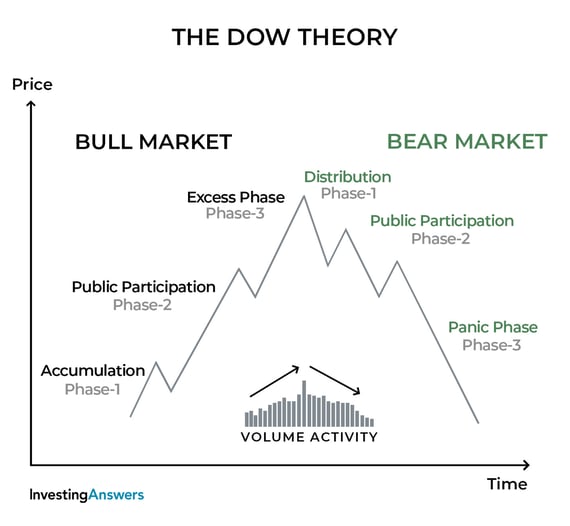

Market Moves in Trends: Dow Theory ke mutabiq, markets ek specific trend mein move karte hain, jo alag-alag phases mein hota hai: primary trend, secondary reaction, aur short-term fluctuations.

Trends Have Three Phases: Primary trend ko Dow Theory mein "accumulation phase," "public participation phase," aur "distribution phase" mein divide kiya gaya hai.

3. Dow Theory in Forex:

Forex market mein, Dow Theory ka istemal market trends ko samajhne aur trading decisions lene mein hota hai. Forex traders is theory ko use karte hain take unhe market trends aur potential reversals ka pata chale.

4. Primary Trend aur Forex:

Dow Theory ke mutabiq, primary trend wo hoti hai jo market ke overall direction ko represent karti hai. Forex traders primary trend ke identification mein interested hote hain kyun ke isse unko pata chalta hai ke market bullish, bearish, ya sideways hai.

5. Secondary Reactions:

Jab primary trend mein short-term reversals ya corrections hote hain, unhe secondary reactions kehte hain. Yeh thode samay ke liye hoti hain aur primary trend ke against hoti hain. Forex traders ko yeh samajhna important hai taake wo differentiate kar sakein ke kya market mein long-term change hone wala hai ya bas short-term correction hai.

6. Accumulation, Distribution, aur Forex:

Dow Theory ke hisab se, accumulation phase mein smart money ya institutional investors positions build karte hain. Distribution phase mein, wo apne positions ko slowly sell karte hain. Forex traders in phases ko analyze karke market sentiment aur potential trend changes ko predict karne ki koshish karte hain.

7. Limitations of Dow Theory:

Dow Theory ke bawajood, yeh kuch limitations bhi rakhti hai. Isme kai subjective elements hote hain, jaise trend lines aur chart patterns, jo traders ke interpretation par depend karte hain. Isliye, Dow Theory ko lagbhag aur confirmatory indicators ke saath use karna important hai.

8. Conclusion:

Dow Theory ek timeless approach hai jo market dynamics ko samajhne mein madad karta hai. Forex traders is theory ka istemal karke market trends ko analyze karte hain aur apne trading strategies ko shape karte hain. Yeh approach, jab sahi tarah se samjha jata hai, traders ko market ke underlying forces ko better samajhne mein help karta hai.

1. Introduction:

Dow Theory ek technical analysis approach hai jo market trends aur price movements ko understand karne mein istemal hoti hai. Charles Dow ne late 19th aur early 20th century mein is theory ko develop kiya tha, aur aaj bhi yeh traders ke liye valuable hai, including those in the forex market.

2. Basic Principles:

Dow Theory ke mool principles three main concepts par tiki hui hain:

Markets Discount Everything: Yeh kehta hai ke saari information already reflected hoti hai current prices mein.

Market Moves in Trends: Dow Theory ke mutabiq, markets ek specific trend mein move karte hain, jo alag-alag phases mein hota hai: primary trend, secondary reaction, aur short-term fluctuations.

Trends Have Three Phases: Primary trend ko Dow Theory mein "accumulation phase," "public participation phase," aur "distribution phase" mein divide kiya gaya hai.

3. Dow Theory in Forex:

Forex market mein, Dow Theory ka istemal market trends ko samajhne aur trading decisions lene mein hota hai. Forex traders is theory ko use karte hain take unhe market trends aur potential reversals ka pata chale.

4. Primary Trend aur Forex:

Dow Theory ke mutabiq, primary trend wo hoti hai jo market ke overall direction ko represent karti hai. Forex traders primary trend ke identification mein interested hote hain kyun ke isse unko pata chalta hai ke market bullish, bearish, ya sideways hai.

5. Secondary Reactions:

Jab primary trend mein short-term reversals ya corrections hote hain, unhe secondary reactions kehte hain. Yeh thode samay ke liye hoti hain aur primary trend ke against hoti hain. Forex traders ko yeh samajhna important hai taake wo differentiate kar sakein ke kya market mein long-term change hone wala hai ya bas short-term correction hai.

6. Accumulation, Distribution, aur Forex:

Dow Theory ke hisab se, accumulation phase mein smart money ya institutional investors positions build karte hain. Distribution phase mein, wo apne positions ko slowly sell karte hain. Forex traders in phases ko analyze karke market sentiment aur potential trend changes ko predict karne ki koshish karte hain.

7. Limitations of Dow Theory:

Dow Theory ke bawajood, yeh kuch limitations bhi rakhti hai. Isme kai subjective elements hote hain, jaise trend lines aur chart patterns, jo traders ke interpretation par depend karte hain. Isliye, Dow Theory ko lagbhag aur confirmatory indicators ke saath use karna important hai.

8. Conclusion:

Dow Theory ek timeless approach hai jo market dynamics ko samajhne mein madad karta hai. Forex traders is theory ka istemal karke market trends ko analyze karte hain aur apne trading strategies ko shape karte hain. Yeh approach, jab sahi tarah se samjha jata hai, traders ko market ke underlying forces ko better samajhne mein help karta hai.

تبصرہ

Расширенный режим Обычный режим