Ask aur Bid Forex Trading Mein

Ask (Pochna):

Ask forex trading mein woh rate hai jis par aap market se currency ya kisi aur financial instrument ko khareed sakte hain. Yani, jab aap currency khareed rahe hote hain, toh aapko market price par nahi, balki slightly higher price par purchase karna parta hai. Ask rate market makers ya brokers dwara set kiya jata hai aur isme spread shamil hota hai, jo ke broker ki fees hai.

Bid (Arzi):

Bid rate woh rate hai jis par aap market mein apni currency ya kisi aur financial instrument ko bech sakte hain. Yani, jab aap currency bech rahe hote hain, toh aapko market price par nahi, balki slightly lower price par sale karna parta hai. Bid rate bhi market makers ya brokers dwara set kiya jata hai aur isme spread shamil hota hai.

Spread (Farq):

Spread ka matlab hota hai Ask aur Bid ke darmiyan ka farq. Yeh farq broker ki fees ko darust karta hai aur spread ka size market conditions aur currency pair par depend karta hai. Jab spread kam hota hai, toh trading cost bhi kam hoti hai.

Example:

Maan lijiye ke EUR/USD currency pair ka Ask rate 1.2000 hai aur Bid rate 1.1995 hai. Iska matlab hai ke agar aap EUR/USD khareedna chahte hain, toh aapko market price par nahi, balki 1.2000 rate par khareedna parta hai. Jab aap ise bechna chahte hain, toh aap ise market price par nahi, balki 1.1995 rate par bech sakte hain.

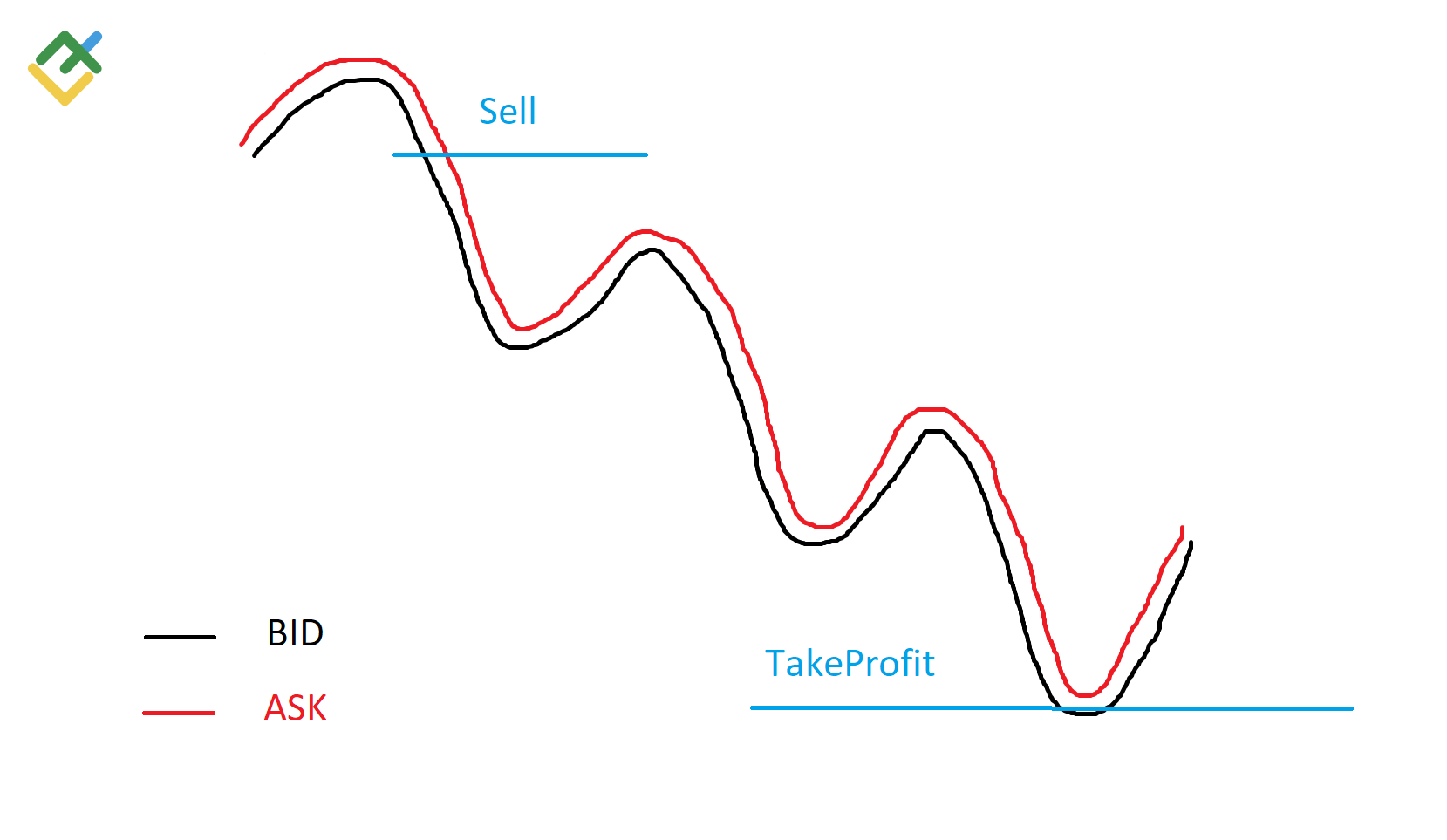

Ask aur Bid Ka Asar:

Ask aur Bid rates ke darmiyan ka farq market liquidity aur supply-demand par depend karta hai. Jab market mein zyada buyers hote hain, toh Ask rate mein izafa hota hai. Jab market mein zyada sellers hote hain, toh Bid rate mein izafa hota hai.

Conclusion:

Ask aur Bid rates forex trading mein ahem hain kyun ke inhi par traders apne transactions complete karte hain. In rates ko samajhna aur sahi taur par interpret karna forex trading mein kamiyabi hasil karne ke liye zaroori hai.

تبصرہ

Расширенный режим Обычный режим