Hanging Man Candlestick Pattern - Bullish Reversal

Introduction: Hanging Man ek bullish reversal candlestick pattern hai jo market mein downtrend ke baad aata hai aur iska matlab hota hai ke bearish momentum kamzor ho sakta hai aur bullish trend shuru hone wala hai.

Hanging Man Pattern Kaise Banata Hai:

Hanging Man pattern tab ban jata hai jab ek single candlestick chart par aata hai, aur iski shape ek inverted T ki tarah hoti hai. Yeh candlestick body ke neeche aik lambi shadow (tail) ke sath aata hai aur iski closing price opening price se ooper hoti hai.

Hanging Man Pattern Ki Pechan: Hanging Man pattern ki pehchan ke liye kuch key points hain:

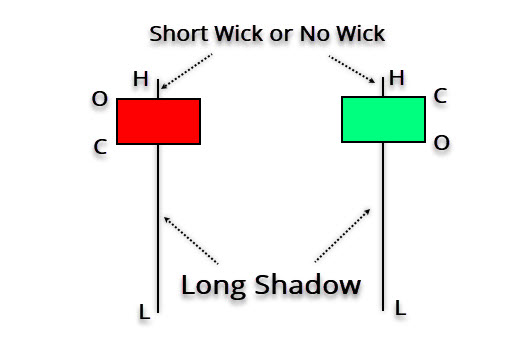

- Body Ka Size:

- Hanging Man candle ka body chhota hota hai, jiska matlab hai ke opening price aur closing price mein kam farq hota hai.

- Lambi Lower Shadow (Tail):

- Hanging Man mein ek lambi lower shadow hoti hai, jo ke neeche ja kar support level tak pohanchti hai.

- No or Small Upper Shadow:

- Upper shadow chhota ya bilkul na ho, lekin agar hai toh woh bhi neeche ki taraf hota hai.

Hanging Man Pattern Aur Bullish Reversal: Hanging Man pattern ka asal maqsad yeh hota hai ke jab market mein downtrend ho, toh jab yeh pattern aata hai, toh yeh indicate karta hai ke sellers ki power kamzor ho rahi hai aur buyers ki taraf shift ho sakti hai.

Trading Strategies:

- Confirmation Ke Liye Wait:

- Hanging Man pattern ko dekh kar direct trading karne se pehle traders ko wait karna chahiye aur dekhna chahiye ke agle candles kya signal dete hain. Agar agle candle bullish hai aur hanging man ko confirm karta hai, toh yeh bullish reversal ko strengthen karta hai.

- Stop-Loss Aur Target Levels Set Karna:

- Har trading strategy mein stop-loss aur target levels set karna zaroori hai. Hanging Man pattern ke baad traders ko apne orders ke liye sahi stop-loss aur target levels set kar ke trade karna chahiye.

Ikhtitam: Hanging Man Bullish Reversal pattern ek powerful indicator ho sakta hai agar sahi taur par istemal kiya jaye. Lekin, jese ke har technical analysis tool, isay bhi dusre indicators ke sath mila kar istemal karna zaroori hai taki sahi trading decisions liye ja sakein.

تبصرہ

Расширенный режим Обычный режим