Introduction Of The Pattern.

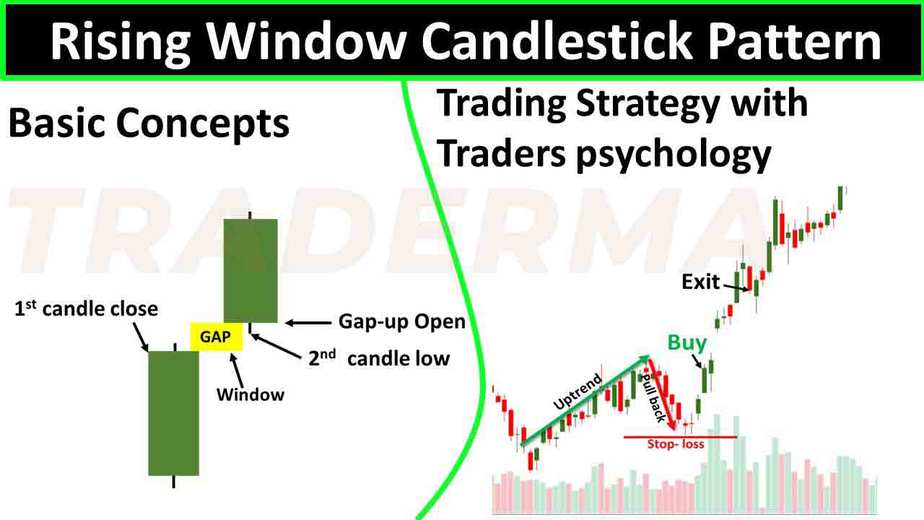

Rising Window, ek candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern price chart par ek bullish trend ke baad dikhai deta hai. rising Window pattern ko candlestick charts par asani se pehchan sakte hain.

Is pattern mein, ek bullish candlestick gap ke saath ek higher level se open hota hai. Gap ka matlab hota hai ki candlestick ka open price higher hota hai previous candlestick ke close price se. Is tarah, naye candlestick ka range purane candlestick ke range se oopar hota hai. Ye gap ko khidki ki tarah dekha jata hai, jis liye is pattern ka naam "Rising Window" hai.

Rising Window pattern bullish momentum ko predict kerta hai, jahan market mein buying pressure hoti hai. Is pattern ki pehchan karne ke liye, candlestick charts par gap ki taraf dhyan dena zaroori hai. rising Window pattern ko confirm karne ke liye, traders price movement aur volume ki analysis karte hain.

Ye pattern aam taur par uptrend ke shuru hone ke baad dekha jata hai aur traders ko future price movement ke baare mein hint deta hai. agar ye pattern sahi samay par dikhta hai, toh traders iska istemal karke entry points, stop-loss levels aur profit targets ka faisla kar sakte hain.

Rising Window pattern ke saath trading karte waqt traders ko hamesha risk management aur dusre technical indicators ka istemal karne ki salah di jati hai. Market volatility aur dusre factors ko bhi dhyan mein rakhte hue is pattern ko samajhna zaroori hai.

Trading Strategy For Rising Window.

Rising Window, jo keh Gap Up ke naam se bhi jana jata hai, ek bullish candlestick pattern hai jise technical analysis mein istemal kia jata hai. rising Window pattern tab banata hai jab current candlestick ki high value aur previous candlestick ki low value ke beech mein ek gap hota hai.

Is strategy ka istemal trend mein uparward move ki pehchan karne ke liye kia jata hai.

Ismein aapko dekhna hota hai ke current candlestick ki high value previous candlestick ki low value se upar hai.

Trade Confirmation

Confirmation ke liye doji ya bullish candlestick talash karein: Rising Window pattern ko confirm karne ke liye, aap doji ya bullish candlestick ki talash kar sakte hain. agar current candlestick doji ya bullish hai, toh pattern ka confirmation hota hai.

Trade entry:

agar Rising Window pattern aur confirmatory candlestick dono maujood hain, toh aap trade enter kar sakte hain. entry point, confirmatory candlestick ki high value se upar rakha ja sakta hai.

Stop Loss And Target Levels

Trade ke risk ko manage karne ke liye, aap stop loss aur target levels set karein. stop loss, trade entry point se thoda neeche rakha ja sakta hai. Target ( T.P) level ko trend analysis ki bunyad aur risk reward ratio k mutabiq decide karein.

Trade Management With Trailing Stop Loss.

Jab trade enter ho jaye, tab aapko trade management karna hoga. Ismein aap trailing stop loss ka istemal kar sakte hain, jo trade ke favorable movement ke saath apne stop loss level ko adjust karta hai.

Rising Window, ek candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern price chart par ek bullish trend ke baad dikhai deta hai. rising Window pattern ko candlestick charts par asani se pehchan sakte hain.

Is pattern mein, ek bullish candlestick gap ke saath ek higher level se open hota hai. Gap ka matlab hota hai ki candlestick ka open price higher hota hai previous candlestick ke close price se. Is tarah, naye candlestick ka range purane candlestick ke range se oopar hota hai. Ye gap ko khidki ki tarah dekha jata hai, jis liye is pattern ka naam "Rising Window" hai.

Rising Window pattern bullish momentum ko predict kerta hai, jahan market mein buying pressure hoti hai. Is pattern ki pehchan karne ke liye, candlestick charts par gap ki taraf dhyan dena zaroori hai. rising Window pattern ko confirm karne ke liye, traders price movement aur volume ki analysis karte hain.

Ye pattern aam taur par uptrend ke shuru hone ke baad dekha jata hai aur traders ko future price movement ke baare mein hint deta hai. agar ye pattern sahi samay par dikhta hai, toh traders iska istemal karke entry points, stop-loss levels aur profit targets ka faisla kar sakte hain.

Rising Window pattern ke saath trading karte waqt traders ko hamesha risk management aur dusre technical indicators ka istemal karne ki salah di jati hai. Market volatility aur dusre factors ko bhi dhyan mein rakhte hue is pattern ko samajhna zaroori hai.

Trading Strategy For Rising Window.

Rising Window, jo keh Gap Up ke naam se bhi jana jata hai, ek bullish candlestick pattern hai jise technical analysis mein istemal kia jata hai. rising Window pattern tab banata hai jab current candlestick ki high value aur previous candlestick ki low value ke beech mein ek gap hota hai.

Is strategy ka istemal trend mein uparward move ki pehchan karne ke liye kia jata hai.

Ismein aapko dekhna hota hai ke current candlestick ki high value previous candlestick ki low value se upar hai.

Trade Confirmation

Confirmation ke liye doji ya bullish candlestick talash karein: Rising Window pattern ko confirm karne ke liye, aap doji ya bullish candlestick ki talash kar sakte hain. agar current candlestick doji ya bullish hai, toh pattern ka confirmation hota hai.

Trade entry:

agar Rising Window pattern aur confirmatory candlestick dono maujood hain, toh aap trade enter kar sakte hain. entry point, confirmatory candlestick ki high value se upar rakha ja sakta hai.

Stop Loss And Target Levels

Trade ke risk ko manage karne ke liye, aap stop loss aur target levels set karein. stop loss, trade entry point se thoda neeche rakha ja sakta hai. Target ( T.P) level ko trend analysis ki bunyad aur risk reward ratio k mutabiq decide karein.

Trade Management With Trailing Stop Loss.

Jab trade enter ho jaye, tab aapko trade management karna hoga. Ismein aap trailing stop loss ka istemal kar sakte hain, jo trade ke favorable movement ke saath apne stop loss level ko adjust karta hai.

تبصرہ

Расширенный режим Обычный режим