Hikkake Candlestick Pattern.

Hikkake Candlestick Pattern, forex trading mein ek popular chart pattern hai. Is pattern ko Japanese trader Daniel Chesler ne develop kiya tha. Is pattern ko candlestick charts se identify kiya jata hai, jisme price action aur market trends ko analyze kiya jata hai.

Hikkake Candlestick Pattern, ek reversal pattern hai, jo market ke direction ko change karne ki indication deta hai. Is pattern mein, market price ek aisi range mein trade karta hai, jisme traders ko confusion hoti hai ki market ka trend kya hai. Is situation ko Hikkake Candlestick Pattern kehte hain.

Is pattern ko identify karne ke liye, traders ko market mein price action aur candlestick charts ko closely observe karna padta hai. Ye pattern kuch steps mein develop hota hai, jo iske signals ko detect karne mein traders ko help karta hai.

Hikkake Candlestick Pattern Steps.

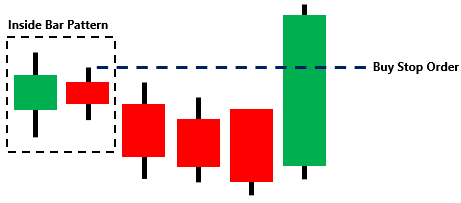

Step 1: Inside Bar Pattern.

Ye pattern barish aur bullish market mein develop hota hai. Jab market ek inside bar pattern mein trade karta hai, matlab ki ek candlestick dusre candlestick ke andar ki range mein trade karta hai, to ye ek indication hai ki market direction change hone wala hai.

Step 2: False Breakout.

False breakout, ek aisi situation hai, jab market ek particular range mein trade karta hai aur phir sudden movement se us range se bahar nikal jata hai. Lekin kuch hi der baad market phir se us range mein wapas aa jata hai. Ye situation, market ke reversal ka indication hai.

Step 3: Hikkake Pattern.

Hikkake Pattern, ek inside bar pattern aur false breakout ka combination hai. Is pattern mein, market ek inside bar pattern mein trade karta hai, phir false breakout se ek bahar nikal jata hai, aur phir phir se us inside bar pattern ke andar aa jata hai. Ye situation, market reversal ka indication hai.

Hikkake Candlestick Pattern, forex trading mein ek useful pattern hai, jo traders ko market trends aur price action ke analysis mein help karta hai. Is pattern ko identify karne ke liye, traders ko candlestick charts aur market analysis ko closely observe karna padta hai. Is pattern ke signals ko detect karne se traders ko profitable trades karne mein help milti hai.

Hikkake Candlestick Pattern, forex trading mein ek popular chart pattern hai. Is pattern ko Japanese trader Daniel Chesler ne develop kiya tha. Is pattern ko candlestick charts se identify kiya jata hai, jisme price action aur market trends ko analyze kiya jata hai.

Hikkake Candlestick Pattern, ek reversal pattern hai, jo market ke direction ko change karne ki indication deta hai. Is pattern mein, market price ek aisi range mein trade karta hai, jisme traders ko confusion hoti hai ki market ka trend kya hai. Is situation ko Hikkake Candlestick Pattern kehte hain.

Is pattern ko identify karne ke liye, traders ko market mein price action aur candlestick charts ko closely observe karna padta hai. Ye pattern kuch steps mein develop hota hai, jo iske signals ko detect karne mein traders ko help karta hai.

Hikkake Candlestick Pattern Steps.

Step 1: Inside Bar Pattern.

Ye pattern barish aur bullish market mein develop hota hai. Jab market ek inside bar pattern mein trade karta hai, matlab ki ek candlestick dusre candlestick ke andar ki range mein trade karta hai, to ye ek indication hai ki market direction change hone wala hai.

Step 2: False Breakout.

False breakout, ek aisi situation hai, jab market ek particular range mein trade karta hai aur phir sudden movement se us range se bahar nikal jata hai. Lekin kuch hi der baad market phir se us range mein wapas aa jata hai. Ye situation, market ke reversal ka indication hai.

Step 3: Hikkake Pattern.

Hikkake Pattern, ek inside bar pattern aur false breakout ka combination hai. Is pattern mein, market ek inside bar pattern mein trade karta hai, phir false breakout se ek bahar nikal jata hai, aur phir phir se us inside bar pattern ke andar aa jata hai. Ye situation, market reversal ka indication hai.

Hikkake Candlestick Pattern, forex trading mein ek useful pattern hai, jo traders ko market trends aur price action ke analysis mein help karta hai. Is pattern ko identify karne ke liye, traders ko candlestick charts aur market analysis ko closely observe karna padta hai. Is pattern ke signals ko detect karne se traders ko profitable trades karne mein help milti hai.

تبصرہ

Расширенный режим Обычный режим