Butterfly candlestick chart patterns kai hai

Butterfly pattern typically refers to a specific harmonic pattern in technical analysis rather than a candlestick pattern. The Butterfly pattern is a part of the broader field of harmonic trading, which involves using specific price relationships between highs and lows to identify potential reversal zones in the market.

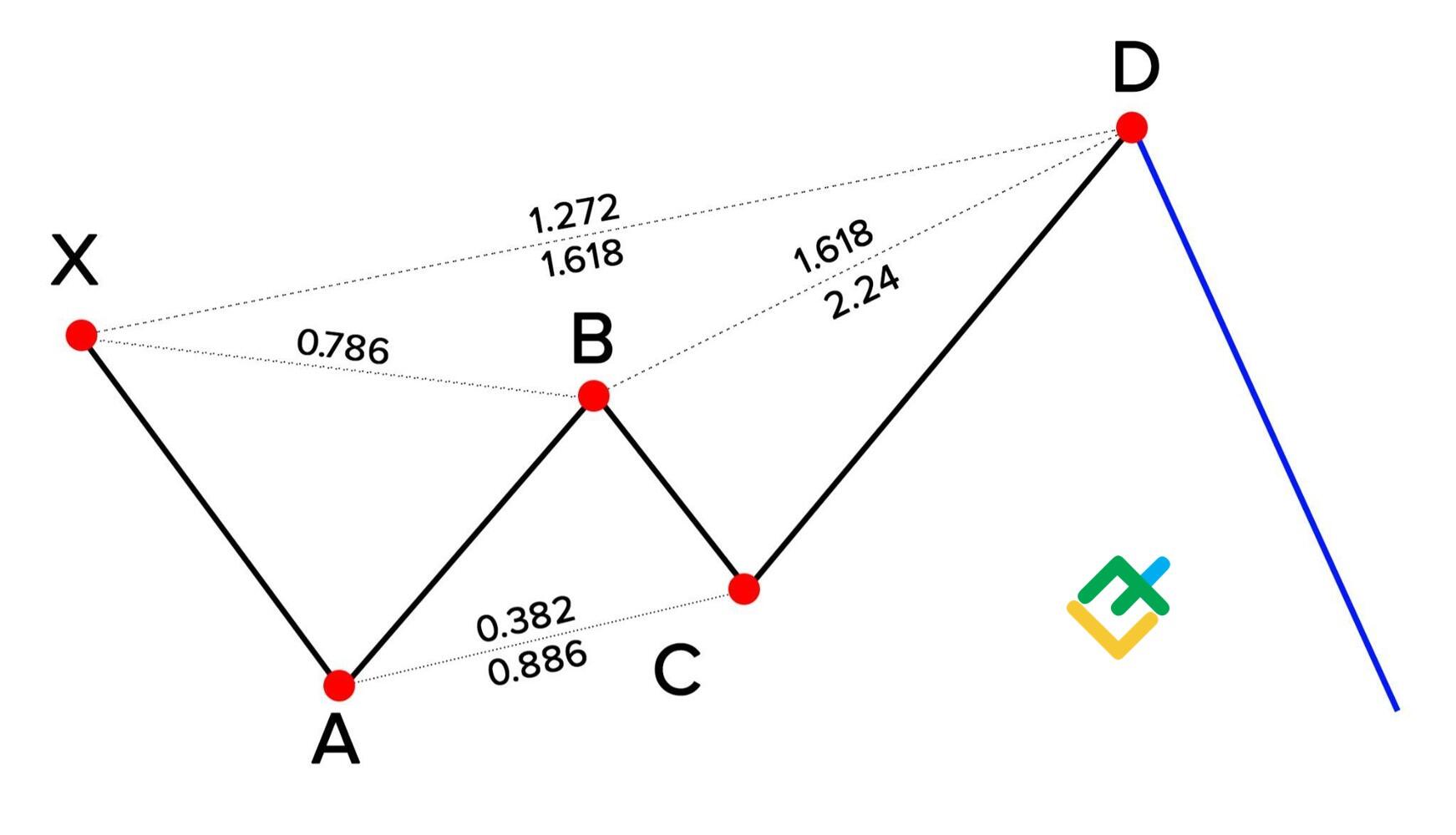

The Butterfly pattern is characterized by the following key points:

- Swing Points:

- The pattern consists of four distinct price swings or points labeled X, A, B, and C.

- Fibonacci Ratios:

- The Butterfly pattern relies on Fibonacci ratios to define the relationships between these points. Specifically, the pattern involves the following ratios:

- AB leg retraces 78.6% of the XA leg.

- BC leg extends to 127.2% or 161.8% of the AB leg.

- CD leg retraces 78.6% of the BC leg.

- The Butterfly pattern relies on Fibonacci ratios to define the relationships between these points. Specifically, the pattern involves the following ratios:

- Completion Point (D):

- The completion point of the pattern is at point D. This is where the CD leg completes its retracement, and it often coincides with the 127.2% or 161.8% Fibonacci extension level.

- Potential Reversal Zone:

- The area around the completion point D is considered the Potential Reversal Zone (PRZ). Traders look for additional technical confluence factors, such as support/resistance levels or other chart patterns, to strengthen the likelihood of a reversal.

Here's a simplified breakdown:

- XA Leg: Initial swing from X to A.

- AB Leg: Correction of XA by 78.6%.

- BC Leg: Extension of AB by 127.2% or 161.8%.

- CD Leg: Correction of BC by 78.6%, completing at the 127.2% or 161.8% extension of XA.

It's important to note that harmonic patterns, including the Butterfly pattern, require careful analysis and may not always unfold exactly as expected. Traders often use them in conjunction with other technical analysis tools and consider broader market conditions for confirmation. Additionally, these patterns are subjective, and different traders may have slightly different interpretations. Always practice good risk management when using any trading strategy or pattern.

تبصرہ

Расширенный режим Обычный режим