"Hammer Candlestick Pattern in Forex Market:

Kundi Mombati Chiragh Ki Pechan"

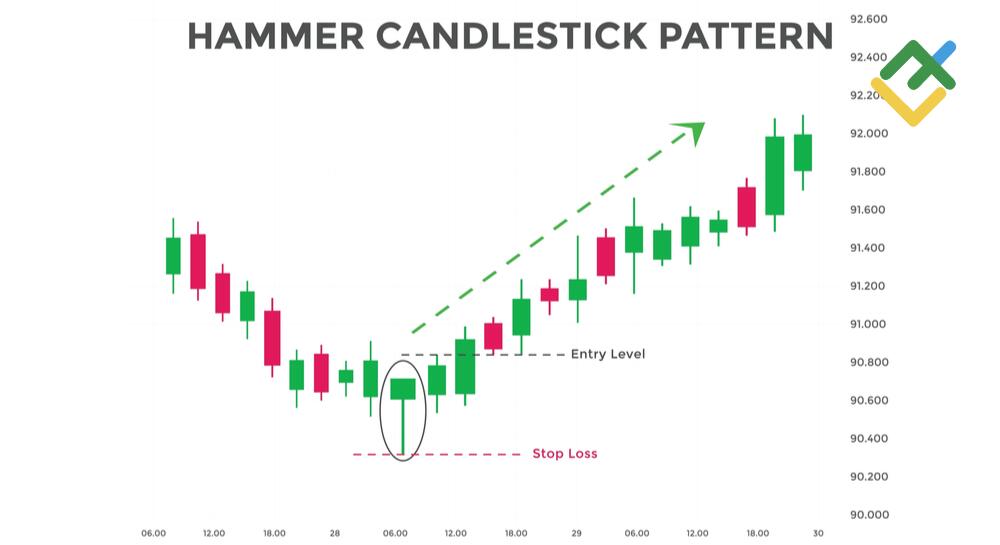

Forex market mein, hammer candlestick pattern ek aham technical analysis tool hai jo market trends ko samajhne mein madad karta hai. Is pattern ka naam "Kundi Mombati Chiragh Ki Pechan" hai, aur ye generally trend reversal ko suggest karta hai.

Hammer candlestick pattern ka appearance ek mombati chiragh ya hammer ki tarah hota hai. Is pattern mein ek lambi lower shadow hoti hai jo indicate karti hai ke market mein sellers ne initial stage mein control kiya tha, lekin phir price ne recover kiya aur candle ka close upper side par hota hai.

Key Features of Hammer Candlestick Pattern:

- Lambi Lower Shadow (Uchhi Neechay Ki Chhaya): Hammer candlestick pattern ka pehla characteristic hai uski lambi lower shadow. Ye lower shadow show karta hai ke price ne trading session ke dauran neeche ja kar touch kiya tha, lekin phir wapas upar aa gaya.

- Short Real Body (Chhota Asal Jism): Is pattern mein candle ka real body chhota hota hai aur upper shadow bhi short hoti hai. Real body candle ke opening aur closing prices ko represent karti hai.

- Trend Reversal Signal (Rukh Badalne Ki Alamat): Hammer candlestick pattern generally downtrend ke baad aata hai aur trend reversal ki indication deta hai. Ye show karta hai ke sellers ki initial dominance ke baad buyers ne control liya hai.

- Volume Analysis (Volume Ki Tafseelat): Hammer pattern ki validity ko confirm karne ke liye, traders ko volume ki bhi tafseelat dekhni chahiye. Agar hammer ke sath high volume ho, toh ye uski credibility ko barhata hai.

Trading Strategy:

- Confirmation Ke Liye Ek Candle Aur Wait Karna: Traders often wait karte hain ke agle candle ka close hammer ke upper side par ho, jisse trend reversal ki confirmation ho sake.

- Stop-Loss Aur Target Price Set Karna: Stop-loss order ko set karna zaroori hai taaki nuksan se bacha ja sake. Target price ko hammer pattern ke size aur overall market conditions ke mutabiq set kiya jata hai.

- Dusre Technical Indicators Ka Istemal: Hammer pattern ki confirmation ke liye, traders dusre technical indicators jese ke moving averages ya RSI ka istemal bhi karte hain.

Conclusion:

Hammer candlestick pattern, forex market mein trend reversal ko indicate karte hue traders ko potential entry points provide karta hai. Lekin, hamesha yaad rahe ke ek hi indicator par pura bharosa na karein aur market conditions ko thos taur par analyze karein.

تبصرہ

Расширенный режим Обычный режим