"Swing Trading Forex Mein:

Taiz Tijarat Se Door, Hidayat aur Tehqiqat Ki Dastaan"

Swing trading forex mein ek trading strategy hai jo traders ko market trends ko exploit karne mein madad karta hai, lekin ismein long-term investment ya intraday trading ki tarah lambi ya chhoti positions nahi li jati. Swing trading ka maqsad hota hai market ke short to medium-term price swings ko capture karna.

Yeh strategy un traders ke liye faidemand ho sakti hai jo market trends ko follow karna pasand karte hain lekin unko long-term positions hold karne mein ruchi nahi hoti. Swing trading mein traders kisi specific trend ya pattern ki pehchan karte hain aur phir us trend ke swings mein trading karte hain.

Key Features of Swing Trading:

- Short to Medium-Term Trades: Swing trading mein trades kuch din se lekar kuch hafton tak ke liye ho sakti hain. Isme traders market ki short to medium-term fluctuations ko target karte hain.

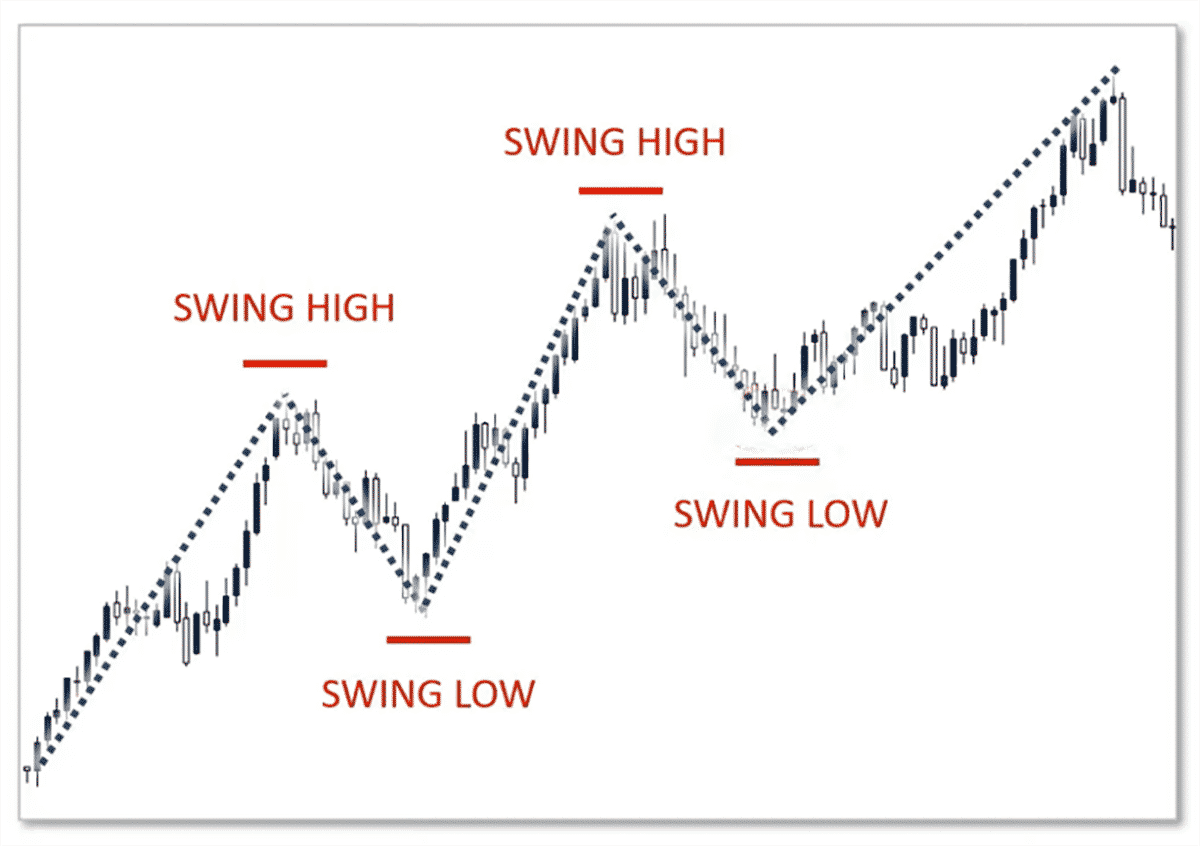

- Trend Identification: Swing traders market mein hone wale trends ko identify karte hain, jese ke uptrend (tezi), downtrend (mandi), ya sideway (range-bound) movements.

- Technical Analysis Ka Istemal: Technical analysis swing traders ke liye ahem hai. Woh price charts, indicators aur chart patterns ka istemal karte hain taaki market ke movements ko samajh sakein.

- Risk Management: Swing trading mein risk management ka bohot ahem kirdar hota hai. Traders stop-loss orders aur risk-reward ratios ka istemal karte hain taaki nuksan se bacha ja sake.

- No Constant Monitoring: Yeh ek part-time trading strategy hai, jiska matlab hai ke traders ko market ko constant nahi dekhna padta. Ismein din bhar ki monitoring ki zarurat nahi hoti.

Swing Trading Process:

- Trend Identification: Traders ko market mein hone wale trends ko pehchanne ke liye technical analysis ka istemal karna hota hai.

- Entry Points: Traders ko sahi entry points identify karne ke liye specific technical indicators aur chart patterns ka istemal karna hota hai.

- Risk Management: Stop-loss orders ka istemal karke traders apne nuksan ko control mein rakhte hain.

- Exit Points: Jab market trend change hone lagta hai, ya phir target price achieve ho jata hai, toh traders apne positions ko exit karte hain.

Conclusion:

Swing trading ek behtareen option ho sakti hai un traders ke liye jo market trends ko follow karna chahte hain lekin long-term positions hold nahi karna chahte. Is strategy mein technical analysis aur risk management ka istemal karke traders market ke fluctuations ko effectively exploit kar sakte hain.

تبصرہ

Расширенный режим Обычный режим