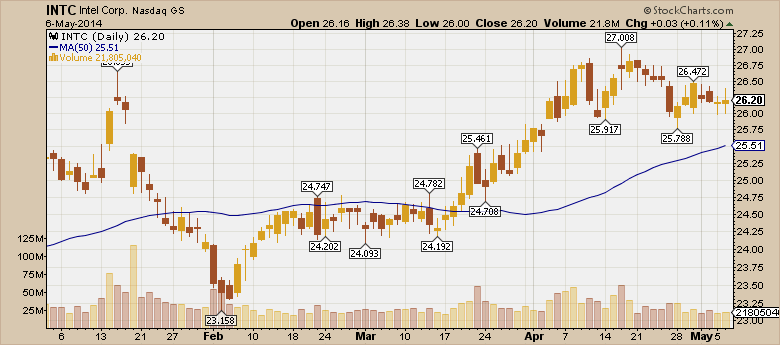

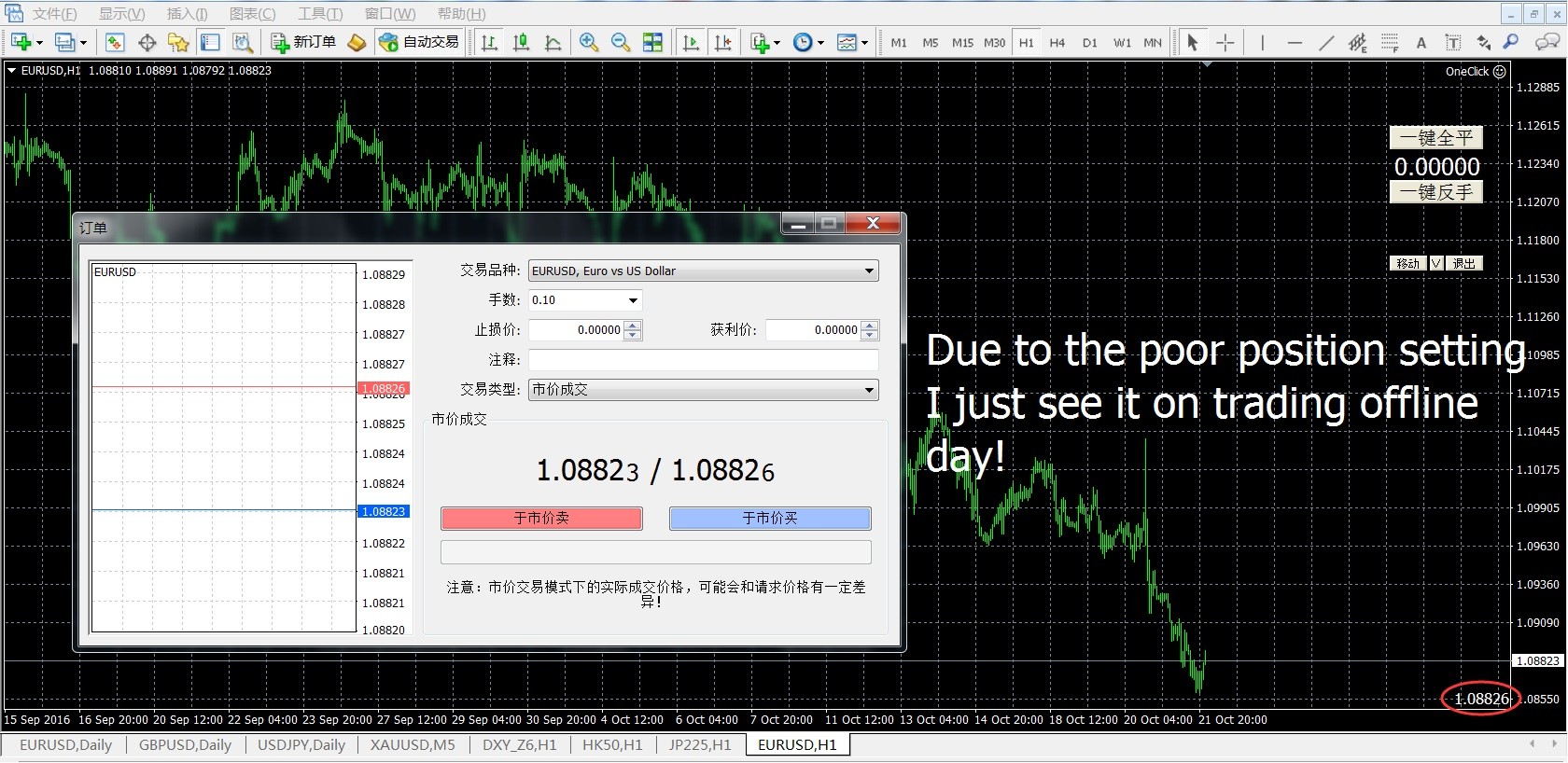

Trading mein left aur right price labels ka istemal prices ko monitor karne aur samajhne mein madad karta hai. Yeh labels trading platforms par aksar dekhe jate hain, jinme buy aur sell orders ko represent karte hain.

Left price label usually bid prices ko display karta hai, jo traders ke dwara specified price par shares kharidne ke liye ready hote hain. Jab aap bid price par trade karte hain, aap effectively lower price par asset purchase kar rahe hote hain.

Right price label, on the other hand, ask prices ko dikhata hai. Ask price woh price hai jis par sellers apne shares bechne ke liye tayyar hote hain. Jab aap ask price par trade karte hain, aap higher price par asset purchase kar rahe hote hain.

In dono labels ka sahi istemal karke traders market trends aur potential trades ko analyze karte hain. Bid aur ask prices ke beech ka spread bhi ek important factor hai, jo market volatility ko reflect karta hai. Kam spread usually ek stable market ko suggest karta hai jabki zyada spread high volatility ko darust karti hai.

Traders left aur right price labels ka istemal karke market depth ko bhi analyze karte hain. Market depth yeh batata hai ke kitne buyers aur sellers market mein maujood hain aur kis price level par. Isse traders ko ye samajhne mein madad milti hai ke market mein kis direction mein movement hone wala hai

Left and right price labels ka istemal trading strategies banane mein bhi hota hai. For example, agar aapko lagta hai ke asset ki price badhne wali hai, to aap bid price par trade karke us asset ko lower price par purchase kar sakte hain. Isi tarah se, agar aapko lagta hai ke price giregi, to aap ask price par trade karke higher price par bech sakte hain.

In conclusion, left and right price labels trading mein ek important tool hain jise traders apne decisions ko informed banane ke liye istemal karte hain. Ye labels market dynamics ko samajhne aur trades ko effectively execute karne mein madad karte hain.

Left price label usually bid prices ko display karta hai, jo traders ke dwara specified price par shares kharidne ke liye ready hote hain. Jab aap bid price par trade karte hain, aap effectively lower price par asset purchase kar rahe hote hain.

Right price label, on the other hand, ask prices ko dikhata hai. Ask price woh price hai jis par sellers apne shares bechne ke liye tayyar hote hain. Jab aap ask price par trade karte hain, aap higher price par asset purchase kar rahe hote hain.

In dono labels ka sahi istemal karke traders market trends aur potential trades ko analyze karte hain. Bid aur ask prices ke beech ka spread bhi ek important factor hai, jo market volatility ko reflect karta hai. Kam spread usually ek stable market ko suggest karta hai jabki zyada spread high volatility ko darust karti hai.

Traders left aur right price labels ka istemal karke market depth ko bhi analyze karte hain. Market depth yeh batata hai ke kitne buyers aur sellers market mein maujood hain aur kis price level par. Isse traders ko ye samajhne mein madad milti hai ke market mein kis direction mein movement hone wala hai

Left and right price labels ka istemal trading strategies banane mein bhi hota hai. For example, agar aapko lagta hai ke asset ki price badhne wali hai, to aap bid price par trade karke us asset ko lower price par purchase kar sakte hain. Isi tarah se, agar aapko lagta hai ke price giregi, to aap ask price par trade karke higher price par bech sakte hain.

In conclusion, left and right price labels trading mein ek important tool hain jise traders apne decisions ko informed banane ke liye istemal karte hain. Ye labels market dynamics ko samajhne aur trades ko effectively execute karne mein madad karte hain.

تبصرہ

Расширенный режим Обычный режим