Pending Orders in Forex Trading

Introduction

Dear Fellows,

Forex trading main pending orders kaa bahut benefit hota hain. Moreover Forex trading main pending orders basically aik aisa beneficial kam hain. K jis say aapki trade automatically open Ho jaati hain. Awar apki kisi ek point per pahunch kar jis se aap Forex trading mein kisi bhi point say apni trade execute kar sakte hain. So why agar aap apni trade kisi bhi point per automatic ke liye open karna chahte hain to aapko ismein pending orders ka use karna hota hai.

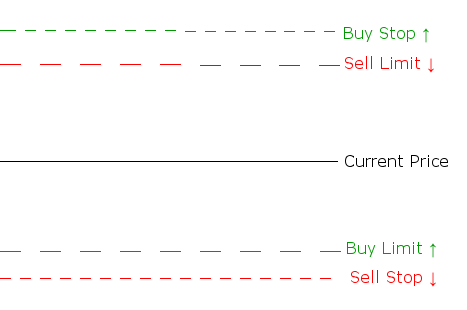

Sell Limit

Buy Limit

Sell Stop

Buy Stop

ye Forex trading mein basically pending orders hote hain Jin se aap Forex trading mein different situations main market ko analyse karte hue kisi ek point per apna pending order place kar sakte hain. K jisse aapko trade automatically open Ho jaati hain. aapko is main ziaada hardwork nahin karna padta aur aapki trade automatically execute hone ke bad ek Orton 1 point per pahunchkar Forex trading mein main proper profit dene ke bad automatically close Ho jaati hai is liye aapko a targeted profit mil sakta hai iske liye aapko ismein kam karne ke liye main se kam karna hota hai aur achcha kam karne chahie aap Forex trading mein kamyab ho sakte hain forexme basic limits ko use krny sy ap ki Forex trading main hum log instant order awar pending order lagaty hain pending order 4 types k hoty hain jo k market kEe situation k mutabiq lagay jaty han jis order ki jahan zarorat hoti ha wahan he lagaya jata ha forex trading main sell limit , buy limit , sell stop or buy stop laga sakty hain.awar ye sab market pe depend karta ha k hum log kase trading karna chahty han or kya strategy ha ya kya planning ha is sab ko hum log behtar learning sy seek sakty han or ache planning or strategy sy acha order laga saken gy or is sy ache earning kar k kamyab ho saken gay awar Sell limit

Sell limit hum log us waqat istamal karty ham jab market main value resistance level pe hoti ha or wahan sy ziada chance resistance level ko touch kar k wapis jany k hoty hain to us waqat log sell limit lagaty han means jab market is level ko touch kar k wapis aati ha to humy maximum profit ho sakta ha is ley humy chae ha ziada sy ziada profit hasil karny k liay sahe analysis karny awaress k mutabiq apna order lagany. Awar Buy limit hum log support level pe lagaty han jab bee market support level pe buy limit ko touch kar k wapis aay ge to maximum profit hasil ho sakey ga warna humy ziada loss nahi ho ga agar support level break kar da ge to wahan stop loss humary account ko safe rakhy gaa.

Sell stop or buy stop

Sell stop awar buy stop hum log support level awar resistance level k bad lagaty han jab bi market support Level pe hoti ha or humy lagta ha k support level weak ha or break ho jay ga to phr hum log sell stop lagaty han jab bi support level break hota ha to us k bad auto pe sell lag jati ha is tahrah humy maximum profit ho sakta hain esi tahra jab bee hum faida utha sakty hain.

Ehmiat

Fellows,

Forex trading market Main pending orders ki bahut ziada value hain. Q k hum ess mein usr karte hueay apni trade ko automatically reset kar sakte hain.

Ess liye Hamen chahie ki Ham painting orders ko bhi kam Mein laen Taki Hamara fayda ho aur Yahan per kam karne se Ham bahut Achcha kar sakte hain. orders ke mutabik kam apni trade ko automatic ke liye set kar sakte hain Jahan Bhi Hamen Laga Ke Hamen apni treat ko reset karna chahie To Ham in orders per focus kar sakte hain in orders may 4 Tarik ke audits a Jaate Hain stop limit limit by limits etc isliye Hamen chahie kya Ham forex market ko open karne se pahle demo Kaun ko open karke bahut acchi practice dene aur Hamen Forex ke bare mein Har EK chij Ka Pata Hona chahie ki kaun sa Patron kaun sa indicator aur kaun se ped Hamare fayde Ke Hain Hamen Kis Tarah Se Kam karna chahie isliye Hamen Forex mein bahut ziada mehnat ki jarurat hai aur jo log bahut mehnat karte hain Vahi log Kamyab hote hain aur ek expert trader banne ke liye Hamen Apne experience ko game karna chahie aur apni working skills ko bhi increase karna chahie Taki Ham Ek acchi trade open karke kam kar sake aur Hamari loss ke chances kam ho jaaye To Hamen forex market ki analysis karna bahut jyada jaruri hai kabhi bhi analysis kiye to aur patterns ko samjhe trade na lagaen Kyunki acid loss mein le Jaati hain.

Conclusion

Fellows,

Conclusion main Forex trading main hamary pass 2 types K orders hotay hain. trade karney K liye ko hum INSTANT ORDER kehtay hay aur dosaray ko haum PENDING ORDER kehtay hay INSTAN ORDERS say Murad ussi wakat order ka lag Jana hain. Agar appko market K current status ka pata chalta hay Kay market up jayegy. Awar ya down jaye gi tou phir haum ussi hisab say apna order lagatay hay jo ussi Wakat execute ho Jaye ga agar market up ja rahi hay tou phir app buy ka order lagay gay aur jab market down ja rahi ho tou app sell ka order lagaya gay appki order type kuch bhi ho app apney order ka stop loss aur take Profit zaroor set kartay hain. Awar volume size lot size order size enn tamaam ka ake hi matlub hay Kay app Jo trade ka order laganay Ja rahay hay usska size kutna ho appki trading may appka faida ho skta hain.

Thanks

Introduction

Dear Fellows,

Forex trading main pending orders kaa bahut benefit hota hain. Moreover Forex trading main pending orders basically aik aisa beneficial kam hain. K jis say aapki trade automatically open Ho jaati hain. Awar apki kisi ek point per pahunch kar jis se aap Forex trading mein kisi bhi point say apni trade execute kar sakte hain. So why agar aap apni trade kisi bhi point per automatic ke liye open karna chahte hain to aapko ismein pending orders ka use karna hota hai.

Sell Limit

Buy Limit

Sell Stop

Buy Stop

ye Forex trading mein basically pending orders hote hain Jin se aap Forex trading mein different situations main market ko analyse karte hue kisi ek point per apna pending order place kar sakte hain. K jisse aapko trade automatically open Ho jaati hain. aapko is main ziaada hardwork nahin karna padta aur aapki trade automatically execute hone ke bad ek Orton 1 point per pahunchkar Forex trading mein main proper profit dene ke bad automatically close Ho jaati hai is liye aapko a targeted profit mil sakta hai iske liye aapko ismein kam karne ke liye main se kam karna hota hai aur achcha kam karne chahie aap Forex trading mein kamyab ho sakte hain forexme basic limits ko use krny sy ap ki Forex trading main hum log instant order awar pending order lagaty hain pending order 4 types k hoty hain jo k market kEe situation k mutabiq lagay jaty han jis order ki jahan zarorat hoti ha wahan he lagaya jata ha forex trading main sell limit , buy limit , sell stop or buy stop laga sakty hain.awar ye sab market pe depend karta ha k hum log kase trading karna chahty han or kya strategy ha ya kya planning ha is sab ko hum log behtar learning sy seek sakty han or ache planning or strategy sy acha order laga saken gy or is sy ache earning kar k kamyab ho saken gay awar Sell limit

Sell limit hum log us waqat istamal karty ham jab market main value resistance level pe hoti ha or wahan sy ziada chance resistance level ko touch kar k wapis jany k hoty hain to us waqat log sell limit lagaty han means jab market is level ko touch kar k wapis aati ha to humy maximum profit ho sakta ha is ley humy chae ha ziada sy ziada profit hasil karny k liay sahe analysis karny awaress k mutabiq apna order lagany. Awar Buy limit hum log support level pe lagaty han jab bee market support level pe buy limit ko touch kar k wapis aay ge to maximum profit hasil ho sakey ga warna humy ziada loss nahi ho ga agar support level break kar da ge to wahan stop loss humary account ko safe rakhy gaa.

Sell stop or buy stop

Sell stop awar buy stop hum log support level awar resistance level k bad lagaty han jab bi market support Level pe hoti ha or humy lagta ha k support level weak ha or break ho jay ga to phr hum log sell stop lagaty han jab bi support level break hota ha to us k bad auto pe sell lag jati ha is tahrah humy maximum profit ho sakta hain esi tahra jab bee hum faida utha sakty hain.

Ehmiat

Fellows,

Forex trading market Main pending orders ki bahut ziada value hain. Q k hum ess mein usr karte hueay apni trade ko automatically reset kar sakte hain.

Ess liye Hamen chahie ki Ham painting orders ko bhi kam Mein laen Taki Hamara fayda ho aur Yahan per kam karne se Ham bahut Achcha kar sakte hain. orders ke mutabik kam apni trade ko automatic ke liye set kar sakte hain Jahan Bhi Hamen Laga Ke Hamen apni treat ko reset karna chahie To Ham in orders per focus kar sakte hain in orders may 4 Tarik ke audits a Jaate Hain stop limit limit by limits etc isliye Hamen chahie kya Ham forex market ko open karne se pahle demo Kaun ko open karke bahut acchi practice dene aur Hamen Forex ke bare mein Har EK chij Ka Pata Hona chahie ki kaun sa Patron kaun sa indicator aur kaun se ped Hamare fayde Ke Hain Hamen Kis Tarah Se Kam karna chahie isliye Hamen Forex mein bahut ziada mehnat ki jarurat hai aur jo log bahut mehnat karte hain Vahi log Kamyab hote hain aur ek expert trader banne ke liye Hamen Apne experience ko game karna chahie aur apni working skills ko bhi increase karna chahie Taki Ham Ek acchi trade open karke kam kar sake aur Hamari loss ke chances kam ho jaaye To Hamen forex market ki analysis karna bahut jyada jaruri hai kabhi bhi analysis kiye to aur patterns ko samjhe trade na lagaen Kyunki acid loss mein le Jaati hain.

Conclusion

Fellows,

Conclusion main Forex trading main hamary pass 2 types K orders hotay hain. trade karney K liye ko hum INSTANT ORDER kehtay hay aur dosaray ko haum PENDING ORDER kehtay hay INSTAN ORDERS say Murad ussi wakat order ka lag Jana hain. Agar appko market K current status ka pata chalta hay Kay market up jayegy. Awar ya down jaye gi tou phir haum ussi hisab say apna order lagatay hay jo ussi Wakat execute ho Jaye ga agar market up ja rahi hay tou phir app buy ka order lagay gay aur jab market down ja rahi ho tou app sell ka order lagaya gay appki order type kuch bhi ho app apney order ka stop loss aur take Profit zaroor set kartay hain. Awar volume size lot size order size enn tamaam ka ake hi matlub hay Kay app Jo trade ka order laganay Ja rahay hay usska size kutna ho appki trading may appka faida ho skta hain.

Thanks

تبصرہ

Расширенный режим Обычный режим