What is Japanese Candlestick

Introduction

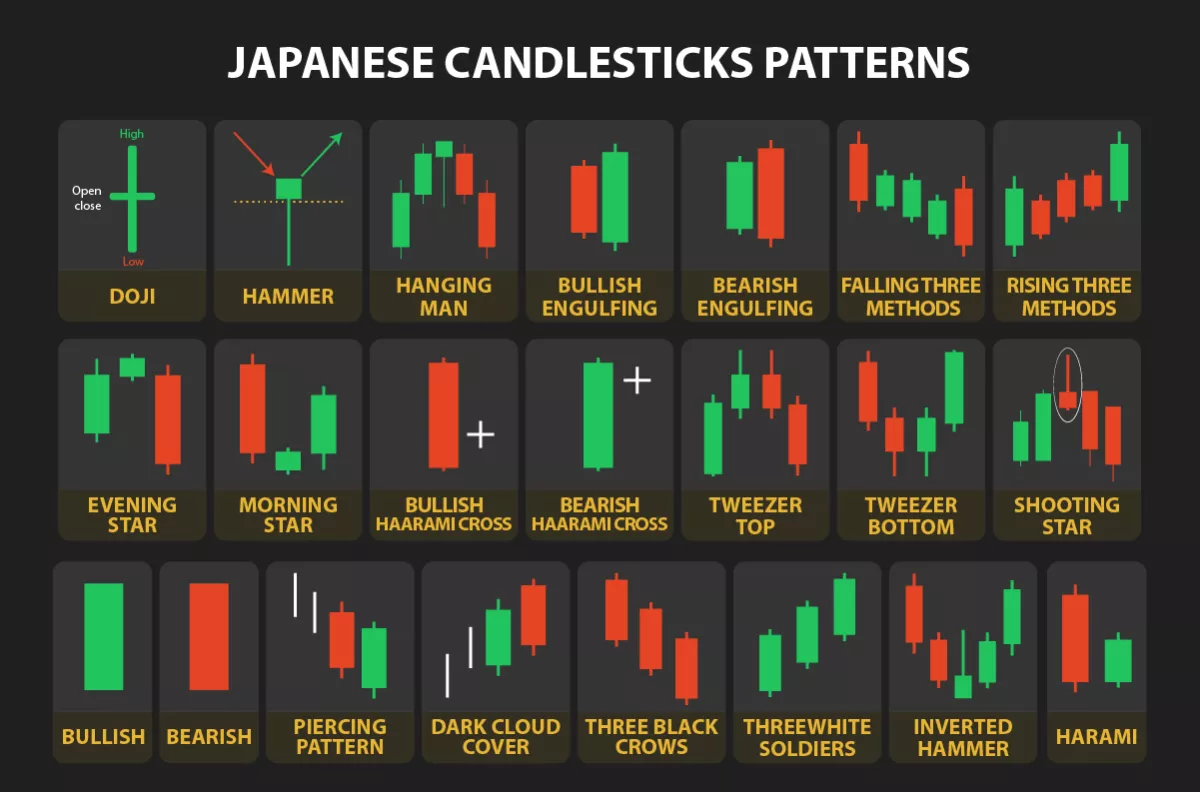

Japanese Candlestick Patterns, Forex aur Stock Market mein istemal hotay hain taake traders ko market ki harkat samajhne mein madad mile. Yeh patterns candlesticks ke shapes aur formations ko analyze karke market trends ko predict karne mein madad karte hain.

1.

Doji ek aisa pattern hai jisme opening aur closing price aik dosre ke bohot qareeb hoti hain. Yeh market mein uncertainty ko darust karti hai aur traders ko indicate karta hai ke market mein reversal hone ke chances hain.

2.

Hammer ek bullish reversal pattern hai, jisme ek chhoti si candle body hoti hai aur lambi lower shadow hoti hai. Yeh market mein bearish trend ko indicate karta hai, lekin phir market mein buyers ka aana isko reversal signal banata hai.

3

Shooting Star ek bearish reversal pattern hai, jisme ek lambi upper shadow hoti hai aur chhoti si candle body hoti hai. Yeh market mein bullish trend ko indicate karta hai, lekin phir market mein sellers ka aana isko reversal signal banata hai.

4.

Bullish Engulfing ek strong bullish reversal signal hai, jisme ek small bearish candle ke baad aata hai aur next candle usse badi bullish candle hoti hai. Yeh market mein bearish trend ko indicate karta hai, lekin phir strong buying ka signal deta hai.

5.

Bearish Engulfing ek strong bearish reversal signal hai, jisme ek small bullish candle ke baad aata hai aur next candle usse badi bearish candle hoti hai. Yeh market mein bullish trend ko indicate karta hai, lekin phir strong selling ka signal deta hai.

6.

Morning Star ek bullish reversal pattern hai, jisme ek downtrend ke baad ek small body wali candle aati hai, phir ek Doji aur phir ek bullish candle. Yeh market mein bearish trend ko indicate karta hai, lekin phir strong buying ka signal deta hai.

7.

Evening Star ek bearish reversal pattern hai, jisme ek uptrend ke baad ek small body wali candle aati hai, phir ek Doji aur phir ek bearish candle. Yeh market mein bullish trend ko indicate karta hai, lekin phir strong selling ka signal deta hai.

In patterns ko samajh kar traders market trends ko better analyze kar sakte hain aur apne trading strategies ko improve kar sakte hain.

Introduction

Japanese Candlestick Patterns, Forex aur Stock Market mein istemal hotay hain taake traders ko market ki harkat samajhne mein madad mile. Yeh patterns candlesticks ke shapes aur formations ko analyze karke market trends ko predict karne mein madad karte hain.

1.

Doji ek aisa pattern hai jisme opening aur closing price aik dosre ke bohot qareeb hoti hain. Yeh market mein uncertainty ko darust karti hai aur traders ko indicate karta hai ke market mein reversal hone ke chances hain.

2.

Hammer ek bullish reversal pattern hai, jisme ek chhoti si candle body hoti hai aur lambi lower shadow hoti hai. Yeh market mein bearish trend ko indicate karta hai, lekin phir market mein buyers ka aana isko reversal signal banata hai.

3

Shooting Star ek bearish reversal pattern hai, jisme ek lambi upper shadow hoti hai aur chhoti si candle body hoti hai. Yeh market mein bullish trend ko indicate karta hai, lekin phir market mein sellers ka aana isko reversal signal banata hai.

4.

Bullish Engulfing ek strong bullish reversal signal hai, jisme ek small bearish candle ke baad aata hai aur next candle usse badi bullish candle hoti hai. Yeh market mein bearish trend ko indicate karta hai, lekin phir strong buying ka signal deta hai.

5.

Bearish Engulfing ek strong bearish reversal signal hai, jisme ek small bullish candle ke baad aata hai aur next candle usse badi bearish candle hoti hai. Yeh market mein bullish trend ko indicate karta hai, lekin phir strong selling ka signal deta hai.

6.

Morning Star ek bullish reversal pattern hai, jisme ek downtrend ke baad ek small body wali candle aati hai, phir ek Doji aur phir ek bullish candle. Yeh market mein bearish trend ko indicate karta hai, lekin phir strong buying ka signal deta hai.

7.

Evening Star ek bearish reversal pattern hai, jisme ek uptrend ke baad ek small body wali candle aati hai, phir ek Doji aur phir ek bearish candle. Yeh market mein bullish trend ko indicate karta hai, lekin phir strong selling ka signal deta hai.

In patterns ko samajh kar traders market trends ko better analyze kar sakte hain aur apne trading strategies ko improve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим