What is positive volume index kai hai

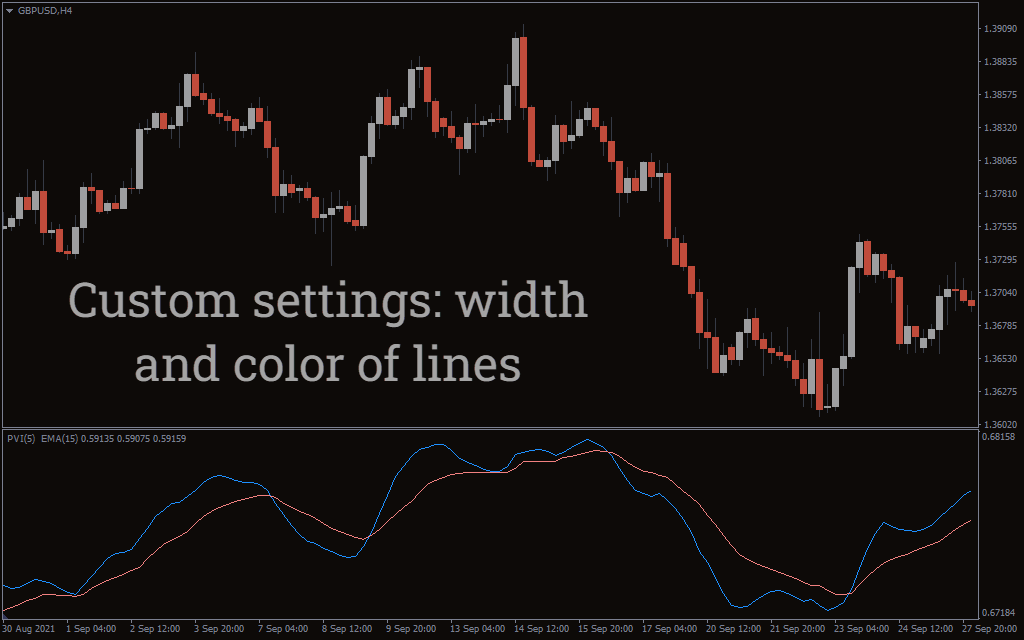

Positive Volume Index (PVI) ek technical indicator hai jo market volume aur price movements ke darmiyan ke correlation ko measure karta hai. Yeh indicator primarily stock market aur equity market analysis mein istemal hota hai. PVI ka maqsad hai positive market trends ko darust karna, jab volume bhi increase hota hai.

Positive Volume Index Ki Key Points:

- Created by Norman Fosback:

- PVI ko Norman Fosback ne create kiya tha. Yeh ek financial analyst aur researcher the jo ne 1970s mein is indicator ko develop kiya.

- Positive Correlation with Price Movements:

- PVI ka concept yeh hai ke jab market mein positive trends hote hain aur trading volume bhi increase hota hai, toh yeh indicate karta hai ke investors optimistic hain aur prices mein further increase expected hai.

- Calculation:

- PVI ko calculate karne ke liye, aapko har trading session ke end mein dekha gaya price par volume ratio calculate karna hota hai. Agar price higher hai, toh PVI increase hoga, warna decrease hoga.

����=����−1+(������−������−1)������−1×�������PVIt =PVIt−1+Closet−1(Closet−Closet−1)×Volumet- ����PVIt = Current Positive Volume Index

- ����−1PVIt−1 = Previous Positive Volume Index

- ������Closet = Current day's closing price

- ������−1Closet−1 = Previous day's closing price

- �������Volumet = Current day's trading volume

- Role in Market Analysis:

- PVI ka istemal primarily bullish markets mein hota hai. Jab PVI increase hota hai, toh yeh indicate karta hai ke market participants positive hain aur prices mein further increase ki umeed hai.

Limitations of Positive Volume Index:

- Limited Applicability:

- PVI ka istemal stock markets aur equity markets mein zyadatar hota hai. Other financial markets jese ke forex market mein, yeh utna popular nahi hota.

- Negative Trends:

- PVI sirf positive trends ko focus karta hai, isliye negative trends ke liye alag se ek indicator ki zarurat hoti hai.

- Reliance on Historical Data:

- PVI apne calculations ke liye historical price aur volume data ka istemal karta hai, isliye current market conditions ko fully capture karne mein limitations ho sakti hain.

Positive Volume Index ko interpret karna aur iska sahi istemal karne ke liye traders ko doosre technical indicators aur market analysis tools ke saath milake dekhna chahiye.

تبصرہ

Расширенный режим Обычный режим