What is head and shoulder pattern.kai hai

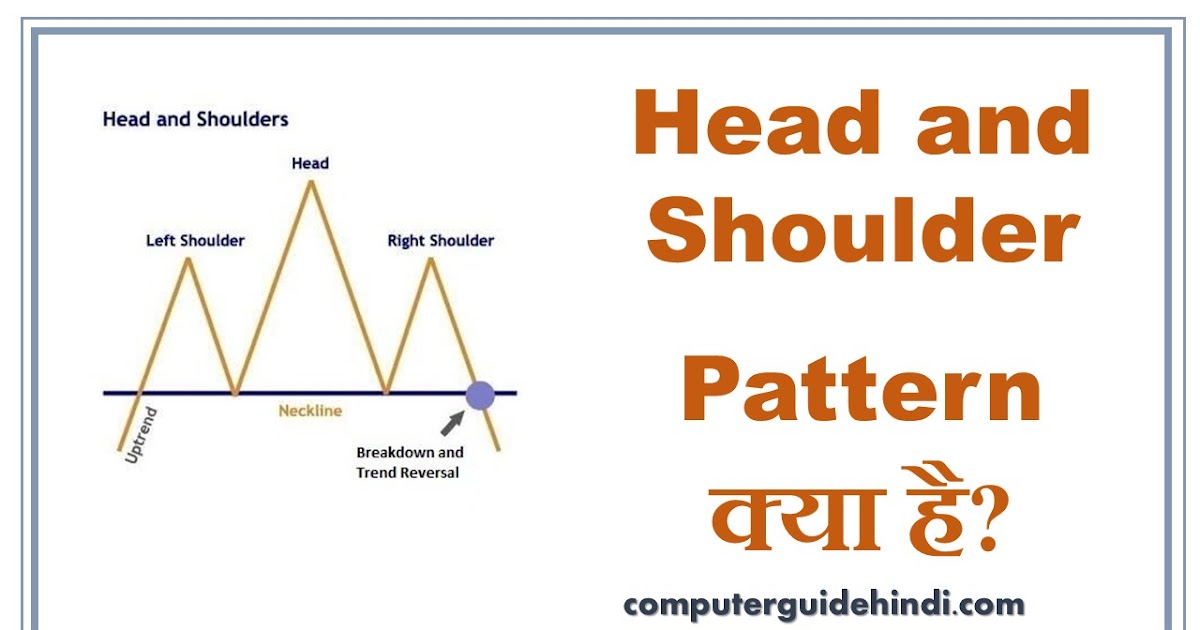

"Head and Shoulders" ek popular technical analysis pattern hai jo market trends ko identify karne mein istemal hota hai. Ye pattern market ke trend reversal ko darust karta hai. Is pattern mein teen prominent peaks hote hain jinhe "head" aur "shoulders" kaha jata hai.

Head and Shoulders Pattern Ka Tareeqa:

- Left Shoulder (Baen Kandha):

- Uptrend ke baad jab price ek high point touch karta hai aur phir se neeche aata hai, to yeh left shoulder hota hai.

- Head (Sar):

- Left shoulder ke baad jab price phir se upar jaakar ek higher point touch karta hai, to yeh head hota hai.

- Right Shoulder (Daen Kandha):

- Head ke baad jab price dobara neeche aakar ek lower point touch karta hai, to yeh right shoulder hota hai.

- Neckline:

- Left shoulder, head, aur right shoulder ke bottoms ko join karke ek imaginary line banti hai, jo neckline kehlata hai.

- Trend Reversal:

- Agar price right shoulder ke neeche neckline ko cross karta hai, toh ye ek bearish trend reversal ko indicate karta hai.

- Inverse Head and Shoulders:

- Agar yeh pattern neeche se upar banta hai, toh ise "Inverse Head and Shoulders" kehte hain, jo bullish trend reversal ko darust karta hai.

Trading Strategies Using Head and Shoulders Pattern:

- Entry Point:

- Bearish trend reversal ke liye entry point right shoulder ke neeche, aur bullish trend reversal ke liye entry point right shoulder ke upar hota hai.

- Stop Loss:

- Stop loss order ko typically opposite shoulder ke opposite side par set kiya jata hai.

- Take Profit:

- Take profit order ko traders apne risk-reward ratio ke mutabiq set karte hain.

Thawabit-e-Dimaagh:

Head and Shoulders pattern ek powerful trend reversal indicator hai, lekin hamesha yaad rahe ke market analysis ek holistic approach mein ki jani chahiye aur is pattern ko confirm karne ke liye doosre technical indicators aur market conditions ka bhi tajzia karna zaroori hai.

:max_bytes(150000):strip_icc()/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)

تبصرہ

Расширенный режим Обычный режим