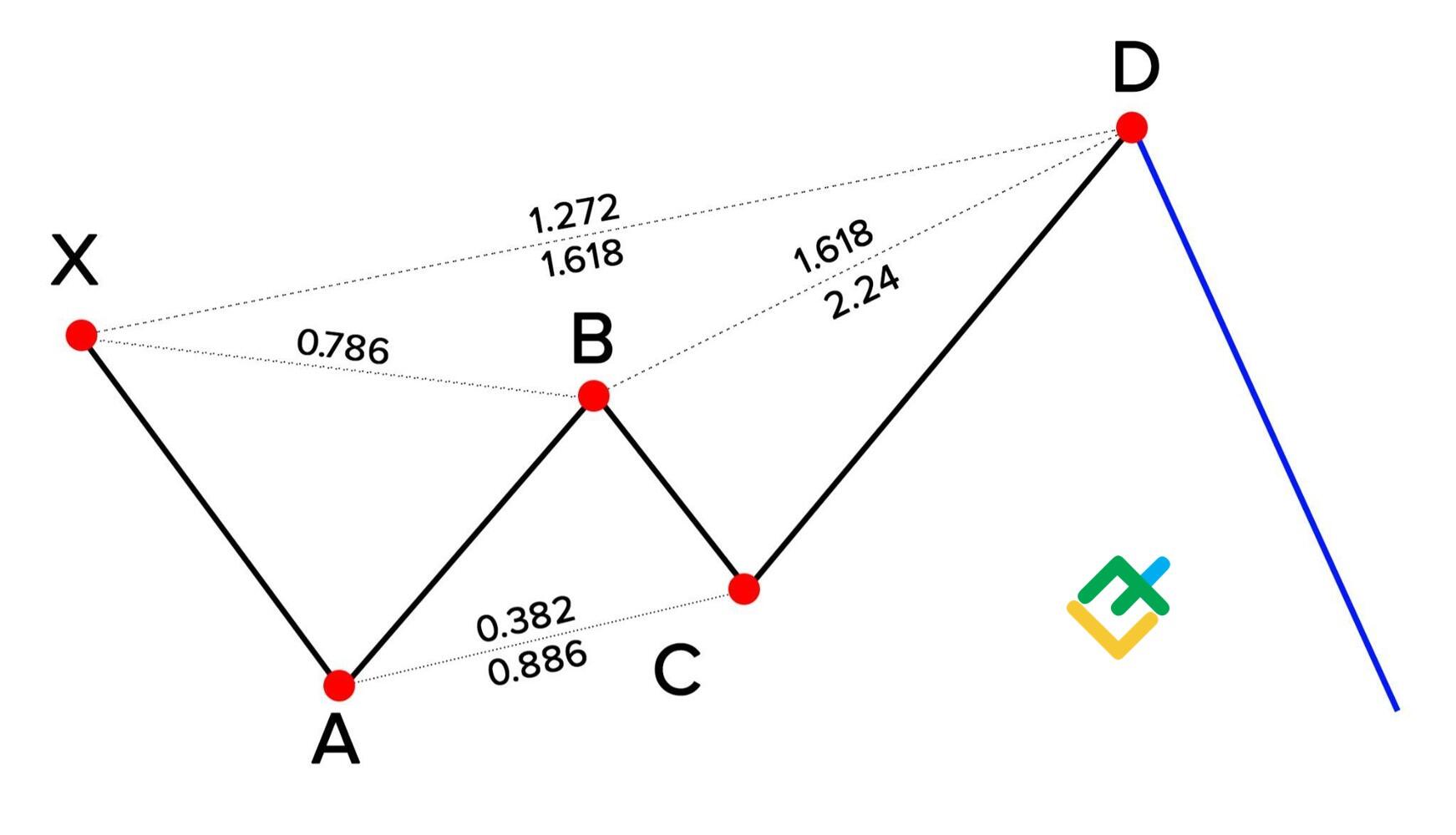

Butterfly candlestick pattern

Butterfly candlestick pattern ek technical analysis concept hai jo market trends aur price movements ko interpret karne mein istemal hota hai. Yeh pattern typically price reversal ko represent karta hai. Butterfly pattern ka formation hota hai jab prices mein initial strong move hoti hai, phir ek sharp reversal hota hai, followed by another move in the original direction.

Butterfly pattern ke pehle phase mein, bullish ya bearish trend hota hai, jise ek substantial move ke through indicate kiya jata hai. Phir aata hai reversal phase, jisme prices sharp pullback karte hain, lekin complete reversal nahi hota. Iske baad, third phase mein, prices fir se original trend direction mein move karte hain.

Traders butterfly pattern ko detect karne ke liye price data closely observe karte hain, especially high and low points par focus rakhte hain. Agar yeh pattern successfully identify hota hai, toh traders ko indication milti hai ke market mein potential reversal hone wala hai.

Butterfly pattern ki confirmation ke liye, traders ko doosre technical indicators ka bhi istemal karna hota hai, taki false signals se bacha ja sake. Butterfly pattern, market mein uncertainty aur potential trend change ko highlight karta hai, jise traders apni strategies mein incorporate karke future price movements ko anticipate kar sakte hain.

Is pattern ki understanding, traders ko market dynamics samajhne mein help karta hai aur sahi waqt par entry ya exit points tay karne mein madad karta hai. Lekin, jaise har technical analysis tool, butterfly pattern bhi 100% reliable nahi hota, isliye prudent risk management ke saath istemal karna important hai.

Butterfly candlestick pattern ek technical analysis concept hai jo market trends aur price movements ko interpret karne mein istemal hota hai. Yeh pattern typically price reversal ko represent karta hai. Butterfly pattern ka formation hota hai jab prices mein initial strong move hoti hai, phir ek sharp reversal hota hai, followed by another move in the original direction.

Butterfly pattern ke pehle phase mein, bullish ya bearish trend hota hai, jise ek substantial move ke through indicate kiya jata hai. Phir aata hai reversal phase, jisme prices sharp pullback karte hain, lekin complete reversal nahi hota. Iske baad, third phase mein, prices fir se original trend direction mein move karte hain.

Traders butterfly pattern ko detect karne ke liye price data closely observe karte hain, especially high and low points par focus rakhte hain. Agar yeh pattern successfully identify hota hai, toh traders ko indication milti hai ke market mein potential reversal hone wala hai.

Butterfly pattern ki confirmation ke liye, traders ko doosre technical indicators ka bhi istemal karna hota hai, taki false signals se bacha ja sake. Butterfly pattern, market mein uncertainty aur potential trend change ko highlight karta hai, jise traders apni strategies mein incorporate karke future price movements ko anticipate kar sakte hain.

Is pattern ki understanding, traders ko market dynamics samajhne mein help karta hai aur sahi waqt par entry ya exit points tay karne mein madad karta hai. Lekin, jaise har technical analysis tool, butterfly pattern bhi 100% reliable nahi hota, isliye prudent risk management ke saath istemal karna important hai.

تبصرہ

Расширенный режим Обычный режим