Butterfly Candlestick Chart Pattern:

Butterfly pattern, jise aam tor par "Bajay Ki Chidiya" ke naam se bhi jana jata hai, ek reversal candlestick chart pattern hai jo price action analysis mein istemal hota hai.

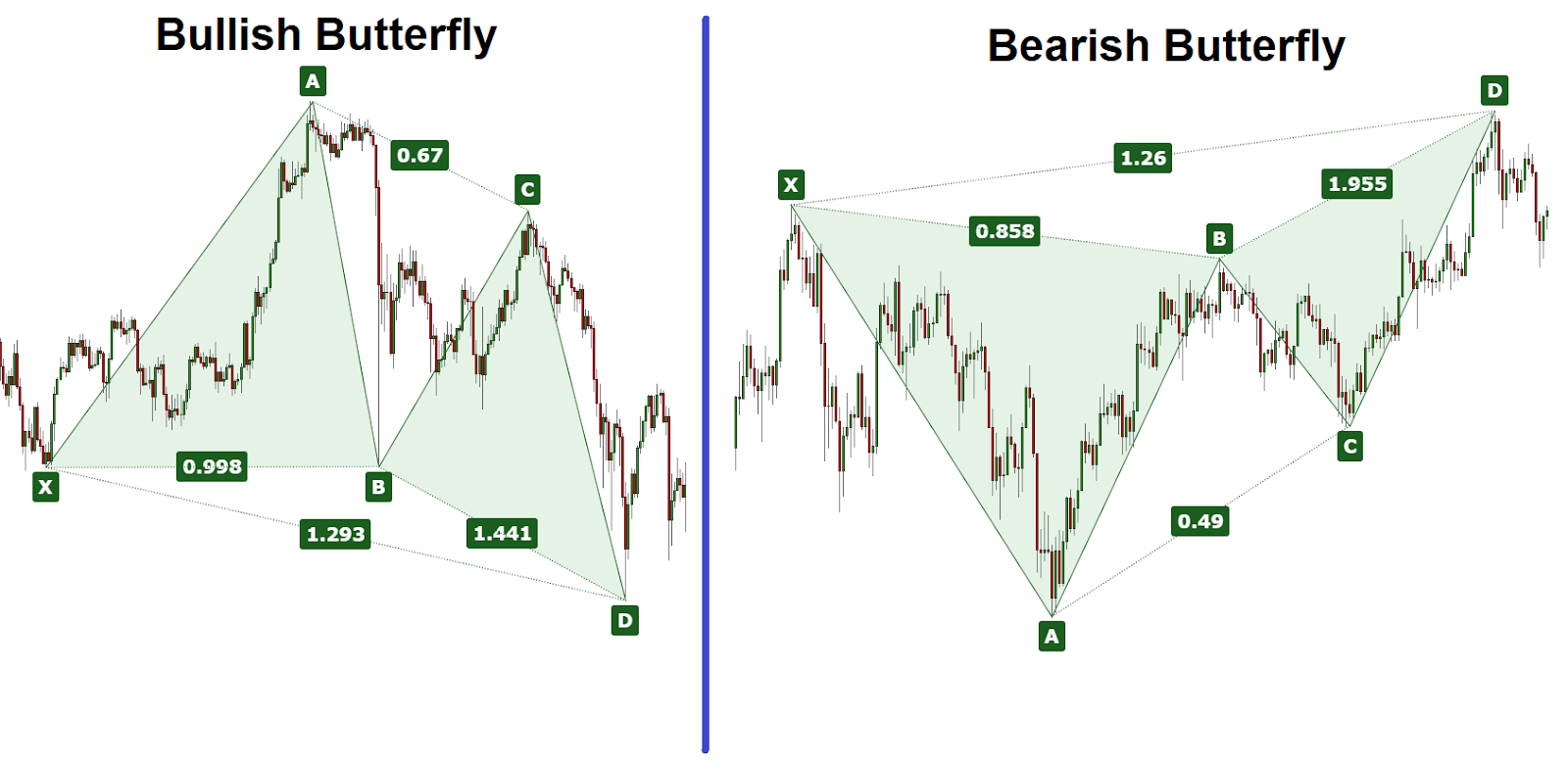

- Pattern Structure:

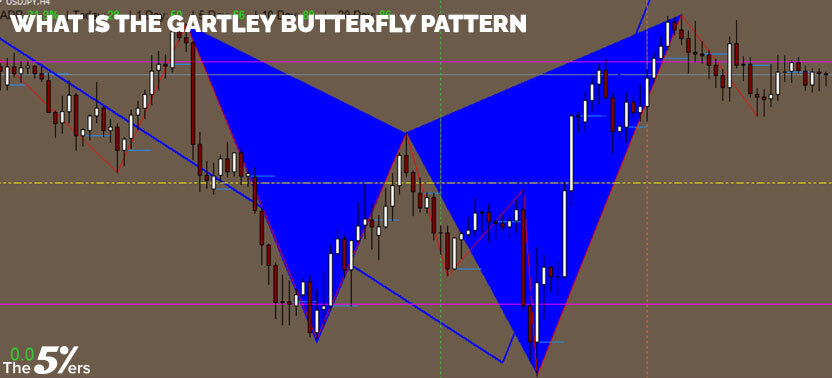

Butterfly pattern, chand mukhtalif candlesticks se bana hota hai jo ek particular sequence mein aate hain. Yeh pattern typically 5 candlesticks se bana hota hai. - Identification:

Butterfly pattern ko identify karne ke liye, traders ko pehli 3 candles ko dekhna hota hai jo ek specific trend ya direction mein move karte hain. Phir agle 2 candles aate hain jo pehli trend ko reverse karte hain. - Key Candles:

Butterfly pattern mein, do main candles hote hain jo pivotal hote hain: Ek bullish candle jise "X" kehte hain aur ek bearish candle jise "A" kehte hain. Agar "X" candle higher high par close hoti hai aur "A" candle lower low par close hoti hai, to yeh pattern confirm hota hai. - Price Targets:

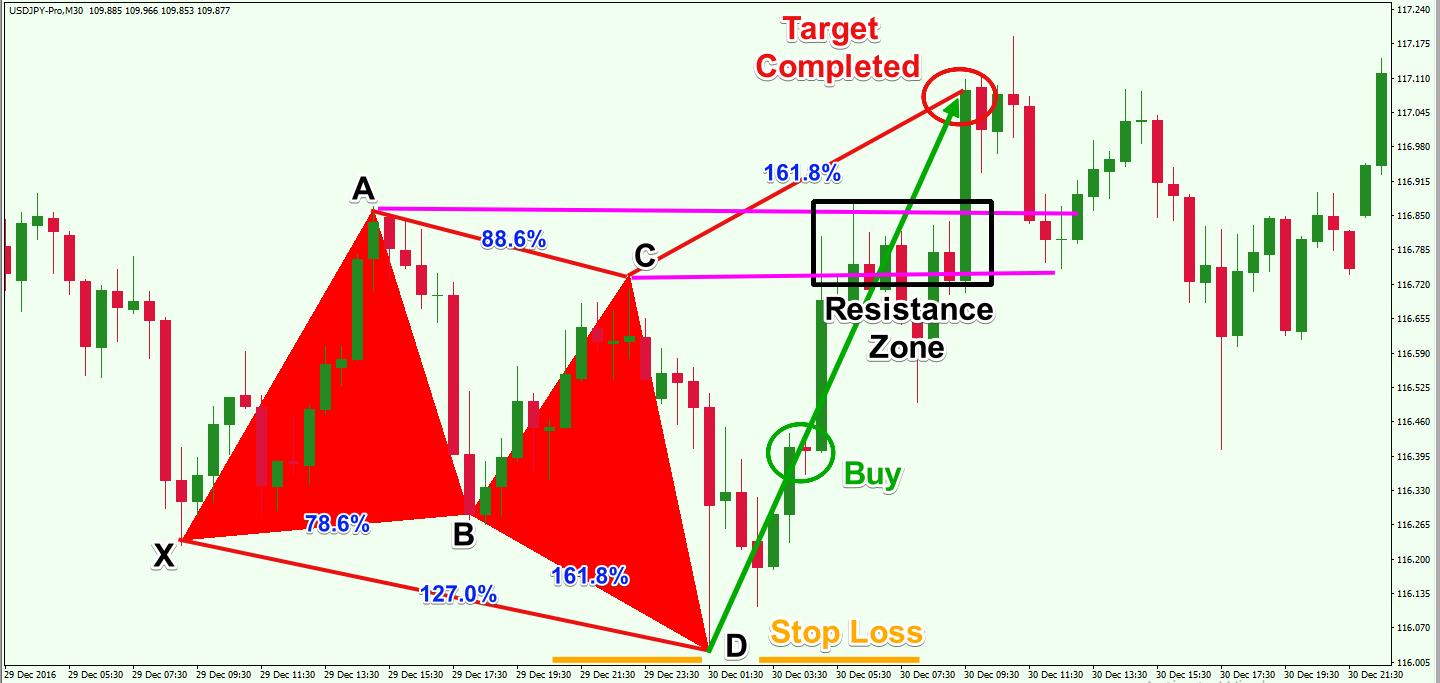

Butterfly pattern ke baad, traders price targets set karte hain jahan woh expect karte hain ke price reverse hoga. Yeh targets previous trend ke end point aur pattern ke starting point ke darmiyan ke area par set kiye jate hain.

- Trading Implications:

Jab butterfly pattern complete hota hai, yeh ek reversal signal provide karta hai. Agar yeh pattern sahi tarike se confirm hota hai, to traders expect karte hain ke market ka trend reverse hoga. - Risk Management:

Jaise har trading pattern ke saath, butterfly pattern ko bhi istemal karte waqt risk management ka khayal rakhna zaroori hai. Stop-loss orders aur proper risk-reward ratio ke saath trading ki jani chahiye.

To summarize, butterfly candlestick chart pattern ek powerful tool hai jo traders ko potential trend reversals ke baare mein alert karta hai. Isay sahi tarike se identify aur interpret karke traders successful trading decisions le sakte hain.

تبصرہ

Расширенный режим Обычный режим