Hello dear

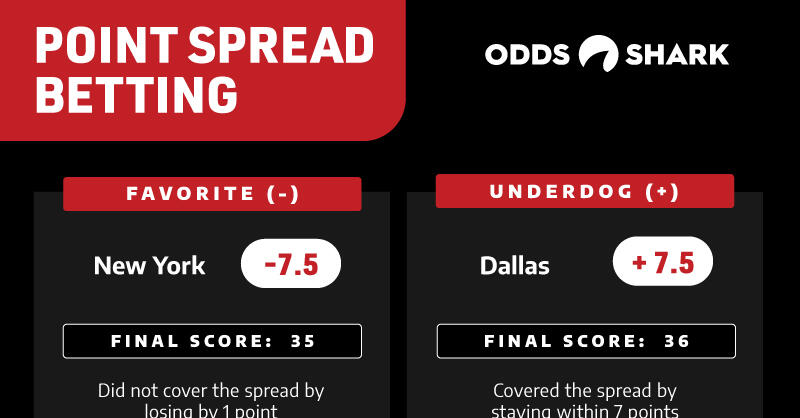

Introduce to spread betting

Spread betting, ya tafseel se kaha jaye to "bikharsh" ek tarah ka aisa tajziya hai jisme aap maal-o-daulat ki taraf se hone wale tabdiliyon par shart laga sakte hain. Is mein aap apni raaye darust hone par paise kamate hain, jabke agar aapki raaye galat nikalti hai to aap nuksan uthate hain. Yeh amuman stocks, indices, forex aur commodities jaise sarmayakari aset par kiya jata hai.

key points for spread betting

Spread betting kaam kaise karta hai, yeh aap ek mukhlis company ke sath shart lagate hain jise spread betting broker kehte hain. Aap is broker ke sath mukhalif shartein lagate hain, jisme aap ek aset ke keemat ki badalao par shart lagate hain. Yeh badalao spread ke roop mein dikhai dete hain, jo aset ki kharid aur bech ke beech ka antar hota hai. Aap shart lagate waqt decide karte hain ke aset ki keemat badhegi ya giregi.

How financiel spread betting work

tarah se, agar aap sochte hain ke aset ki keemat badhegi to aap 'y' shart lagate hain, aur agar giraigi to 'sell' shart. Aapki jeet ya haar spread ke hisab se hoti hai, jisme broker aapko ek fixed spread provide karta hai aur agar aapki raaye theek nikalti hai to aap spread ka hissa jeet jaate hain.

Origins of spread betting

Spread betting ka ek mukhya fayda yeh hai ke aap kam paise lagakar bade hawale se shartein laga sakte hain, kyunki aapko aset ko asal keemat par khareedne ki zarurat nahi hoti. Yeh aapko leverage ka mauka deta hai, lekin yaad rahe ke leverage se aapki jeet ya haar dono mein adhik risk hota hai.

Stock market Trade vs spread betting

Yeh tarika mukhtalif markets mein istemal hota hai aur logo ko aksar trading aur investment ke liye ek naya rasta dikhata hai. Lekin, isme risk bhi hota hai, aur market ke tabdil hone par nuksan ka khatra bhi badh jaata hai. Isliye, spread betting mein shamil hone se pehle acchi tarah se taiyari aur samajh zaruri hai.

Pros and cons

To conclude, spread betting ek financial instrument hai jisme aap aset ke keemat par shart laga sakte hain, aur aapki jeet ya haar spread ke hisab se hoti hai. Isme leverage ka istemal hota hai, lekin yeh ek risky tajziya hai jise samajh kar hi participate karna chahiye.

Introduce to spread betting

Spread betting, ya tafseel se kaha jaye to "bikharsh" ek tarah ka aisa tajziya hai jisme aap maal-o-daulat ki taraf se hone wale tabdiliyon par shart laga sakte hain. Is mein aap apni raaye darust hone par paise kamate hain, jabke agar aapki raaye galat nikalti hai to aap nuksan uthate hain. Yeh amuman stocks, indices, forex aur commodities jaise sarmayakari aset par kiya jata hai.

key points for spread betting

Spread betting kaam kaise karta hai, yeh aap ek mukhlis company ke sath shart lagate hain jise spread betting broker kehte hain. Aap is broker ke sath mukhalif shartein lagate hain, jisme aap ek aset ke keemat ki badalao par shart lagate hain. Yeh badalao spread ke roop mein dikhai dete hain, jo aset ki kharid aur bech ke beech ka antar hota hai. Aap shart lagate waqt decide karte hain ke aset ki keemat badhegi ya giregi.

How financiel spread betting work

tarah se, agar aap sochte hain ke aset ki keemat badhegi to aap 'y' shart lagate hain, aur agar giraigi to 'sell' shart. Aapki jeet ya haar spread ke hisab se hoti hai, jisme broker aapko ek fixed spread provide karta hai aur agar aapki raaye theek nikalti hai to aap spread ka hissa jeet jaate hain.

Origins of spread betting

Spread betting ka ek mukhya fayda yeh hai ke aap kam paise lagakar bade hawale se shartein laga sakte hain, kyunki aapko aset ko asal keemat par khareedne ki zarurat nahi hoti. Yeh aapko leverage ka mauka deta hai, lekin yaad rahe ke leverage se aapki jeet ya haar dono mein adhik risk hota hai.

Stock market Trade vs spread betting

Yeh tarika mukhtalif markets mein istemal hota hai aur logo ko aksar trading aur investment ke liye ek naya rasta dikhata hai. Lekin, isme risk bhi hota hai, aur market ke tabdil hone par nuksan ka khatra bhi badh jaata hai. Isliye, spread betting mein shamil hone se pehle acchi tarah se taiyari aur samajh zaruri hai.

Pros and cons

To conclude, spread betting ek financial instrument hai jisme aap aset ke keemat par shart laga sakte hain, aur aapki jeet ya haar spread ke hisab se hoti hai. Isme leverage ka istemal hota hai, lekin yeh ek risky tajziya hai jise samajh kar hi participate karna chahiye.

تبصرہ

Расширенный режим Обычный режим