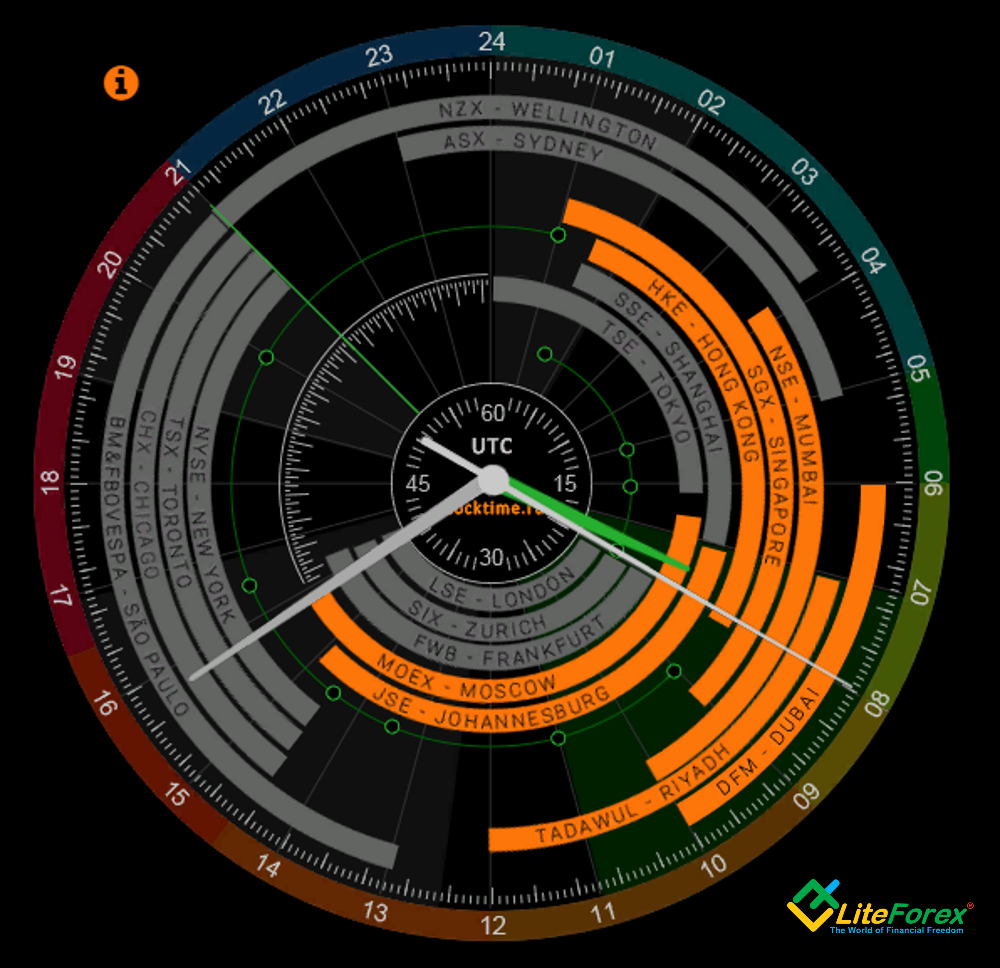

Forex market 24 ghante khula rehta hai aur alag-alag regions ke trading sessions ke beech mein overlap hota hai. Har trading session apne unique characteristics aur trading opportunities ke saath aata hai. Yeh kuch key trading sessions hain:

- Asian Trading Session:

- Yeh session Tokyo, Japan ke market opening ke saath shuru hota hai. Asian session usually low volatility ke saath shuru hota hai, lekin jab Tokyo aur London ke sessions overlap karte hain, tab market mein activity badh jaati hai.

- European (London) Trading Session:

- London session market ka sabse active aur liquid session hai. Yahan par major currency pairs jaise ke EUR/USD, GBP/USD, aur USD/CHF mein zyada activity hoti hai. London session ke dauran market mein significant price movements hote hain.

- North American (New York) Trading Session:

- New York session London session ke baad shuru hota hai. Yeh bhi market mein active rehta hai, aur especially USD-based currency pairs mein trading hoti hai. Jab London aur New York sessions overlap karte hain, toh market mein high volatility hoti hai.

- Sydney/Tokyo Overlap:

- Asian session ke beech mein Sydney aur Tokyo ka overlap hota hai. Is time par market mein liquidity increase hoti hai, lekin overall, Asian session relatively low volatility ke saath rehta hai.

Sabse Best Trading Session Konsa Hai:

- Best trading session depend karta hai aapki personal preferences aur trading strategy par. Agar aap prefer karte hain ki market mein high volatility ho aur aap major price movements capture karna chahte hain, toh London aur New York sessions aapke liye zyada suitable ho sakte hain.

- Agar aapko low volatility aur stable market chahiye, toh Asian session suitable ho sakta hai. Har session ki apni advantages aur challenges hain, aur trader ke goals aur preferences par depend karta hai ki kaunsa session unke liye best hai.

- Overlap periods, jaise ke London aur New York ka overlap, market mein zyada activity aur trading opportunities la sakte hain. Is waqt mein market mein zyada liquidity hoti hai.

- Kuch traders prefer karte hain ke woh multiple sessions ke overlap ke time par trading karein, kyun ki is time par market dynamics change hote hain aur opportunities zyada hoti hain.

Aakhir mein, har trader ka trading style alag hota hai, isliye best trading session ko determine karne ke liye apne personal schedule, market conditions, aur trading goals ko consider karna important hai.

تبصرہ

Расширенный режим Обычный режим