What is Running Flat pattern

Introduction

Flat pattern ya sidhaar (range-bound) market, forex trading mein aam taur par dekha gaya hai. Ye wo waqt hota hai jab currency pairs ka price movement limited hota hai aur market mein kisi specific direction ki strong movement nahi hoti. Yeh muddat kuch dino se lekar hafton tak ka ho sakta hai.

Flat pattern ki pehchaan karne ke liye traders market ki price charts par dhyan dete hain. Ismein kuch key features hote hain jo indicate karte hain ke market flat pattern mein hai.

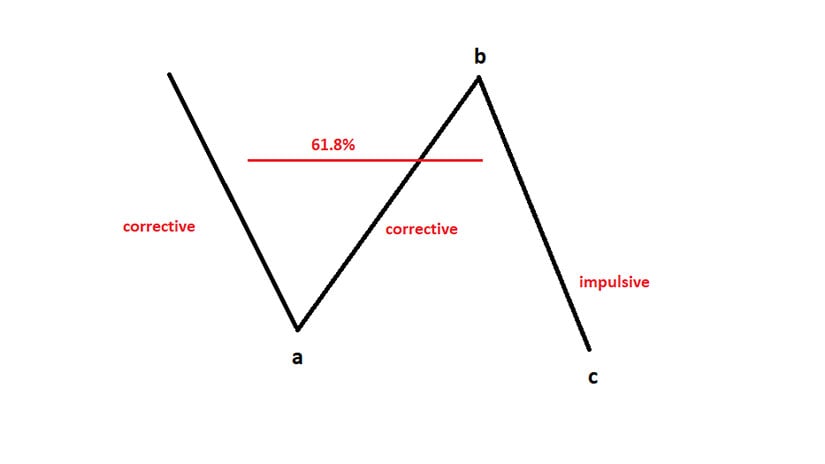

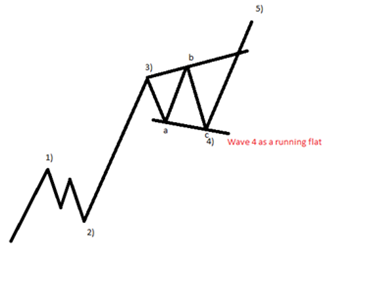

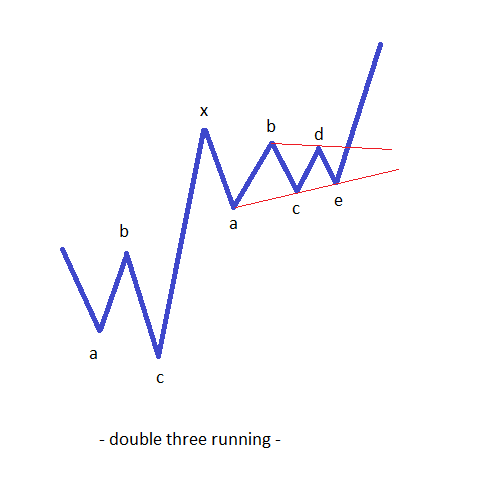

Running Flat pattern ki Pehchan

1. **Price Range**:

Flat pattern ki pehli pehchaan hoti hai ke currency pair ka price ek specific range mein move kar raha hota hai. Jaise ke support aur resistance levels ke darmiyan.

2. **Low Volatility**:

Flat pattern mein market kaafi kam volatility dikhaati hai. Iska mtlb hai ke price mein kam fluctuations hote hain aur market mein zyada uncertainty nahi hoti.

3. **Horizontal Price Movement**:

Flat pattern mein price ka movement zyadatar seedha (horizontal) hota hai, upar neeche nahi hota. Isse ye samajhna aasan hota hai ke market ek range mein consolidate ho rahi hai.

4. **Consolidation**:

Market mein consolidation ka phase hota hai jab price ek specific range mein oscillate karta hai. Yeh ek indication hai ke buyers aur sellers ke darmiyan koi clear consensus nahi hai.

5. **Low Trading Volume**:

Flat pattern mein trading volume bhi kam hota hai. Traders ka interest kam hota hai kyunki market mein clear trend nahi hai.

Flat pattern ka mukhtalif types ho sakte hain, jaise symmetric flat, ascending flat, aur descending flat. Inmein se har ek apne tareeqe se market ke mood ko reflect karte hain.

Traders flat pattern ka faida utha sakte hain agar unhein sahi tarah se samajh aa jata hai. Is time mein, range trading strategies ka istemal kiya ja sakta hai jismein traders support aur resistance levels ke darmiyan trade karte hain.

Lekin yaad rahe ke market mein kisi bhi waqt kuch bhi ho sakta hai aur flat pattern ke baad sudden breakout ho sakta hai. Isliye risk management ka bhi dhyan rakhna zaroori hai.

Flat pattern dekh kar traders ko patience rakhna zaroori hai aur market ke future direction ka wait karna chahiye. Technical analysis ke saath-saath, economic indicators aur global events ka bhi dhyan rakhna important hai flat pattern ko samajhne mein.

Introduction

Flat pattern ya sidhaar (range-bound) market, forex trading mein aam taur par dekha gaya hai. Ye wo waqt hota hai jab currency pairs ka price movement limited hota hai aur market mein kisi specific direction ki strong movement nahi hoti. Yeh muddat kuch dino se lekar hafton tak ka ho sakta hai.

Flat pattern ki pehchaan karne ke liye traders market ki price charts par dhyan dete hain. Ismein kuch key features hote hain jo indicate karte hain ke market flat pattern mein hai.

Running Flat pattern ki Pehchan

1. **Price Range**:

Flat pattern ki pehli pehchaan hoti hai ke currency pair ka price ek specific range mein move kar raha hota hai. Jaise ke support aur resistance levels ke darmiyan.

2. **Low Volatility**:

Flat pattern mein market kaafi kam volatility dikhaati hai. Iska mtlb hai ke price mein kam fluctuations hote hain aur market mein zyada uncertainty nahi hoti.

3. **Horizontal Price Movement**:

Flat pattern mein price ka movement zyadatar seedha (horizontal) hota hai, upar neeche nahi hota. Isse ye samajhna aasan hota hai ke market ek range mein consolidate ho rahi hai.

4. **Consolidation**:

Market mein consolidation ka phase hota hai jab price ek specific range mein oscillate karta hai. Yeh ek indication hai ke buyers aur sellers ke darmiyan koi clear consensus nahi hai.

5. **Low Trading Volume**:

Flat pattern mein trading volume bhi kam hota hai. Traders ka interest kam hota hai kyunki market mein clear trend nahi hai.

Flat pattern ka mukhtalif types ho sakte hain, jaise symmetric flat, ascending flat, aur descending flat. Inmein se har ek apne tareeqe se market ke mood ko reflect karte hain.

Traders flat pattern ka faida utha sakte hain agar unhein sahi tarah se samajh aa jata hai. Is time mein, range trading strategies ka istemal kiya ja sakta hai jismein traders support aur resistance levels ke darmiyan trade karte hain.

Lekin yaad rahe ke market mein kisi bhi waqt kuch bhi ho sakta hai aur flat pattern ke baad sudden breakout ho sakta hai. Isliye risk management ka bhi dhyan rakhna zaroori hai.

Flat pattern dekh kar traders ko patience rakhna zaroori hai aur market ke future direction ka wait karna chahiye. Technical analysis ke saath-saath, economic indicators aur global events ka bhi dhyan rakhna important hai flat pattern ko samajhne mein.

تبصرہ

Расширенный режим Обычный режим