Flag pattern aik technical analysis ka taweez hai jo forex trading mein istemal hota hai taake potenti price reversals ko pehchana jaye. Yeh continuation pattern hai, jo yeh batata hai ke ek taqatwar trend shuru ho chuka hai. Flag pattern ko pennant ya pennant flag bhi kaha jata hai, aur iska do hisson mein taqseem hota hai: pole aur flag.

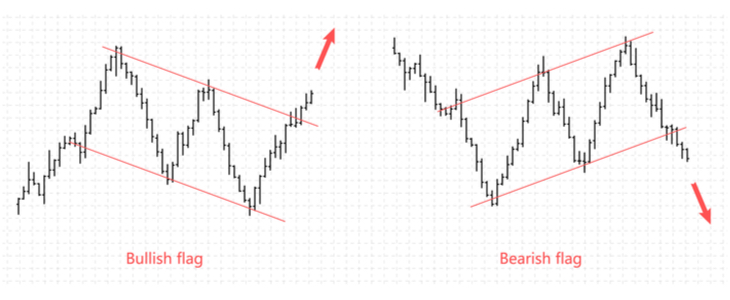

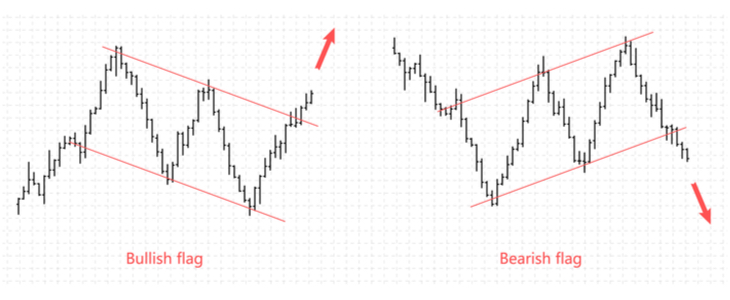

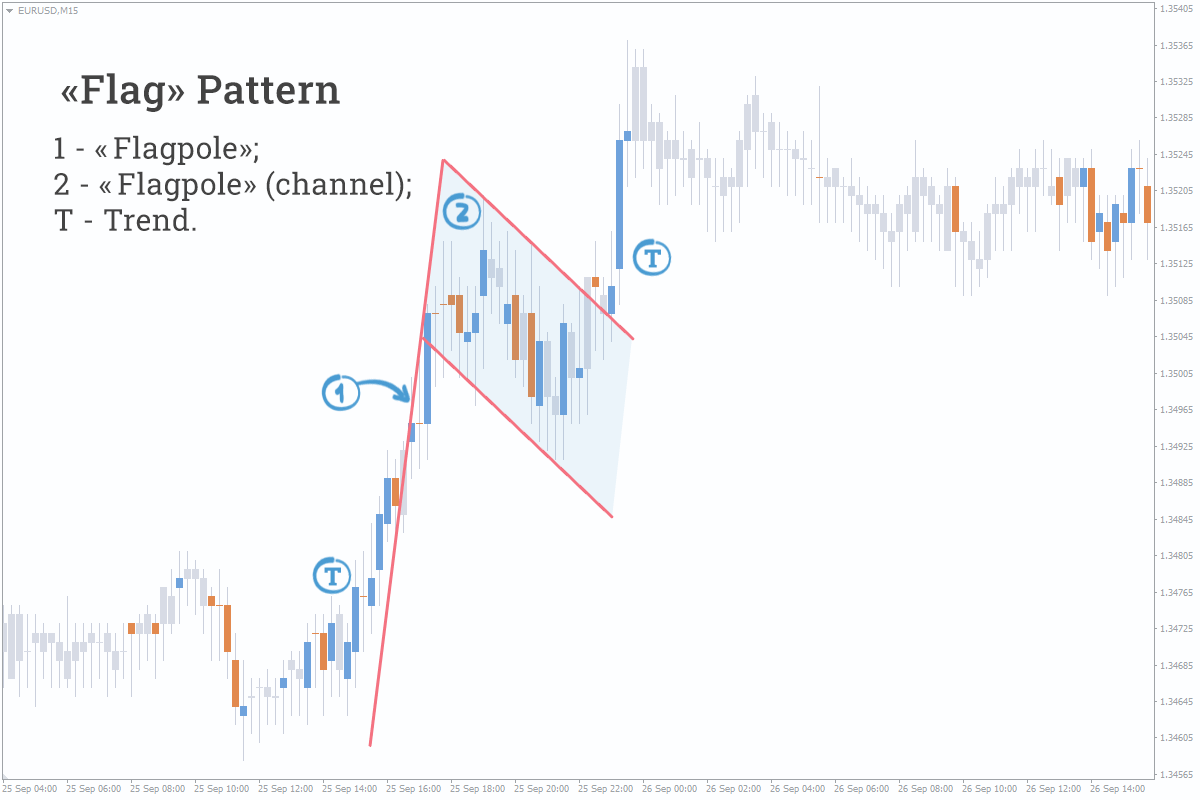

Pole flag pattern se pehle woh pehla trend hai. Yeh price chart mein ek taqatwar aur tezi se bewaqoofi karne wala movement hai, jo ke uptrend ya downtrend ho sakta hai. Pole market ke conditions ke mutabiq kai dino ya hafton tak chal sakta hai. Flag pattern ka doosra hissa flag hai jo pole ke baad aik consolidation range ke tor par banta hai. Yeh ek tang aur mazboot price range hota hai jo ke ek flag ya pennant ki shakal mein hota hai. Flag kai dino se lekar kai hafton tak reh sakta hai, aur yeh ishara karta hai ke price apne asal trend ko dobara shuru karne se pehle aik break le raha hai.

Flag pattern is apne naam ko uski jhilmili hui parcham ki mawafiqat se hasil karta hai. Pole parcham ka mast dikhata hai, aur flag asal parcham ko dikhata hai. Flag ke doran hone wali tang aur mazboot price range parcham ki sakooni hararat ki tarah hoti hai jab hawa nahi chalti.

Flag pattern kisi bhi currency pair mein ho sakta hai, lekin yeh pairs mein zyada hota hai jin mein high volatility hoti hai, jaise ke USD/JPY, GBP/USD, aur AUD/USD. Yeh pattern kisi bhi time frame mein banta hai, lekin is par zyada bharosa daily ya weekly charts mein hota hai.

Flag pattern pehchanne ke liye traders ko in khasoosiyat ki taraf dekhna chahiye:

Flag pattern continuation pattern ke tor par liya jata hai kyun ke ishara karta hai ke price flag phase se bahar nikalne ke baad apne asal trend ko dobara shuru karega. Lekin traders ko yeh maloom hona chahiye ke sabhi flags sahi breakout nahi dete. Kuch flags breakout nahi kar pate, jo galat signals aur nuqsaanat ka sabab ban sakte hain agar ghalat tareekay se trade kiya jaye. Is liye zaroori hai ke flags ko trade karte waqt nuqsaanat ko kam karne ke liye sahi risk management strategies ka istemal kiya jaye.

Traders technical indicators ka istemal karke flag pattern ke banne ko tasdeeq kar sakte hain aur is par trading mein apne itminan ko barha sakte hain. Kuch mashhoor indicators mein moving averages, Bollinger Bands, Relative Strength Index, aur Moving Average Convergence Divergence shamil hain. Yeh indicators traders ko support aur resistance levels, overbought ya oversold conditions, aur flag phase ke doran potential reversal points pehchanne mein madad kar sakte hain.

Flags ko kamiyabi se trade karne ke liye, traders ko in steps ko follow karna chahiye:

Pole flag pattern se pehle woh pehla trend hai. Yeh price chart mein ek taqatwar aur tezi se bewaqoofi karne wala movement hai, jo ke uptrend ya downtrend ho sakta hai. Pole market ke conditions ke mutabiq kai dino ya hafton tak chal sakta hai. Flag pattern ka doosra hissa flag hai jo pole ke baad aik consolidation range ke tor par banta hai. Yeh ek tang aur mazboot price range hota hai jo ke ek flag ya pennant ki shakal mein hota hai. Flag kai dino se lekar kai hafton tak reh sakta hai, aur yeh ishara karta hai ke price apne asal trend ko dobara shuru karne se pehle aik break le raha hai.

Flag pattern is apne naam ko uski jhilmili hui parcham ki mawafiqat se hasil karta hai. Pole parcham ka mast dikhata hai, aur flag asal parcham ko dikhata hai. Flag ke doran hone wali tang aur mazboot price range parcham ki sakooni hararat ki tarah hoti hai jab hawa nahi chalti.

Flag pattern kisi bhi currency pair mein ho sakta hai, lekin yeh pairs mein zyada hota hai jin mein high volatility hoti hai, jaise ke USD/JPY, GBP/USD, aur AUD/USD. Yeh pattern kisi bhi time frame mein banta hai, lekin is par zyada bharosa daily ya weekly charts mein hota hai.

Flag pattern pehchanne ke liye traders ko in khasoosiyat ki taraf dekhna chahiye:

- Clear pole: Pole kam az kam flag ki chaurai se 1.5 guna lamba hona chahiye. Pole ko tezi se aur saaf rukh se hona chahiye.

- Narrow and tight flag: Flag tang aur mazboot hona chahiye, aisa ke uski chaurai pole ke lambai se kam ho 15% se kam. Flag phase ke doran price action ko do parallel lines mein rakha jana chahiye jo aik triangle ya pennant banate hain.

- Breakout: Flag phase ke baad, price ko triangle ya pennant ki shakal se bahar nikalna chahiye aur apne asal trend ko pole phase ke jaise hi taqat ke sath shuru karna chahiye.

Flag pattern continuation pattern ke tor par liya jata hai kyun ke ishara karta hai ke price flag phase se bahar nikalne ke baad apne asal trend ko dobara shuru karega. Lekin traders ko yeh maloom hona chahiye ke sabhi flags sahi breakout nahi dete. Kuch flags breakout nahi kar pate, jo galat signals aur nuqsaanat ka sabab ban sakte hain agar ghalat tareekay se trade kiya jaye. Is liye zaroori hai ke flags ko trade karte waqt nuqsaanat ko kam karne ke liye sahi risk management strategies ka istemal kiya jaye.

Traders technical indicators ka istemal karke flag pattern ke banne ko tasdeeq kar sakte hain aur is par trading mein apne itminan ko barha sakte hain. Kuch mashhoor indicators mein moving averages, Bollinger Bands, Relative Strength Index, aur Moving Average Convergence Divergence shamil hain. Yeh indicators traders ko support aur resistance levels, overbought ya oversold conditions, aur flag phase ke doran potential reversal points pehchanne mein madad kar sakte hain.

Flags ko kamiyabi se trade karne ke liye, traders ko in steps ko follow karna chahiye:

- Identify a clear pole: Dhundhen aik taqatwar trend jo saaf rukh se hai aur jiska potential flag phase ke chaurai se kam az kam 1.5 guna zyada ho.

- Wait for consolidation: Clear pole ko pehchanne ke baad, intezar karen ke price action flag phase ke doran tang aur mazboot range mein consolidate ho. Yeh consolidation muddat market ke conditions ke mutabiq kai dino ya hafton tak chal sakti hai.

- Confirm breakout: Consolidation ke baad, intezar karen ke price action triangle ya pennant ki shakal se bahar nikle jaise ke pole phase ke doran. Tasdeeq technical indicators jaise MAs ya BBs ka istemal karke kiya ja sakta hai takay support aur resistance levels ko pehchana ja sake ya breakout phase ke doran overbought ya oversold conditions ko pehchana ja sake RSI ya MACD ke zariye.

- Set stop-loss orders: Nuqsaanat ko kam karne ke liye, traders ko uptrends ke doran support levels ke neeche ya downtrends ke doran resistance levels ke upar stop-loss orders set karne chahiye. Yeh strategy traders ki madad karegi agar prices unke makhrajon mein pahunchne se pehle unke khilaaf chalayen.

تبصرہ

Расширенный режим Обычный режим