Forex trading mein "leading" aur "lagging"

do mukhtalif types ke indicators hote hain, jo market trends ko analyze karne mein aur future price movements ko predict karne mein madad karte hain.

- Leading Indicators (Peshgoi Karne Wale Indicators): Leading indicators, jise peshgoi karne wale indicators bhi kaha jata hai, wo indicators hote hain jo current market conditions ko analyze karke future price movements ki prediction karne ka kaam karte hain. Ye indicators traders ko market ke potential changes ke bare mein pehle hi signal dete hain. Kuch common leading indicators hain:

- Relative Strength Index (RSI): RSI market mein overbought ya oversold conditions ko indicate karta hai, jisse traders future price reversals ka pata laga sakte hain.

- Stochastic Oscillator: Stochastic oscillator bhi overbought ya oversold conditions ko measure karta hai, aur traders ko market ke momentum ke changes ke bare mein peshgoi deta hai.

- Moving Averages: Moving averages bhi ek leading indicator hai jo market trends ko smooth karta hai aur traders ko trend reversals ke signals deta hai.

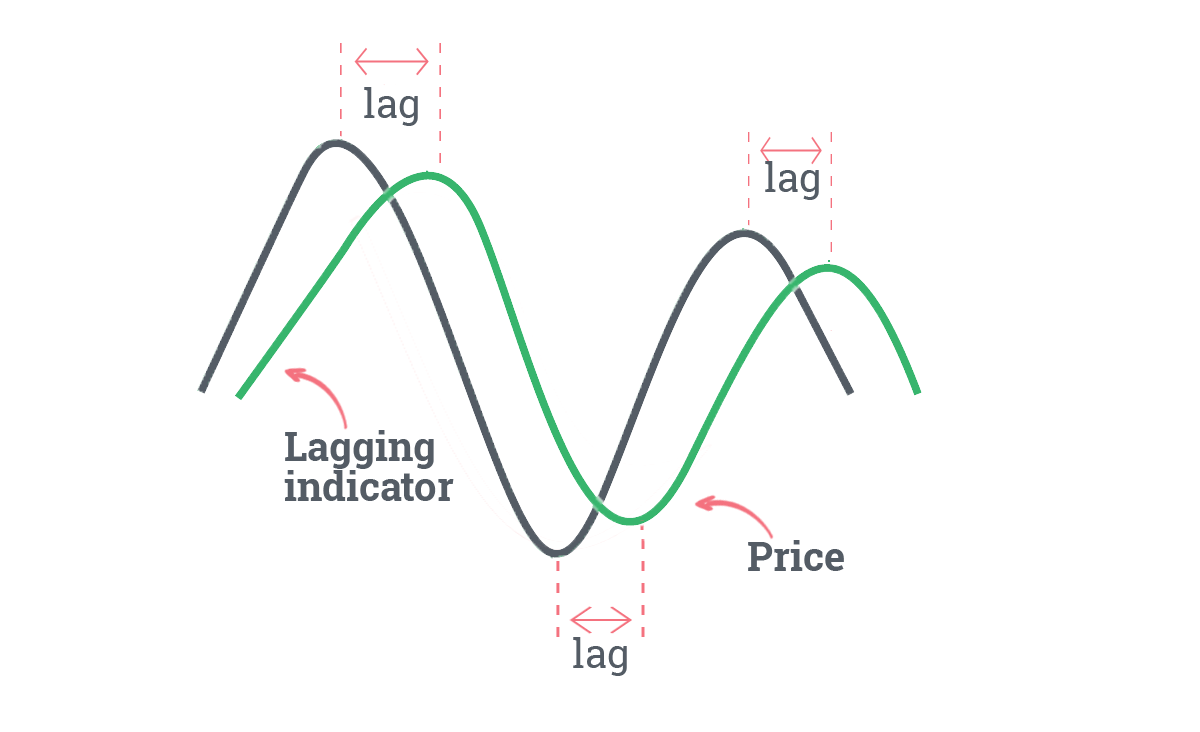

Leading indicators ka istemal traders ko market mein hone wale changes se advance mein inform karne mein madad karta hai, lekin inki accuracy mein kabhi-kabhi uncertainty hoti hai. - Lagging Indicators (Hatif Indicators): Lagging indicators, jise hatif indicators bhi kaha jata hai, wo indicators hote hain jo current market conditions ko reflect karte hain aur inki values market ke movements ke baad aati hain. Ye indicators price trends ko confirm karne mein aur already occurring trends ko identify karne mein madad karte hain. Kuch common lagging indicators hain:

- Moving Averages (Simple and Exponential): Moving averages, jab lagging indicators ki baat hoti hai, toh inka istemal trend confirmation ke liye hota hai.

- Bollinger Bands: Bollinger Bands volatility aur price levels ko measure karta hai, aur inka istemal lagging trends ko identify karne mein hota hai.

- Ichimoku Cloud: Ichimoku Cloud lagging indicator hai jo support, resistance, aur trend direction ko visualize karta hai.

Lagging indicators traders ko current market conditions ke mutabiq trend ka pata lagane mein madad karte hain. Inki limitation ye hoti hai ke ye future movements ko predict karne mein thoda time lete hain, kyun ki inki values current market data ke peechhe rehti hain.

Dono types ke indicators ka sahi taur par istemal karke traders apni trading strategies ko develop karte hain. Hamesha yaad rahe ke kisi bhi indicator ka istemal karne se pehle thorough research karna zaroori hai aur ek overall trading plan ke saath inka istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим