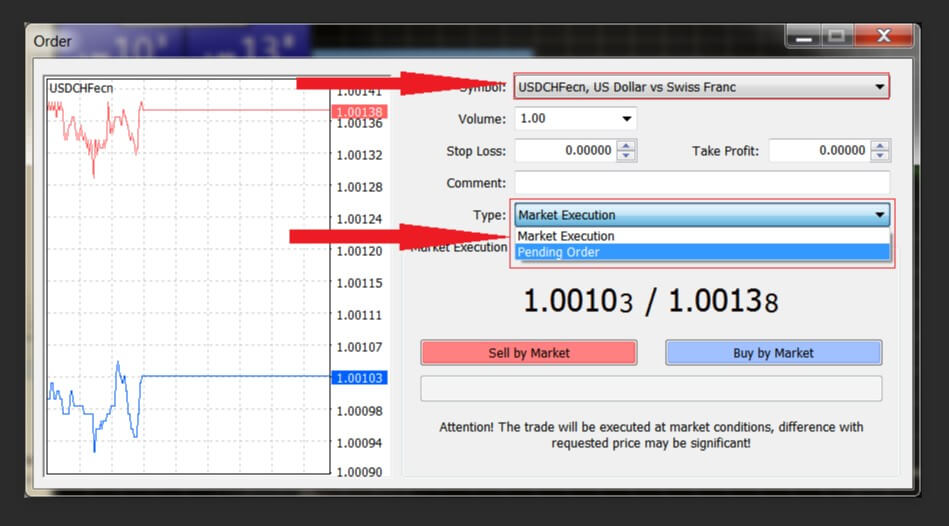

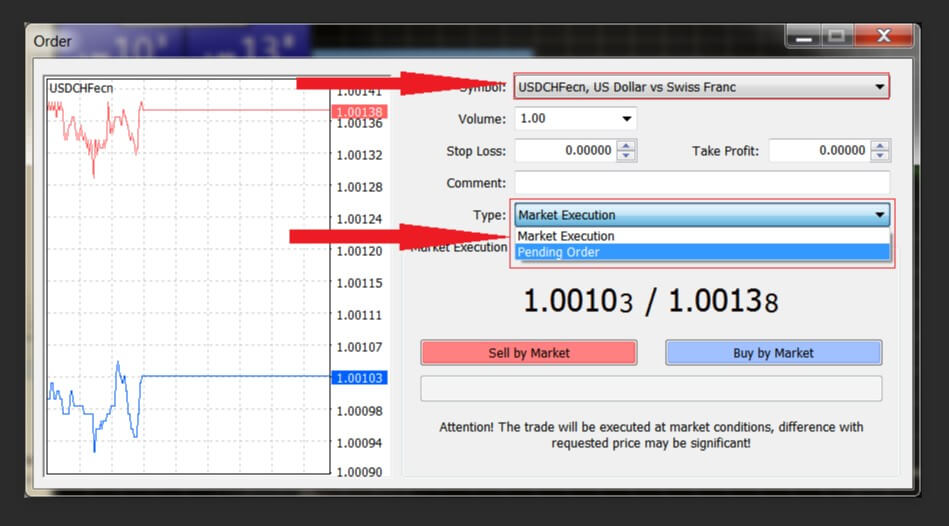

Forex market mein pending order aik aisi order hai jo ek trader dwara ki jaati hai taake wo future mein kisi muqarar keemat par kisi currency pair ko khareedne ya bechne ke liye. Market orders ke mukhable, jo current market keemat par turant execute ho jaate hain, pending orders tabhi execute hote hain jab market ek pehle se decide ki gayi keemat par pahunchti hai. Yeh feature pending orders ko forex traders ke liye ek taqatwar tool banata hai, kyun ki isse unhein mauqa milta hai trades mein dakhil ho ya unse bahar jaane ke liye zyada behtareen keematon par, jo adverse price movements ka khatra kam karta hai aur munafa ko behtar banata hai.

Char tarah ke pending orders hote hain: buy stop, sell stop, buy limit, aur sell limit. Har ek order ka istemaal alag market conditions aur alag trading strategies ke liye hota hai.

Buy Stop Order:

Buy stop order current market keemat se upar rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat stop price tak pahunchti hai. Ye order ek long position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein. For example, agar koi trader yeh manta hai ke EUR/USD pair 1.1500 ke upar badhega, toh wo 1.1501 par buy stop order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai, kyun ki isse unhein ek behtar keemat par trade mein dakhil hone ka mauqa milta hai jo ke market order se zyada hota hai.

Sell Stop Order:

Sell stop order current market keemat se neeche rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat stop price tak pahunchti hai. Ye order ek short position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein. For example, agar koi trader yeh manta hai ke GBP/USD pair 1.3000 ke neeche girayga, toh wo 1.3001 par sell stop order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai, kyun ki isse unhein ek behtar keemat par trade mein dakhil hone ka mauqa milta hai jo ke market order se zyada hota hai.

Buy Limit Order:

Buy limit order current market keemat se neeche rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat limit price tak pahunchti hai. Ye order ek long position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein aur wo bhi market order ya buy stop order se zyada behtareen keemat par. For example, agar koi trader yeh manta hai ke USD/JPY pair 107.50 ke upar badhega lekin wo is pair ke liye 107.25 se zyada nahi dena chahta, toh wo 107.25 par buy limit order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai aur agar market mein is level par is currency pair ke liye kafi demand hai.

Sell Limit Order:

Sell limit order current market keemat se upar rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat limit price tak pahunchti hai. Ye order ek short position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein aur wo bhi market order ya sell stop order se zyada behtareen keemat par. For example, agar koi trader yeh manta hai ke AUD/USD pair 0.7250 ke neeche girayga lekin wo is pair ko 0.7275 se neeche nahi bechna chahta, toh wo 0.7275 par sell limit order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai aur agar market mein is level par is currency pair ke liye kafi supply hai.

Char tarah ke pending orders hote hain: buy stop, sell stop, buy limit, aur sell limit. Har ek order ka istemaal alag market conditions aur alag trading strategies ke liye hota hai.

Buy Stop Order:

Buy stop order current market keemat se upar rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat stop price tak pahunchti hai. Ye order ek long position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein. For example, agar koi trader yeh manta hai ke EUR/USD pair 1.1500 ke upar badhega, toh wo 1.1501 par buy stop order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai, kyun ki isse unhein ek behtar keemat par trade mein dakhil hone ka mauqa milta hai jo ke market order se zyada hota hai.

Sell Stop Order:

Sell stop order current market keemat se neeche rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat stop price tak pahunchti hai. Ye order ek short position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein. For example, agar koi trader yeh manta hai ke GBP/USD pair 1.3000 ke neeche girayga, toh wo 1.3001 par sell stop order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai, kyun ki isse unhein ek behtar keemat par trade mein dakhil hone ka mauqa milta hai jo ke market order se zyada hota hai.

Buy Limit Order:

Buy limit order current market keemat se neeche rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat limit price tak pahunchti hai. Ye order ek long position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein aur wo bhi market order ya buy stop order se zyada behtareen keemat par. For example, agar koi trader yeh manta hai ke USD/JPY pair 107.50 ke upar badhega lekin wo is pair ke liye 107.25 se zyada nahi dena chahta, toh wo 107.25 par buy limit order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai aur agar market mein is level par is currency pair ke liye kafi demand hai.

Sell Limit Order:

Sell limit order current market keemat se upar rakha jata hai, aur ye tab execute hota hai jab currency pair ki keemat limit price tak pahunchti hai. Ye order ek short position mein dakhil hone ke liye istemal hota hai, ek aane waale price movement ke intezaar mein aur wo bhi market order ya sell stop order se zyada behtareen keemat par. For example, agar koi trader yeh manta hai ke AUD/USD pair 0.7250 ke neeche girayga lekin wo is pair ko 0.7275 se neeche nahi bechna chahta, toh wo 0.7275 par sell limit order rakh sakta hai, taake jab keemat is level par pahunchti hai, tab wo market mein dakhil ho sake. Ye strategy tab munafa dila sakta hai jab trader ka forecast sahi hota hai aur agar market mein is level par is currency pair ke liye kafi supply hai.

تبصرہ

Расширенный режим Обычный режим