"Rectangle Chart Pattern"

ek technical analysis pattern hai jo forex trading mein istemal hota hai. Is pattern mein price range mein move karte hue sideways movement hota hai aur traders ko market ke consolidation phase ka pata chalta hai. Chaliye is pattern ko Roman Urdu mein samajhte hain:

Rectangle Chart Pattern Kya Hai?

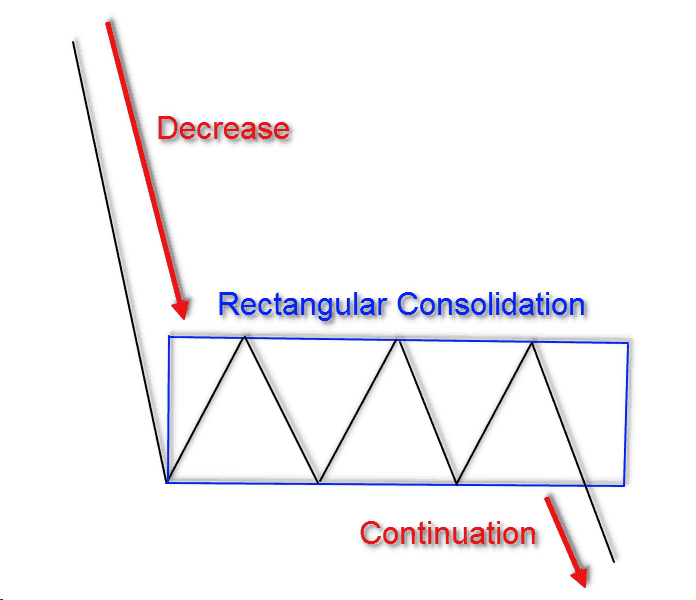

Rectangle chart pattern ek continuation pattern hai jo market mein hone wale trend ka consolidation phase darust karta hai. Is pattern mein price ek horizontal range ke andar move karta hai, jisme upper resistance aur lower support levels define hote hain. Yeh pattern market ke temporary indecision ko indicate karta hai.

Kaise Hota Hai?

- Price Range:

- Rectangle pattern mein price ek specific range ke andar move karta hai, jisme upper resistance level aur lower support level define hote hain.

- Horizontal Lines:

- Rectangle ke andar price movement horizontal lines ke darmiyan hota hai.

- Upper line ko resistance aur lower line ko support level ke roop mein dekha jata hai.

- Consolidation Phase:

- Price ke movement mein consolidation phase hoti hai, jiska matlab hai ke market indecisive hota hai aur buyers aur sellers ke darmiyan equal pressure rehta hai.

- Breakout Point:

- Rectangle pattern ke baad ek point aata hai jise breakout point kehte hain. Jab price is point ko cross karta hai, to yeh indicate karta hai ke market mein strong movement hone wala hai.

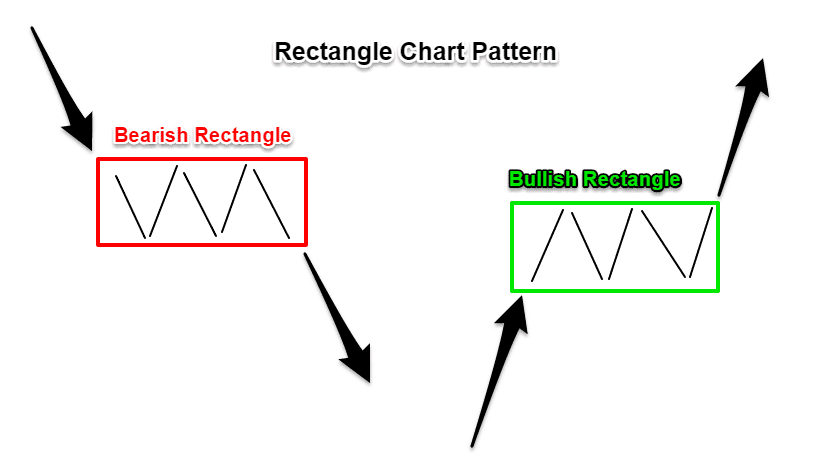

1. Entry Point:

- Traders rectangle pattern ke breakout point ke liye wait karte hain. Agar price upper resistance ko break karta hai, to yeh uptrend ka sign ho sakta hai, aur agar lower support ko break karta hai, to downtrend ka sign ho sakta hai.

2. Stop-Loss Order:

- Traders apne trades ko protect karne ke liye stop-loss orders ka istemal karte hain. Yeh ek predetermined level par lagaya jata hai jahan par trader ko loss limit kar diya jata hai.

3. Target Price:

- Target price ko calculate karne ke liye traders rectangle pattern ke height ko measure karte hain. Yeh unhe idea deta hai ke price kitna upar ya neeche ja sakta hai.

- Trend Continuation Indicator:

- Rectangle pattern ek current trend ka continuation hone ka sign ho sakta hai.

- Breakout Confirmation:

- Breakout point ke breakout ke baad, trend direction confirm hota hai.

- Support aur Resistance Levels:

- Rectangle pattern traders ko support aur resistance levels ke identification mein madad karta hai.

- Confirmation:

- Rectangle pattern ko confirm karne ke liye, doosre technical indicators aur analysis ka istemal karna behtar hota hai.

- Risk Management:

- Har trading decision ke sath risk management ka istemal karna zaruri hai. Stop-loss orders ka istemal kar ke apne trades ko protect karein.

- Multiple Time Frames:

- Rectangle pattern ko confirm karne ke liye traders multiple time frames par nazar rakh sakte hain.

Rectangle chart pattern, jese ke har technical pattern, market conditions aur dusre factors ke sath mila kar istemal karna chahiye. Iski sahi samajh aur istemal se traders market trends ko sahi taur par interpret kar sakte hain.

تبصرہ

Расширенный режим Обычный режим