Asalam u alaikum

Fundamental analysis

Fundamental analysis ek tajziya hai jo company ya market ki sehat ko dekhti hai, is par bharosa karte hue jo basic factors hain unpe ghaur karta hai. Ye factors company ke earnings, dividends, fair value, aur industry ke news ko shamil karte hain. Fundamental analysis ko amooman lambi muddat ki soch aur lamhon ki nazar se dekha jata hai.

technical analysis

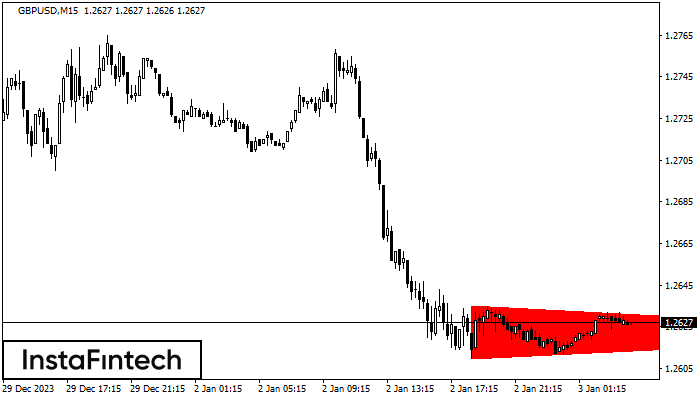

Kisi company ki fair value ko dekhte hue, investors ye tajziya karte hain ke kya wo company ki keemat mein izafah mumkin hai ya nahi. Fair value ko maloom karne ke liye, mukhtalif ratio, faiday aur company ki strategic factors ko shamil kiya jata haiTechnical analysis mein charts, graphs aur historical data ka istemal hota hai taki alag-alag investments ki harkat ko samjha ja sake. Ismein alag alag patterns, jese ke moving averages, Bollinger Bands, aur Relative Strength Indicators, ka istemal hota hai.

Comparison

Technical analysis se investors market ki harkaton aur important levels ko pehchan sakte hain. Ye analysis amooman jaldi aur chand lamhon mein hoti hai, aur isay kuch traders short-term trading ke liye istemal karte hain.Fundamental analysis mein mehnat ki zyadati hoti hai jabke technical analysis jald aur market ki movement ko analyze karne mein madadgar hoti hai.Kisi company ke fair value ko determine karke, investors samajh sakte hain ke wo company ke share ke prices mein izafay ki sambhavna hai ya nahi. Fundamental analysis ke zariye investors company ke potential aur health ko lambi muddat mein dekhte hain.

Hide and seek

Wahi technical analysis jaldi aur short-term mein kaam aati hai. Traders isay market ki immediate harkaton ko samajhne ke liye istemal karte hain, jisse unhe trading decisions mein madad milti hai.Har tajziye ki apni ahmiyat hai, aur dono hi investors ko market mein asani se navigate karne mein madad karti hain. Kuch log dono tajziyon ko mila kar istemal karte hain, taki unhe comprehensive view mile aur wo apne investment decisions ko behtar taur par le sakein.

Summary

Aakhir mein, investors ko apni risk tolerance, investment horizon aur maqsad ke mutabiq tajziya chunna chahiye, taki wo market mein mufeed aur maqbul faislay kar sakein.

Fundamental analysis

Fundamental analysis ek tajziya hai jo company ya market ki sehat ko dekhti hai, is par bharosa karte hue jo basic factors hain unpe ghaur karta hai. Ye factors company ke earnings, dividends, fair value, aur industry ke news ko shamil karte hain. Fundamental analysis ko amooman lambi muddat ki soch aur lamhon ki nazar se dekha jata hai.

technical analysis

Kisi company ki fair value ko dekhte hue, investors ye tajziya karte hain ke kya wo company ki keemat mein izafah mumkin hai ya nahi. Fair value ko maloom karne ke liye, mukhtalif ratio, faiday aur company ki strategic factors ko shamil kiya jata haiTechnical analysis mein charts, graphs aur historical data ka istemal hota hai taki alag-alag investments ki harkat ko samjha ja sake. Ismein alag alag patterns, jese ke moving averages, Bollinger Bands, aur Relative Strength Indicators, ka istemal hota hai.

Comparison

Technical analysis se investors market ki harkaton aur important levels ko pehchan sakte hain. Ye analysis amooman jaldi aur chand lamhon mein hoti hai, aur isay kuch traders short-term trading ke liye istemal karte hain.Fundamental analysis mein mehnat ki zyadati hoti hai jabke technical analysis jald aur market ki movement ko analyze karne mein madadgar hoti hai.Kisi company ke fair value ko determine karke, investors samajh sakte hain ke wo company ke share ke prices mein izafay ki sambhavna hai ya nahi. Fundamental analysis ke zariye investors company ke potential aur health ko lambi muddat mein dekhte hain.

Hide and seek

Wahi technical analysis jaldi aur short-term mein kaam aati hai. Traders isay market ki immediate harkaton ko samajhne ke liye istemal karte hain, jisse unhe trading decisions mein madad milti hai.Har tajziye ki apni ahmiyat hai, aur dono hi investors ko market mein asani se navigate karne mein madad karti hain. Kuch log dono tajziyon ko mila kar istemal karte hain, taki unhe comprehensive view mile aur wo apne investment decisions ko behtar taur par le sakein.

Summary

Aakhir mein, investors ko apni risk tolerance, investment horizon aur maqsad ke mutabiq tajziya chunna chahiye, taki wo market mein mufeed aur maqbul faislay kar sakein.

تبصرہ

Расширенный режим Обычный режим