What is stick sandwich pattern?

aik stick sandwich aik makhsoos tabadlay ka mansoobah hai jis mein teen mom batian aisi banti hain jo aik shiper ki screen parsandwich ki terhan nazar aati hain. chhari ke sandwich mein darmiyani roshni ke aik ya doosri taraf mom batian ulti tones ki hon gi, aur un ki tijarat darmiyani sholay ki nisbat ziyada numaya hogi. manfi aur taizi dono nishanain stick sandwich ke mansoobay haasil kar sakti hain .

Understand stick sandwich pattern

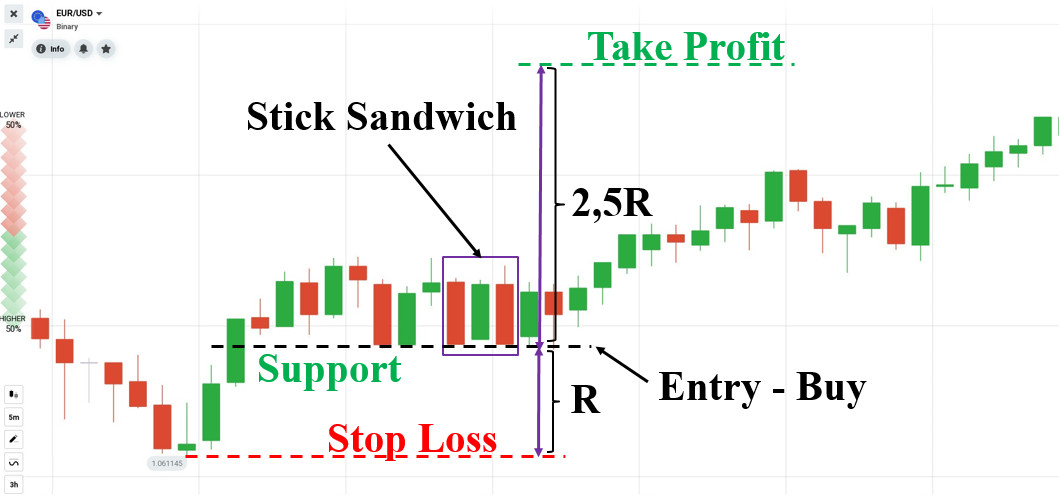

manfi stickSandwich mein, bairooni mom batian lambi sabz mom batian hon gi, jab ke andar ki aag ziyada mehdood aur surkh ho gi, aur bairooni lathyon se bilkul kam ho jaye gi. aik blush stick sandwich mukhalif lehjey aur manfi sandwich ke tor par mansoobon ke tabadlay ke sath kisi bhi soorat mein ghair wazeh honay ka ta-assur phelaaye ga. yeh intikhab karte waqt ke aaya taizi ikhtiyar karni hai ya manfi position, shipers baqaidagi se teesri roshni ke ikhtitami akhrajaat ki pairwi karte hain .

aik aam roshni bazaar ke khulay, ziyada, kam, aur qareebi akhrajaat ko dukhati hai, jaisay ke baar frame. roshni ka aik wasee hissa hai, jisay" yakeeni jism" kaha jata hai. yeh haqeeqi idaara is din ke tabadlay ke khulay aur band honay ke darmiyan laagat ki had par nazar rakhta hai. khaas tor par jab tasdeeq shuda jism bhara sun-hwa ho ya pheeka ho, yeh tajweez karta hai ke qareebi hissa khulay se kam tha. yeh bardasht karna ke durust jism bhara sun-hwa hai, is se akhaz hota hai ke qareebi khulay se ziyada tha. stick sandwich ke design ka pata lagana mushkil nahi hai, phir bhi taajiron ko hooshiyar rehna chahiye taakay woh aqsam ko note karen kyunkay woh bail ya reechh ke bazaar mein zahir ho satke hain. bunyadi usool mukhtalif atraaf ke liye mom btyon ke saaye ke sath sath markaz mein sandwich ki roshni ke saaye ki taraf mael thay. is model ko dekhnay ke baad, saalis sabz surkh sabz ko chalanay ke liye manfi sandwich aur surkh sabz surkh ko chalanay ke liye aik taiz sandwich par ghhor karte hain .

stick sandwich approach ke peechay qiyaas aarai par mabni istadlaal yeh hai ke jab market nai nichli satah ki koshish kar rahi hai, to yeh surkh din ka elaan kere ga. aglay din dramayi tor par oonchai se shuru hoga, din bhar ouncha tairta rahay ga, aur is ki oonchai par ya is ke qareeb khatam hoga. yeh behtari neechay ke rujhan ke ulat ko zahir karti hai, aur ziyada tar short mrchnts ahthyat se jari rakhen ge. aglay din, laagat bohat ziyada khil jati hai, jis se qaleel mudti ihata mein taizi aati hai. is ke bawajood, qeematein do din pehlay isi satah par band honay ke liye neechay tairti hain. qabil farokht knndgan ko do yaksaa satah ke bundon ke zareya tajweez kardah laagat mein madad nazar aaye gi .

Candlestick Pattern Reliability

tamam roshni ki mansoobah bandi ki salahiyat shandaar nahi hai. jis terhan se aam asason aur un ke andazon ne un ko khatam kar diya hai, is ki wajah se un ki shaytani bartari ne un ki saabit qadmi ko kam kar diya hai. yeh aur barray sabsadi walay khilari bijli ki raftaar par amal daraamad ke baad inhisaar karte hain ke woh khorda maali madad aur mayaari asasa malkaan ke khilaaf tabadlah karen jo baqaya matan mein darj makhsoos tshkhisi tareeqa car ko injaam dete hain. is had mein, aam funds manager aisay logon ko phansanay ke liye programming ka istemaal karte hain jo ziyada imkanaat ki taizi ya mukhalifana nataij ki talaash karte hain. is ke bawajood, thos models zahir hotay rehtay hain, mukhtasir aur ahem lambai ke faida ke mumkina dakhli raastoon par ghhor karte hue

is ke baad anay walay paanch sholay design hain jo herat angaiz tor par achi karkardagi ka muzahira karte hain aur bohat ziyada maliyat ke bearing aur power ke heralder. har aik aas paas ke laagat ki salakhon ke tanazur mein kaam karta hai jab yeh paish goi karta hai ke aaya laagat barhay gi ya giray gi. neez, woh do tareeqon se waqt ke lehaaz se naazuk hain. qata nazar, woh sirf surway kiye jane walay chart ki rukawaton ke andar kaam karte hain, chahay intra day, baqaida, hafton ki aik barri tadaad ho ya maheena bah maheena. dosra, model khatam honay ke baad un ki taaqat taizi se teen se paanch baar kam ho jati hai .

market ke khilari halkay mansoobon par tawajah markooz karte hain, taham un ke peda kardah ulat palat aur tasalsul ke bohat saaray signals zaroori nahi ke mojooda aala sathi electronic aabb o sun-hwa mein har muamlay mein kaam karen. khush qismati se, thomas bulkowski ki maloomat ke tukre un models ke chhootey intikhab ke liye heran kin durustagi zahir karte ha

aik stick sandwich aik makhsoos tabadlay ka mansoobah hai jis mein teen mom batian aisi banti hain jo aik shiper ki screen parsandwich ki terhan nazar aati hain. chhari ke sandwich mein darmiyani roshni ke aik ya doosri taraf mom batian ulti tones ki hon gi, aur un ki tijarat darmiyani sholay ki nisbat ziyada numaya hogi. manfi aur taizi dono nishanain stick sandwich ke mansoobay haasil kar sakti hain .

Understand stick sandwich pattern

manfi stickSandwich mein, bairooni mom batian lambi sabz mom batian hon gi, jab ke andar ki aag ziyada mehdood aur surkh ho gi, aur bairooni lathyon se bilkul kam ho jaye gi. aik blush stick sandwich mukhalif lehjey aur manfi sandwich ke tor par mansoobon ke tabadlay ke sath kisi bhi soorat mein ghair wazeh honay ka ta-assur phelaaye ga. yeh intikhab karte waqt ke aaya taizi ikhtiyar karni hai ya manfi position, shipers baqaidagi se teesri roshni ke ikhtitami akhrajaat ki pairwi karte hain .

aik aam roshni bazaar ke khulay, ziyada, kam, aur qareebi akhrajaat ko dukhati hai, jaisay ke baar frame. roshni ka aik wasee hissa hai, jisay" yakeeni jism" kaha jata hai. yeh haqeeqi idaara is din ke tabadlay ke khulay aur band honay ke darmiyan laagat ki had par nazar rakhta hai. khaas tor par jab tasdeeq shuda jism bhara sun-hwa ho ya pheeka ho, yeh tajweez karta hai ke qareebi hissa khulay se kam tha. yeh bardasht karna ke durust jism bhara sun-hwa hai, is se akhaz hota hai ke qareebi khulay se ziyada tha. stick sandwich ke design ka pata lagana mushkil nahi hai, phir bhi taajiron ko hooshiyar rehna chahiye taakay woh aqsam ko note karen kyunkay woh bail ya reechh ke bazaar mein zahir ho satke hain. bunyadi usool mukhtalif atraaf ke liye mom btyon ke saaye ke sath sath markaz mein sandwich ki roshni ke saaye ki taraf mael thay. is model ko dekhnay ke baad, saalis sabz surkh sabz ko chalanay ke liye manfi sandwich aur surkh sabz surkh ko chalanay ke liye aik taiz sandwich par ghhor karte hain .

stick sandwich approach ke peechay qiyaas aarai par mabni istadlaal yeh hai ke jab market nai nichli satah ki koshish kar rahi hai, to yeh surkh din ka elaan kere ga. aglay din dramayi tor par oonchai se shuru hoga, din bhar ouncha tairta rahay ga, aur is ki oonchai par ya is ke qareeb khatam hoga. yeh behtari neechay ke rujhan ke ulat ko zahir karti hai, aur ziyada tar short mrchnts ahthyat se jari rakhen ge. aglay din, laagat bohat ziyada khil jati hai, jis se qaleel mudti ihata mein taizi aati hai. is ke bawajood, qeematein do din pehlay isi satah par band honay ke liye neechay tairti hain. qabil farokht knndgan ko do yaksaa satah ke bundon ke zareya tajweez kardah laagat mein madad nazar aaye gi .

Candlestick Pattern Reliability

tamam roshni ki mansoobah bandi ki salahiyat shandaar nahi hai. jis terhan se aam asason aur un ke andazon ne un ko khatam kar diya hai, is ki wajah se un ki shaytani bartari ne un ki saabit qadmi ko kam kar diya hai. yeh aur barray sabsadi walay khilari bijli ki raftaar par amal daraamad ke baad inhisaar karte hain ke woh khorda maali madad aur mayaari asasa malkaan ke khilaaf tabadlah karen jo baqaya matan mein darj makhsoos tshkhisi tareeqa car ko injaam dete hain. is had mein, aam funds manager aisay logon ko phansanay ke liye programming ka istemaal karte hain jo ziyada imkanaat ki taizi ya mukhalifana nataij ki talaash karte hain. is ke bawajood, thos models zahir hotay rehtay hain, mukhtasir aur ahem lambai ke faida ke mumkina dakhli raastoon par ghhor karte hue

is ke baad anay walay paanch sholay design hain jo herat angaiz tor par achi karkardagi ka muzahira karte hain aur bohat ziyada maliyat ke bearing aur power ke heralder. har aik aas paas ke laagat ki salakhon ke tanazur mein kaam karta hai jab yeh paish goi karta hai ke aaya laagat barhay gi ya giray gi. neez, woh do tareeqon se waqt ke lehaaz se naazuk hain. qata nazar, woh sirf surway kiye jane walay chart ki rukawaton ke andar kaam karte hain, chahay intra day, baqaida, hafton ki aik barri tadaad ho ya maheena bah maheena. dosra, model khatam honay ke baad un ki taaqat taizi se teen se paanch baar kam ho jati hai .

market ke khilari halkay mansoobon par tawajah markooz karte hain, taham un ke peda kardah ulat palat aur tasalsul ke bohat saaray signals zaroori nahi ke mojooda aala sathi electronic aabb o sun-hwa mein har muamlay mein kaam karen. khush qismati se, thomas bulkowski ki maloomat ke tukre un models ke chhootey intikhab ke liye heran kin durustagi zahir karte ha

تبصرہ

Расширенный режим Обычный режим