Assalamu Alaikum Dosto!

Economic Calendar

Forex trading mein koi bhi trading position open karne se pehle, zyadatar tar experienced traders Economic Calendar par aik nazar daalte hain. Ismein tamam announcements aur currencies ke liye sahi waqtain di jaati hain, jo asar andaz hoti hain. Is tarah yeh essentially dates aur exact times ko forecast karta hai jahan expected market volatility ho sakti hai.

Economic calendar ko kai tareeqon se istemaal kiya ja sakta hai. Pehle toh, kyunki ismein pichle release ki numbers bhi shaamil hote hain, trader economic indicators ki direction ke baare mein kuch idea hasil kar sakta hai. For example, latest Eurozone inflation forecast 0.7% par aayi, jabke pichle release 1.2% tha. Yeh dikhata hai ki HICP ECB ke 'close to 2%' goal se not only bahut kam hai, balki haal hi mein is goal se aur zyada door ho raha hai. Isliye hum yeh conclude kar sakte hain ki EUR par aur zyada pressure aayega.

Economic calendar mein consensus of forecasts bhi dikhta hai; basically, yeh market ki expectations hain. For example, upcoming event risk hai Reserve Bank of Australia ka Interest rate decision. Iski forecast 0.25% par hai. Agar RBA rates ko 0.50% tak unexpected taur par badha deti hai, toh ye market expectations ko exceed karegi aur Australian dollar ke liye bullish ho sakti hai. Dusri taraf, agar rate 0% par cut hota hai, toh ye AUD ke liye bearish ho sakta hai.

Last mein, economic calendar kuch traders ke liye useful ho sakta hai jo identify karna chahte hain kab trading se bacha jaye. Major announcements ke doran, market kam liquid hoti hai aur zyada volatile hoti hai. Isliye kuch experienced traders economic calendar dekhte hain aur apne positions ko uss news release se pehle bandh dete hain.

Forex Economic Calendar Ki Reading

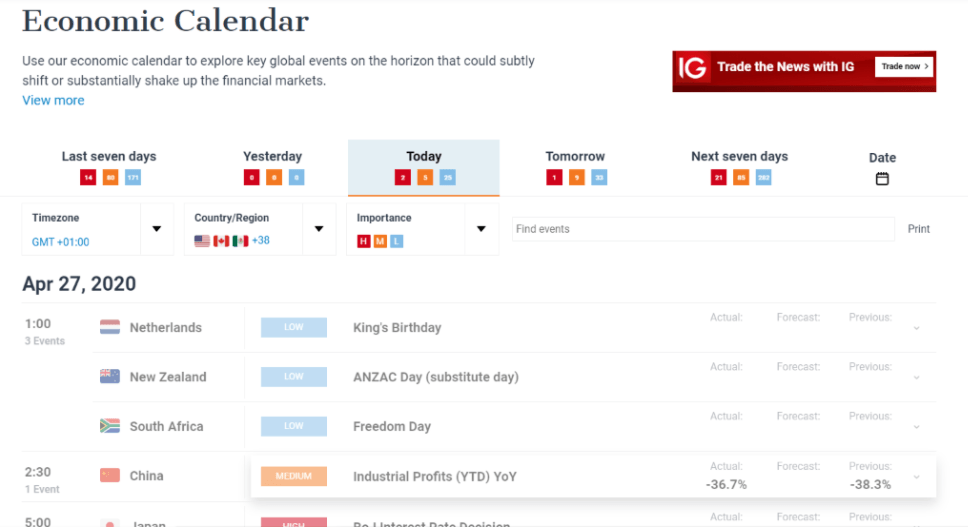

Har live Forex economic calendar saari upcoming economic data releases ko list karta hai aur jab ye announcements aati hain, toh actual numbers se bharta hai. Lekin dhyan mein rakhna zaruri hai ki har data release ka market par ek hi tarah ka asar nahi hota. Bahut se Forex news websites inhe low, medium, ya high ke roop mein categorize aur mark karti hain.

- Low volatility: Announcements jinmein thoda sa market reaction expected hota hai, jaise kuch minor bond sales, surveys ke results, aur doosre kam mashhoor indicators.

- Medium volatility: Zyada important news releases jinmein moderate impact Forex par hota hai. Retail sales, trade balance, aur doosre household spending data is category mein aksar aate hain.

- High volatility: Sabse important events, jaise interest rate decisions, Consumer Prices Index, Gross Domestic Product, Unemployment Rate aur Non-Farm Payroll numbers.

Daily Forex Economic Calendar

Zahiri baat hai ki har trader ke liye ek hi behtareen economic calendar nahi hota. Har kisi ka apna pasand hota hai. Kuch log kisi particular calendar ki design ko pasand karte hain, jabki doosre apne trading platform ke saath aane wale calendar ko istemaal karna pasand karte hain.

Ek example lene ke liye, Axiory economic calendar for Forex trading ek option hai, jo saare important economic news announcements ko list karta hai. Iski trading platform Metatrader 4 apps aur computer software ke saath available hai, jo traders ke liye ek economic calendar ke saath aata hai.

Economic Calendar Mein Kuch Important Items

Toh traders ko sabse zyada dhyan dena chahiye kis announcements par? Sabse obvious ek hai central bank interest rate decisions. Amooman, sab kuch barabar ho toh high-yielding currency zyada traders aur investors ko attract karta hai, jabki low-yielding currencies mostly carry trade aur borrowing ke liye istemaal hoti hain. Bahut baar press conference mein chairmen aur doosre board members ke statements actual rate decision se bhi important ho sakte hain.

Dusre important item Consumer Price Index announcements hote hain. Duniya ke zyadatar central banks actively kisi level ki inflation ko target karte hain. Isliye latest figures traders aur investors ko ye opportunity dete hain ki analyze karein ki CPI is goal ke kitne kareeb hai aur authorities divergence ka response kaise denge. Inflation long term Forex analysis ke liye bhi zaroori hai, jaise ke Purchasing Power Parity levels determine karne mein.

Agla item list mein aata hai unemployment rate. Duniya ke zyadatar central banks ka official target toh nahi hota, lekin woh usually significant changes in jobless rates ke liye response dete hain. Ye toh kehna bhi zaroori hai ki Gross Domestic Product indicators, especially real GDP ke growth rate, exchange rates ko move karne mein ek aur important factor hai. Currencies strong economic indicators ke saath support karte hain, traders ko ye samajhne mein madad hoti hai ki is case mein central banks interest rates ko increase karne ke zyada mauqoof hain.

Dusri taraf, weak growth ya recession ke case mein Federal Reserve, for example, rates ko significantly kam karne aur Quantitative Easing program ko expand karne ke liye zyada mauqoof hota hai, jisse ki dollar ki weakness hoti hai. Doosre important announcements mein Non-Farm Payrolls, Consumer Confidence Index, Trade aur Budget Balances, Retail sales, Home sales, aur Manufacturing Purchasing Managers Index shaamil hain.

Economic Calendar Se Forex Trading Kaise Karein

Ek nazar mein toh major announcements ke doran trading karna acha idea lag sakta hai, kyunke high volatility significant payouts ke liye opportunities create karti hai. Haqeeqatan mein, bahut se professional Forex traders usually try karte hain apne positions ko major announcement se pehle close karna aur jab economic data release hoti hai aur market reaction clear hoti hai, tab hi trading resume karte hain.

Iske peeche wajah ye hai ki kyun ki kai traders apne positions ko news release se pehle hi bandh dete hain, toh market mein liquidity kam hoti hai. Ye traders ke liye risk ko badha deti hai. Haan, kabhi-kabhi traders ko kuch lucky ho sakta hai, lekin news release se pehle, mostly ye ek 50/50 guessing game hota hai. Agar forecasts sahi nikalte hain, toh bhi ye mushkil hota hai ki market ka exact reaction kya hoga.

Problem yeh hai ki traders shayad hi actual news release ka outcome expect kar rahe hain aur usko currency pairs mein price kar chuke hain. Toh jab central bank rate decision ya latest CPI ya GDP numbers aate hain, toh market ka reaction logically expect kiye jane wale se kaafi alag ho sakta hai. Isliye jo kahawat hai, "Buy the rumor, sell the fact," Forex trading ke liye itni relevant hai.

COVID-19 ke concerns ke chalte, US Federal Reserve ne 3rd March 2020 ko Federal Funds rate ko 25 basis points se cut karne ka faisla kiya. Jaise hum upar ke chart se dekh sakte hain, traders aur investors ka initial reaction kaafi predictable tha. Is announcement se pehle ka din, USD/JPY ¥108 level ke upar trade ho raha tha. Is decision ke baad, US dollar girne laga, 4 dinon mein ¥102 tak gir gaya.

Is development ke baad, USD/JPY recover hua, 13th March tak ¥108 level par wapas pahunch gaya. Lekin, 3 dinon baad US Federal Reserve ne ek emergency announcement ki, further cutting Funds rate by 150 basis points, ise 0 se 0.25% range mein le gaya.

Ab, conventional wisdom ke hisab se, pairs ko pehle se zyada hard girna chahiye tha, kyunki 1.50% ka cut 0.25% se zyada significant hai. Pehle toh sahi tha, Japanese Yen strengthen hua aur USD ne ¥106 ke nazdeek gira. Lekin, is initial decline ke baad, USD/JPY steady taur par chaar trading days ke liye badha, jo ki ek higher level tha, Federal Reserve ne rates ko cut karna shuru kiya hua din se mukable.

Toh isko hum kaise samjhein? Kyun USD/JPY ne doosre aur bade rate reduction ka response nahi diya? Ek karan ye ho sakta hai ki market ne ye judge kiya tha ki Federal Reserve sirf ek one-off 25 basis point rate cut ke liye settle nahi karegi.

Economic Calendar Importance

COVID-19 virus ke phailne ke chalte kai businesses jaise airlines aur hotels ne serious losses suffer kiye, kuch bankrupt bhi ho sakte the. Kuch mulkon mein restaurants, bars, museums, aur cinemas ko bandh kar diya gaya hai. Kai aur companies ne temporarily apne operations suspend kar diye hain. Iske natije mein kai log apne jobs kho chuke hain.

Clearly, koi bhi honest analysis ye conclude kar sakta hai ki ye most likely economic activity mein significant decline la sakta hai. Considering ki household consumption aur business investment gross domestic product ke do essential components hain, ye future economic growth par major impact daal sakta hai. Isliye traders aur investors duniya bhar mein US central bank se more decisive action expect kar rahe the.

Isliye, is massive 150 basis point rate cut ke time par, ye step mostly priced in aur expected tha, isliye USD/JPY ne short-lived decline se jaldi recover kiya. Isliye, jab highest expected volatility wale announcements aate hain, iske saath deal karne ka ek tareeka ye hai ki sab positions ko is event risk se pehle close kar dein, relevant Forex pairs ko kuch time observe karein aur uske baad trading resume karein.

Ek aur option ye hai ki possible outcome guess karein aur positions accordingly place karein. Hamare pehle example par lautte hain, Reserve Bank of Australia ke baare mein. Agar wo rate cut karna decide kare 0% par, toh ye market expectations ko disappoint karega. Toh agar trader ye expect karta hai, toh wo short AUD/USD, long EUR/AUD, aur similar positions open kar sakta hai.

Lekin yahan stop-loss orders essential hote hain losses ko cut karne ke liye, case mein market opposite direction mein jaaye. Jaise humne upar ke example se dekha hai, major announcements ke baad currency movements guess karna notoriously difficult ho sakta hai. Isliye stop-loss orders in cases mein valuable insurance policy ki tarah kaam kar sakte hain.

تبصرہ

Расширенный режим Обычный режим