Slippage in Forex Trading:

Forex Tijarat Mein Silippage

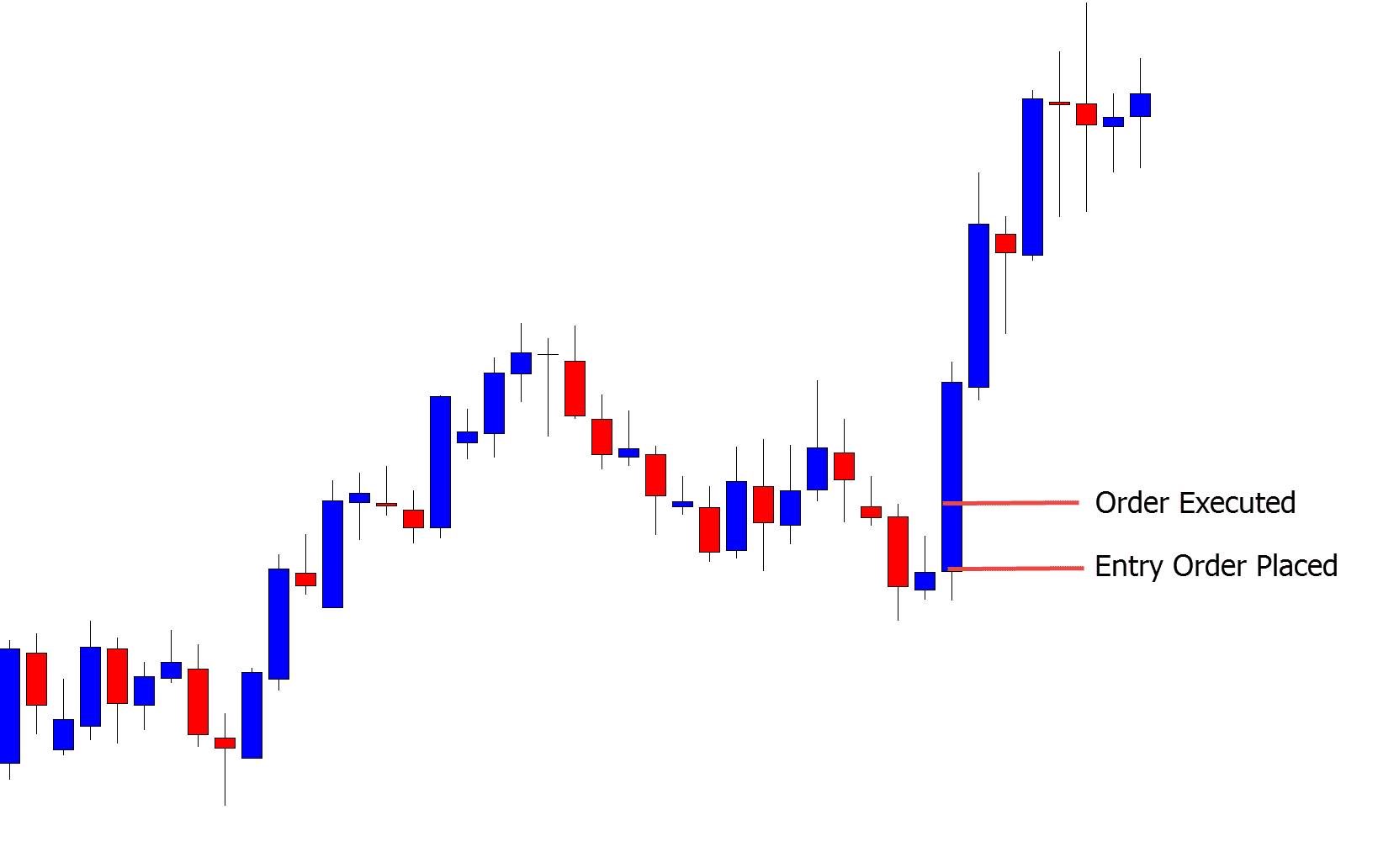

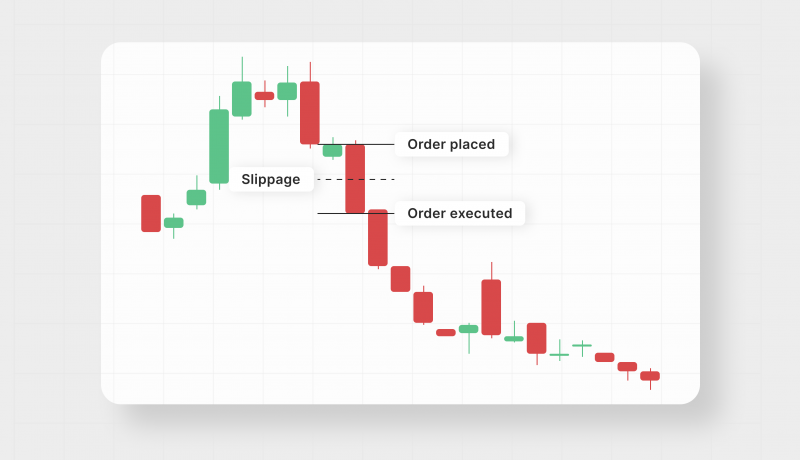

Slippage ek aam forex trading term hai jo trading order execute hone ke dauran price mein anay wali choti si tawanai ko darust karta hai. Jab traders apne order execute karte hain, toh wo price aur execution price mein chand pips ka farq dekhte hain. Yeh farq hone ka sabab market mein chhoti si tezi ya girenge, liquidity ki kammi, ya volatiliyat ki wajah se ho sakta hai.

Slippage Kaise Hota Hai:

- Market Volatility:

- Jab market mein zyada volatility hoti hai, tab order execute hone mein silippage ka zyada chance hota hai.

- Fast-moving market mein, prices mein choti si tawanai (fluctuations) hote hain jo order execution mein asar dalte hain.

- Low Liquidity:

- Low liquidity wale market mein, yani jab market mein kam tijarat ho rahi ho, tab bhi silippage hone ke chances badh jaate hain.

- Ismein order execute hone mein thora sa waqt lagta hai aur prices mein chhoti si tawanai aati hai.

- News Events:

- Kuch ahem khabar events ke waqt, market mein tezi se price changes aate hain.

- Is time par, order execute hone mein silippage ka risk hota hai kyun ki prices tezi se badal sakti hain.

Silippage Ka Asar:

- Positive Silippage:

- Kabhi-kabhi silippage traders ke faiday mein bhi ho sakta hai.

- Agar market mein tezi se price badal rahi hai aur order execute hone mein silippage hota hai, toh traders ko expected se zyada faida ho sakta hai.

- Negative Silippage:

- Negative silippage traders ke liye nuksan dayak ho sakta hai.

- Agar market mein girenge ya fast-moving conditions mein order execute hone mein silippage hota hai, toh traders ko expected se zyada nuksan ho sakta hai.

Silippage Se Bachne Ke Tareeqay:

- Limit Orders:

- Limit orders ka istemal kar ke traders silippage se bach sakte hain.

- Limit order mein traders specify karte hain ke woh sirf specific price par hi trade karna chahte hain.

- Use Stop-Loss Orders:

- Stop-loss orders ka sahi istemal kar ke traders apne nuksan ko kam kar sakte hain.

- Agar market mein girenge ya fast-moving conditions mein order execute hone mein silippage hota hai, toh stop-loss order losses ko control karne mein madadgar ho sakta hai.

- Trading During High Liquidity:

- High liquidity wale waqt mein tijarat karna silippage se bachne mein madadgar ho sakta hai.

- Market mein zyada liquidity hone se order execution mein tezi hoti hai.

Silippage ek common phenomenon hai aur traders ko iske hone par tayyar rehna chahiye. Sahi risk management aur sahi tareeqay se order place karne se silippage ke asarat kam kiye ja sakte hain.

تبصرہ

Расширенный режим Обычный режим