What is Mat Hold Trading

Introduction

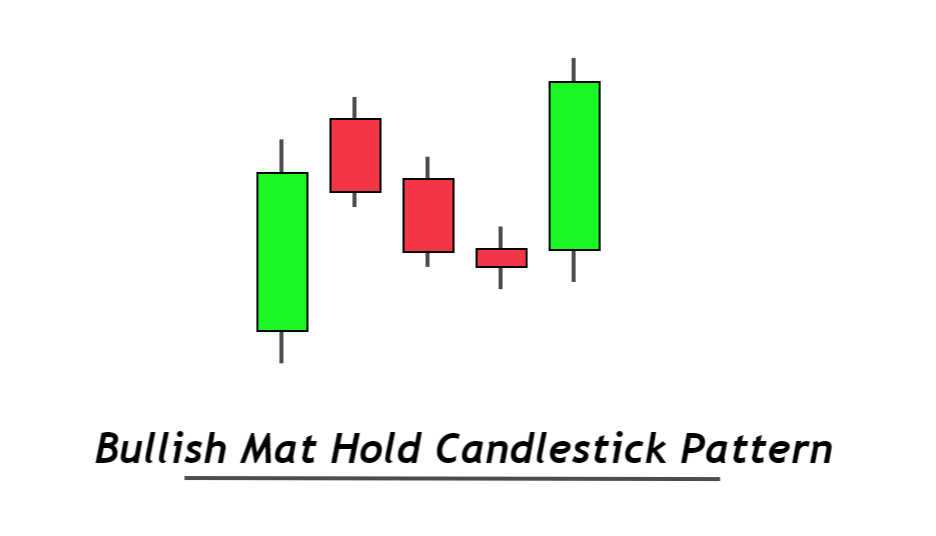

Mat Hold Trading ek candlestick chart pattern hai jo stock market mein istemal hota hai. Yeh pattern bullish trend ke doran paya jata hai aur traders ko market ke future movement ke baray mein hint deta hai. "Mat Hold" ka naam is liye hai kyunki yeh pattern ek lambe uptrend ke baad aata hai jab market mein thora sa consolidation hota hai

Explanatin

Mat Hold Trading ka pattern ek lamba green candle hota hai jo ek uptrend ke baad aata hai. Iske baad, ek chota sa red candle aata hai jo typically pehle green candle ke upper half mein hota hai. Yeh do candles mil kar ek mat hold pattern banate hain.

How to use the Mat Hold Trading

Mat Hold Pattern ko samajhne ke liye, yeh mahatvapurna hai ke green candle ka size bada hona chahiye aur iska close price upper side pe hona chahiye. Uske baad red candle ka size chhota hona chahiye aur ideally pehle green candle ke upper half mein close hona chahiye.

Mat Hold ka matlab hota hai ke market mein thora sa profit booking ya consolidation ho raha hai, lekin overall trend bullish hai aur traders ko ek aur uptrend ki possibility dikhata hai. Is pattern ko confirm karne ke liye, traders ko ek aur green candle ka wait karna padta hai jo mat hold pattern ke baad aata hai. Agar yeh candle bhi green hota hai, toh iska matlab hai ke bullish trend continue ho sakta hai.

Risk Management

Mat Hold Trading ke istemal mein risk management ka bhi khayal rakhna zaroori hai. Traders ko apne stop-loss levels ko set karna chahiye taki agar market unexpected direction mein jaata hai toh nuksan se bacha ja sake. Is pattern ki strength ko samajhne ke liye, volume analysis bhi kiya jata hai. Agar mat hold pattern ke saath high volume bhi hota hai, toh yeh uske reliability ko aur bhi badha deta hai.

How to Trade the Mat Hold Trading

Mat Hold Trading ek technical analysis ka hissa hai, aur isay samajh kar traders market mein hone wale movements ke liye prepare ho sakte hain. Lekin, market mein kai factors hote hain jo unexpected movements ko influence karte hain, is liye hamesha ek cautious approach rakhna zaroori hai.

Is pattern ko samajhne mein practice aur experience ka bhi baraabar hissa hota hai. Traders ko regularly market ka watch karna aur patterns ko identify karna sikhna chahiye taaki unhe sahi samay par sahi decisions lene mein madad mil sake

Introduction

Mat Hold Trading ek candlestick chart pattern hai jo stock market mein istemal hota hai. Yeh pattern bullish trend ke doran paya jata hai aur traders ko market ke future movement ke baray mein hint deta hai. "Mat Hold" ka naam is liye hai kyunki yeh pattern ek lambe uptrend ke baad aata hai jab market mein thora sa consolidation hota hai

Explanatin

Mat Hold Trading ka pattern ek lamba green candle hota hai jo ek uptrend ke baad aata hai. Iske baad, ek chota sa red candle aata hai jo typically pehle green candle ke upper half mein hota hai. Yeh do candles mil kar ek mat hold pattern banate hain.

How to use the Mat Hold Trading

Mat Hold Pattern ko samajhne ke liye, yeh mahatvapurna hai ke green candle ka size bada hona chahiye aur iska close price upper side pe hona chahiye. Uske baad red candle ka size chhota hona chahiye aur ideally pehle green candle ke upper half mein close hona chahiye.

Mat Hold ka matlab hota hai ke market mein thora sa profit booking ya consolidation ho raha hai, lekin overall trend bullish hai aur traders ko ek aur uptrend ki possibility dikhata hai. Is pattern ko confirm karne ke liye, traders ko ek aur green candle ka wait karna padta hai jo mat hold pattern ke baad aata hai. Agar yeh candle bhi green hota hai, toh iska matlab hai ke bullish trend continue ho sakta hai.

Risk Management

Mat Hold Trading ke istemal mein risk management ka bhi khayal rakhna zaroori hai. Traders ko apne stop-loss levels ko set karna chahiye taki agar market unexpected direction mein jaata hai toh nuksan se bacha ja sake. Is pattern ki strength ko samajhne ke liye, volume analysis bhi kiya jata hai. Agar mat hold pattern ke saath high volume bhi hota hai, toh yeh uske reliability ko aur bhi badha deta hai.

How to Trade the Mat Hold Trading

Mat Hold Trading ek technical analysis ka hissa hai, aur isay samajh kar traders market mein hone wale movements ke liye prepare ho sakte hain. Lekin, market mein kai factors hote hain jo unexpected movements ko influence karte hain, is liye hamesha ek cautious approach rakhna zaroori hai.

Is pattern ko samajhne mein practice aur experience ka bhi baraabar hissa hota hai. Traders ko regularly market ka watch karna aur patterns ko identify karna sikhna chahiye taaki unhe sahi samay par sahi decisions lene mein madad mil sake

تبصرہ

Расширенный режим Обычный режим