usre technical indicators aur risk management ko bhi madde nazar rakha jana chahiye. pattern ko samajh kar traders market mein hone wale changes ko anticipate kar sakte hain. Agar uptrend ke baad Harami pattern nazar aaye to yeh ishara ho sakta hai ke market mein bearish reversal hone wala hai. Aur agar downtrend ke baad Harami pattern nazar aaye to yeh ishara ho sakta hai ke market mein bullish reversal hone wala hai. Traders ko chahiye ke woh market trends aur patterns ko sahi taur par samajh kar apne trading strategies ko improve karen. Harami pattern ek matloob tool hai jo market volatility aur uncertainty ko handle karne mein madad forex trading mein istemaal hone wala ek technical analysis tool hai jo market mein mukhtalif palatane ki pehchaan karne ke liye istemaal hota hai. Ye do-candle formation hoqatwar nahi hain ke bechne wale pressure ko hara sakein. candlesticks se mil kar banta hai. Pehla candlestick ek lamba aur mazeed muqawim candle hota hai, jo ke market ke trend ko zahir karta hai. Doosra candlestick chhota hota hai, aur iska ander market mein taqat ki kami ya phir reversal ki shuruwat hoti hai.

Harami Candlestick Pattern Kya Hai?

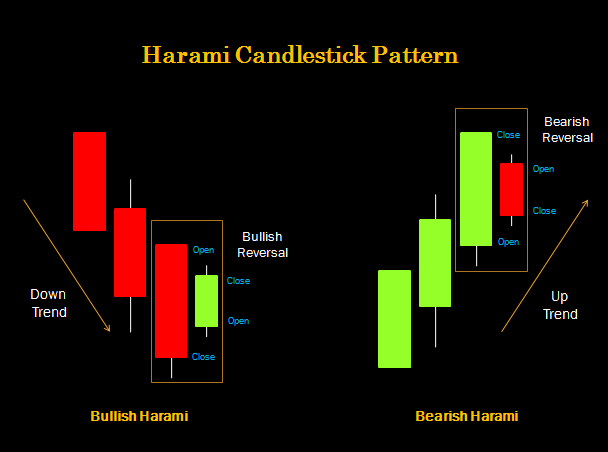

Harami Candlmesha d Candlestick Pattern, forex aur stock market mein istemal hone wale aham candlestick patterns mein se aik hai. Yeh pattern traders ke liye market ke mazmon ko samajhne mein madadgar hota hai aur unko behtar trading decisions lene mein sahayak hota hai. Is article mein, hum Harami Candlestick Pattern ke bare mein roman Urdu mein tafseel se baat karenge. do mumtaz candles se mil kar banta hai. Is pattern mein pehli candle bari hoti hai, jise "mother candle" kehte hain, aur iske baad ek choti candle ati hai jo pehli candle ke estick ti hai jo ke downtrend ya uptrend mein nazar aati hai aur ek mumkin price reversal ko signal karti hai. Harami candlestick pattern do candles se bana hota hai, pehli candle lambi laal candle (jo bearish candle bhi kehlati hai) hoti hai jo market mein taqatwar selling pressure ko darust karti hai. Dusri candle, jo choti hoti hai aur iski body purani candle ki body mein puri tarah ghairat hai, ise harami candle kehte hain. Ye dusri candle darust karta hai ke khareedne wale market mein dakhil ho rahe hain aur prices ko upar le ja rahe hain lekin abhi tak ye kafi taCandlestick Pattern ka istemal karke market mein hone wale reversals ko pehchan sakte hain. Agar yeh pattern uptrend ke baad aata hai, toh traders ko selling opportunities ki taraf ishara milta hai. Lekin, is pattern ko istemal karte waqt, ha hoti hai. Dusri candle ko "inside candle" kehte hain. Yeh pattern bullish ya bearish market ke trend reversal ko darust karne mein madadgar sabit ho sakta hai.

Harami Candlestick Pattern Ke Types:

hai. Stop-losil karne ke liye, traBullish Harami: Agar pehli candle bearish hai aur dusri candle bullish hai, to isey bullish harami kehte hain. Yeh ishara karta hai ke bearish trend kamzor ho sakta hai aur bullish trend shuru hone wala hai.Bearish Harami: Agar pehli candle bullish hai aur dus orders ka istemal karein taake nuksan se bacha ja Market Conditions Ka Tafsili Mutala: Harami pattern ko dekhte hue market conditions ka tafsili mutala karein. Market mein kya chal raha hai, isay samajhne ke liye fundamental aur technical analysis ka istemal Harami Candlestick Pattern, market ke mazmon ko samajhne mein madadgar hone ke sath-sath, traders ko behtar trading decisions lene mein bhi madad karta hai. Is pattern ko samajhne ke liye practice aur tajaweezat par amal karna zaroori hai. Tijarat mein kamyabi hassri candle bearish hai, to isey bearish harami kehte hain. Yeh ishara karta hai ke bullish trend kamzor ho sakta hai aur bearish trend shuru honeHarami Candlestick Pattern Ka TijaratHarami Candlestick Pattern ka istemal tijarat karne wale logon ke liye aham ho sakta hai. Agar aapko lagta hai ke market ka trend badalne wala hai, to Harami pattern ko samajhna aur pehchan lena bohot zaroori hai. Is pattern ko dekhte hue traders apne trading strategies ko adjust kar sakips for Trading with Harami CaConfirmation ke liye doosre indicators ka istemal: Harami Candlestick Pattern ko sirf ek indicator ke tor par na lein, balki isey doosre technical indicators ke sath istemal karein takay aapko confirmations milein.Risk Management: Hamesha yaad rakhein ke tijarat mein risk management bohot zarooriders ko mehnat aur tajaweezat par amal karne ke sath-sath, sahi waqt par sahi decisions lene ki zarurat hoti hai.

Harami Candlestick Pattern Kya Hai?

Harami Candlmesha d Candlestick Pattern, forex aur stock market mein istemal hone wale aham candlestick patterns mein se aik hai. Yeh pattern traders ke liye market ke mazmon ko samajhne mein madadgar hota hai aur unko behtar trading decisions lene mein sahayak hota hai. Is article mein, hum Harami Candlestick Pattern ke bare mein roman Urdu mein tafseel se baat karenge. do mumtaz candles se mil kar banta hai. Is pattern mein pehli candle bari hoti hai, jise "mother candle" kehte hain, aur iske baad ek choti candle ati hai jo pehli candle ke estick ti hai jo ke downtrend ya uptrend mein nazar aati hai aur ek mumkin price reversal ko signal karti hai. Harami candlestick pattern do candles se bana hota hai, pehli candle lambi laal candle (jo bearish candle bhi kehlati hai) hoti hai jo market mein taqatwar selling pressure ko darust karti hai. Dusri candle, jo choti hoti hai aur iski body purani candle ki body mein puri tarah ghairat hai, ise harami candle kehte hain. Ye dusri candle darust karta hai ke khareedne wale market mein dakhil ho rahe hain aur prices ko upar le ja rahe hain lekin abhi tak ye kafi taCandlestick Pattern ka istemal karke market mein hone wale reversals ko pehchan sakte hain. Agar yeh pattern uptrend ke baad aata hai, toh traders ko selling opportunities ki taraf ishara milta hai. Lekin, is pattern ko istemal karte waqt, ha hoti hai. Dusri candle ko "inside candle" kehte hain. Yeh pattern bullish ya bearish market ke trend reversal ko darust karne mein madadgar sabit ho sakta hai.

Harami Candlestick Pattern Ke Types:

hai. Stop-losil karne ke liye, traBullish Harami: Agar pehli candle bearish hai aur dusri candle bullish hai, to isey bullish harami kehte hain. Yeh ishara karta hai ke bearish trend kamzor ho sakta hai aur bullish trend shuru hone wala hai.Bearish Harami: Agar pehli candle bullish hai aur dus orders ka istemal karein taake nuksan se bacha ja Market Conditions Ka Tafsili Mutala: Harami pattern ko dekhte hue market conditions ka tafsili mutala karein. Market mein kya chal raha hai, isay samajhne ke liye fundamental aur technical analysis ka istemal Harami Candlestick Pattern, market ke mazmon ko samajhne mein madadgar hone ke sath-sath, traders ko behtar trading decisions lene mein bhi madad karta hai. Is pattern ko samajhne ke liye practice aur tajaweezat par amal karna zaroori hai. Tijarat mein kamyabi hassri candle bearish hai, to isey bearish harami kehte hain. Yeh ishara karta hai ke bullish trend kamzor ho sakta hai aur bearish trend shuru honeHarami Candlestick Pattern Ka TijaratHarami Candlestick Pattern ka istemal tijarat karne wale logon ke liye aham ho sakta hai. Agar aapko lagta hai ke market ka trend badalne wala hai, to Harami pattern ko samajhna aur pehchan lena bohot zaroori hai. Is pattern ko dekhte hue traders apne trading strategies ko adjust kar sakips for Trading with Harami CaConfirmation ke liye doosre indicators ka istemal: Harami Candlestick Pattern ko sirf ek indicator ke tor par na lein, balki isey doosre technical indicators ke sath istemal karein takay aapko confirmations milein.Risk Management: Hamesha yaad rakhein ke tijarat mein risk management bohot zarooriders ko mehnat aur tajaweezat par amal karne ke sath-sath, sahi waqt par sahi decisions lene ki zarurat hoti hai.

تبصرہ

Расширенный режим Обычный режим