Assalamu Alaikum Dosto!

Forex Trading

Forex trading financial markets ka aik aisa business hai, jo k stocks trading se melta julta hai lekin yahan par dunya bhar ke log aik doosre ke saath currencies ki trading karte hain. Is ka maqsad hai forex market se paiso kamana, jis ke liye kuchh samajh hona zaroori hai. Is article mein, hum forex trading ke bare mein baat karenge aur is ke maqsad, tareeqe aur faide ke baare mein jaanenge.

Forex trading ka maqsad paiso kamana hai. Yeh aik aisa tareeqa hai jis se aap paiso ko apni marzi se invest aur withdrawal kar sakte hain. Is ke saath, aap dunya bhar ke logo ke saath paiso ki trading kar sakte hain. Forex market ka maqsad hai foreign currencies ko khareedna aur bechna. Jis se log foreign currencies ke rates ke baray mein maloomat hasil karte hain aur forex market se faida uthate hain.

Forex trading ke tareeqe mein, aap ko forex broker ki zaroorat hoti hai. Forex broker aik aisa shakhs hai jo forex market mein paiso ki trading karta hai aur aap ki trading ki saholat deta hai. Is ke saath, aap ko apne forex account ko kholne ki zaroorat hoti hai. Forex account ko kholne ke baad, aap ko apni currency pair ke baare mein sochna hota hai. Currency pair do currencies ko darj karta hai, jo forex market mein khareedi aur farokht ki jaati hain.

Forex Trading Importance

Forex trading aik ban-al-aqwami business ka bara market hai, jiss ka koi markaz maojood nahi hai. Iss waja se iss karobar par pori dunya k afraad bharosa karte hen. Forex trading market aik bari almi mandi hai, jiss ki rozana ki maleyat taqreeban 6 trilion dollar hai. Ye karobar roz ba roz bharta hi ja raha hai, jiss me pori dunya k investors dilchaspi le rahe hen. Forex trading me aghaz me currencies ka lain dain hota hai, lekin ab uss me dosre commodities jaise gold, oil, metals aur stocks ka bhi trading karte hen. Aaj kal ye market itni bari ho chuki hai, k pori dunya k stocks exchange bhi mel kar iss ka muqabela nahi kar sakte hen.

Forex trading aik 24 ghantay ki aala liquidity market hai, jis mein small start up sarmaye, small lain dain ke akhrajaat ke sath trading ki ja sakti hai jahan koi aik idaara jati trader market ki qeematon ko control nahi kar sakta.

Agar aap expert trader hain to, forex trading aap ke liye aik behtareen karobari jagah hai. Yeh aik aisa option hai jo aap ke liye aalmi market mein dastyab hai. Yeh intehai munafe bakhash hai, aur aap ko is ke daily zindagi mein bohat se fawaid haasil ho satke hain. Forex trading ke tamam fawaid haasil kar satke hain agar sirf aur sirf is soorat mein jab aap is mein expert hon. Doosri soorat mein, yeh aap ke kaam ka intikhab nahi ho sakta hai. Lekin is ki choti choti barikion ko seekhnay ke baad, aap ziyada munafe kama satke hain.

Forex trading mein practice karne ke liye kuch zaruri tariqe hain:

- Education: Forex trading ki samajh aur uske fundamental concepts ko samajhna bahut zaruri hai. Traders ko trading strategies, technical analysis, market indicators, aur risk management ki samajh honi chahiye. Iske liye, online courses, tutorials, books aur webinars wagera se khud ko educate karna zaroori hai.

- Demo Accounts: Demo accounts ki madad se traders virtual environment mein real-time market conditions par trading kar sakte hain. Isse unhe practical experience milti hai bina kisi risk ke. Demo accounts mein virtual currency hoti hai, jiski madad se traders apni strategies ko test kar sakte hain aur apna trading style develop kar sakte hain.

- Paper Trading: Paper trading ek aur tariqa hai jisme traders fake trades execute karte hain aur market ke performance par apni trading decisions ko evaluate karte hain. Isme real-time market data aur historical data ka istemal hota hai. Paper trading mein traders apne trades ka record rakhte hain aur unhe analyze karke apni galtiyan aur kamzoriyan pata lagate hain.

- Analysis and Practice: Forex trading mein technical aur fundamental analysis ka istemal karna zaruri hai. Traders ko market trends, price patterns, aur economic indicators ko samajhna chahiye. Iske saath hi, unhe trading strategies ko backtest karke apne results ko analyze karna chahiye. Practice ke dauran, traders ko apne skills ko improve karne ke liye apne mistakes se seekhna chahiye.

- Discipline: Forex trading mein practice karne ke liye discipline, consistency aur patience bahut zaruri hai. Traders ko apne trading plan ko follow karna chahiye aur emotions par control rakhna zaruri hai. Regular practice aur experience ke saath hi traders apni trading skills aur market understanding ko improve kar sakte hain aur successful traders ban sakte hain.

Isliye, forex trading mein practice aur tajarba lena traders ke liye bahut zaruri hai. Ye unhe market ke dynamics aur apne trading strategies ko samajhne mein madad karta hai aur unki success ke chances ko badhata hai.

Forex Trading Ki Practices

Forex trading mein practice karne ke liye tajarba bahut zaruri hai. Tajarba ke baghair forex trading mein kamyabi hasil karna mushkil ho sakta hai. Isliye, neem tajarba karobarion ke liye demo accounts bhi mojood hote hain jin mein virtual currency hoti hai aur traders iske zariye real-time market conditions par practice kar sakte hain.

Demo accounts ke saath, traders ko market ki trends aur indicators ko samajhane ka bhi mauqa milta hai. Is tarah, wo apne trading strategies ko test kar sakte hain aur apne skills ko improve kar sakte hain.

- Paiso ko invest aur withdraw karna aasaan hota hai:

Forex trading mein, paiso ko invest aur withdraw karna aik bohot aasaan tareeqa hai. Aap apne trading account se paison ko invest aur withdraw kar sakte hain. Is ke saath, aap ke paas bohot se payment methods hote hain, jaise bank transfer, credit card aur debit card, jis se aap aik aasaan tareeqe se apne paison ko manage kar sakte hain. - 24/7 trading ka maahol:

Forex trading market 24/7 khula rehta hai. Is ke saath, aap ko kisi bhi waqt trading ki saholat milti hai. Is ka matlab hai ke aap ko kisi bhi waqt trading ke liye khud ko available rakhne ki zaroorat nahi hai. Aap apne time schedule ke mutabiq trading kar sakte hain aur paiso ko control kar sakte hain. - High liquidity:

Forex market ka liquidity level bohot zyada hai. Is ka matlab hai ke forex market mein khareedne aur bechne ke liye hamesha koi buyer ya seller hota hai. Is se aap ko trading karne mein koi difficulty nahi hoti hai. Is ke saath, aap ko bohot se currency pairs milte hain, jis se aap apni trading strategies aur techniques ko istemaal kar sakte hain. - Apne kharchon ko kam karna:

Forex trading se paiso kamana aik acha tareeqa hai apne kharchon ko kam karne ka. Is ke saath, aap apne time aur energy ko forex trading mein laga sakte hain aur paiso kamane ke liye kaam kar sakte hain. Is ke saath, aap apne kharchon ko control kar sakte hain aur apne financial goals ko achieve kar sakte hain. - Trading strategies aur techniques istemaal karna:

Forex trading mein, log apni trading strategies aur techniques ko istemaal kar sakte hain. Is ka matlab hai ke aap apni trading ko customize kar sakte hain aur apne khud ke tareeqe se trading kar sakte hain. Is ke saath, aap apne trading ko improve karne ke liye bohot se tools aur indicators ko istemaal kar sakte hain.

Forex Trading History

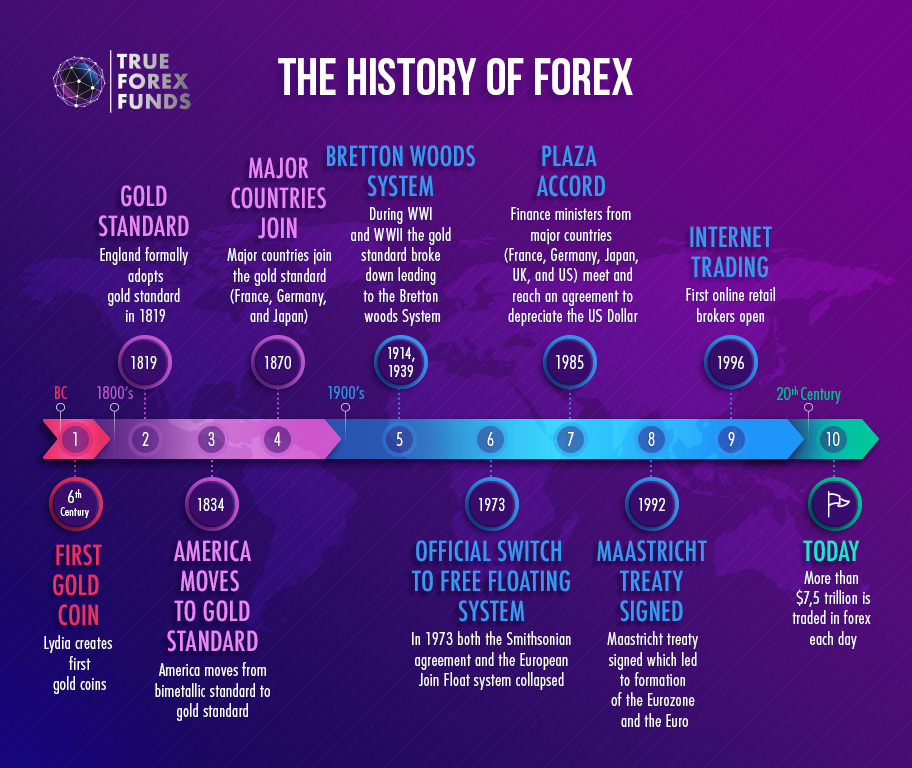

Forex trading ki ibteda ek darwaze ki tarah hoti hai jis se log tijarat mein shamil hote hain. Is tajurbe se shuru hoti hai jab log currencies ko khareedte aur bechte hain. Ye currencies mulk se mulk transfer kiye jate hain aur in currencies ki keemat ka tajarba karne ke liye forex market ka istemal hota hai.

Forex trading ka aghaz 1970s mein hua jab international currencies ke badalte maqasad aur tarjumaniyat ke liye zaruri hua. Tab se lekar aaj tak, forex trading ki qayadat hamesha tabdeel hote rahi hai. Iske pehle, foreign exchange trading sirf banks aur financial institutions ke liye muhaiya thi, lekin ab yeh amm logon ke liye bhi mojood hai.

- Forex Trading ke Asbab aur Tarikh

Forex trading ke pehle kuch asbab the, jaise gold standard ke khatmay hone ke baad currencies ki keemat ke tabdeel hone ki zarurat. Baad mein, technology aur internet ki taraqqi ne forex trading ko mazeed asan kar diya aur iski pohanch ko barha diya. Aaj ke daur mein, traders aur investors online platforms aur software ka istemal karke forex trading karte hain.

Forex trading ki tarikh mein kuch mahatvapurna waqiat bhi shamil hain. 1971 mein Bretton Woods system khatam hua aur currencies ke liye flexible exchange rates ka silsila shuru hua. 1990s mein internet ki shuruat ne forex trading ko global level par aur bhi accessible banaya. Aur phir 2000s mein mobile aur smartphone technology ke aane se traders ne forex trading ko apne hathon mein le liya. - Forex Trading ka Maqsad aur Faida

Forex trading ka maqsad currencies ki keemat ko samajhna aur us par tijarat karna hai. Isse traders aur investors currencies ki fluctuation aur market trends ko samajh sakte hain aur iske istemal se profit kamate hain. Forex trading ka ek bada faida yeh hai ki yeh 24 ghante khula rehta hai, jiske chalte traders din aur raat mein bhi currencies ki tijarat kar sakte hain.

Forex trading ki aur ek aham baat yeh hai ki isme leverage ka istemal kiya jata hai. Leverage ke zariye traders apne investment se zyada volume ki tijarat kar sakte hain. Yeh unhe mazeed opportunities deti hai profit kamane ke liye, lekin iske saath hi risk bhi barh jata hai.

Advantages Of Forex Trading

- Trading Time

Forex trading me trading ke baray mein pehli behtareen cheez yeh hai ke aap din ke kisi bhi waqat kaam kar satke hain. Yeh aik aisa option hai jo 24 ghantay dastyab hai. Aap haftay ke aakhir mein waqfa bhi le satke hain, kyunkay haftay ke aakhir mein bazaar band rehta hai. Market ka kaam ka waqt itwaar EST ko shaam 5 bujey se hai. Trading America mein shuru hoti hai aur is waqat khatam hoti hai jab barri trading manndi jummay 5 bujey EST tak band ho jati hai. Trading mein koi bara faraq nahi hai kyunkay market sirf ekhtataam hafta par kaam nahi karti hai. - High Liquidity

Liquidity forex trading ka sab se bara faida hai kyunkay yeh kisi asasay ki naqdi mein tabdeel honay ki salahiyat ki terhan hai. Lehaza jab yeh kaha jata hai ke aap ki trading mein ziyada liquidity hai, to is ka matlab hai ke aap barri miqdaar mein naqad raqam kama satke hain, ya aap ke paas is makhsoos din ke sath trading karne ke liye barri raqam ho sakti hai. Yeh small spread ke andar bhi hoga. Forex market mein har roz trilion dollar ka bahao hota hai. Koi aik idaara jati trading nahi hai jo market ki qeematon ko control kar sakay. - Small Transaction Costs

Forex market spread trading mein aik ahem istilaah hain kyunkay yeh bet aur ask ki is valum ke darmiyan farq hai jisay aap theek kar satke hain aur is valum ke darmiyan jo mumkina farokht karne walay log paish kar satke hain. Yeh phelao darasal un logon ke liye adaigi ho ga jo is trading mein shaamil hain. Lehaza, lain deen ki laagat aam tor par choti hoti hai jab hum un ka stock lain deen ke akhrajaat se mawazna karte hain. - High Leverage

Aap dekh satke hain ke jo brokers forex trading mein shaamil hain woh aam tor par market mein sell walon aur kharidaron ko kaafi had tak beyana istemaal karne dete hain. Leverage 1:1000 tak ho sakti hai. Yahi woh cheez hai jo inhen –apne khaton mein mojood raqam se ziyada raqam ke sath tijarat karne ki salahiyat faraham karti hai. Lehaza, yeh lyorij woh hai jo dar haqeeqat aap ko is se kam sarmaye ke sath tijarat ko control karne ki ijazat deta hai jo aap ke paas hai . - Clear Rising and Falling Prices cycles

Forex trading mein khud ko shaamil karne ka aik aur faida yeh hai ke qeematein bherne ya girnay par aap faida utha satke hain. yeh dono awamil aap ke liye mozoon ho satke hain is par munhasir hai ke aap un ko kis terhan istemaal karte hain. Agar aap ko currency ka jora nazar aata hai jis ki qeemat mein izafah hota hai, to aap usay khareed satke hain ya is ke bar aks. Yeh stock market aur forex trading ke fawaid hain. - Small start-up capital

Traders small start up sarmaye ke sath forex market mein tijarat kar saktay hain. Aap $ 500 se shuru kar satke hain. Stock market mein, taajiron ko aksar $ 25000 se shuru karne ki zaroorat hoti hai.

Forex Trading Drawbacks

- High risk:

Forex trading mein bohot zyada risk hota hai. Is ke saath, trading ke profits ke saath loss ka bhi khatra hota hai. Is ka matlab hai ke forex trading mein aap ke paise bohot jaldi khatam ho sakte hain aur aap ko trading se nuqsan ho sakta hai. Agar aap ne forex trading ka sahi tarika nahi seekha hai to aap ke investments ki khatra bohot zyada hai. - Lack of transparency:

Forex trading ka market lack of transparency ka shikar hai. Is ka matlab hai ke forex market mein koi bhi investor ko kisi currency pair ka real time value nahi pata hota hai. Is ke saath, forex market mein koi bhi news ya event ka effect bohot zyada hota hai. Is se aap ko trading mein bohot zyada difficulty hoti hai. - Overconfidence:

Forex trading ke beginners ko apni trading mein overconfidence ka shikar hona bohot aam hai. Is ka matlab hai ke wo apne trading ko bahut asaan samajhne lagte hain aur apne decisions ko justify karte hain. Is se aap ko trading ke results par bohot bura asar hota hai aur aap ko nuqsan ho sakta hai. - Leverage ka istemaal:

Forex trading mein leverage ka istemaal aik bada drawback hai. Leverage ka matlab hai ke aap apne trading account se zyada paise ka istemaal kar sakte hain, jis se aap ke profits aur loss dono bohot zyada ho sakte hain. Is se aap ko high risk ka samna karna padta hai aur aap ke paise ko control karna bohot mushkil ho jata hai. - Emotional trading:

Forex trading mein emotional trading aik bada drawback hai. Is ka matlab hai ke agar aap trading mein involved ho jate hain to aap ke emotions aap ke trading decisions par bohot zyada asar karte hain. Is se aap ko apne trading strategies aur techniques ko follow karne mein mushkil ho jata hai aur aap ko nuqsan ho sakta hai.

Conclusion

Forex trading aik aisa tareeqa hai jis se paiso ki trading ki jaati hai aur log is se paiso kamate hain. Forex trading ke bohot se faide hain. Jis mein, paiso ko invest aur withdraw karne ka aik aasaan tareeqa, 24/7 trading ka maahol, high liquidity, apne kharchon ko kam karna aur trading strategies aur techniques ko istemaal karna shamil hain. Is liye, forex trading aik acha tareeqa hai paiso kamane ka. Is ke saath, forex trading mein paiso ko control karne ke liye samajh bohot zaroori hai, is liye log is ke baare mein maloomat hasil karte hain aur trading ke saholat hasil karte hain.

Forex trading ke bohot se drawbacks hain. Jis mein, high risk, lack of transparency, overconfidence, leverage ka istemaal aur emotional trading shamil hain. Is liye, forex trading ka istemaal karne se pehle logon ko trading ke baare mein bohot zyada maloomat hasil karni chahiye aur sahi tareeqe se training aur practice karne chahiye. Is ke saath, aap ko apni trading strategies aur techniques ko improve karne ke liye bohot se tools aur indicators ko istemaal karna chahiye.

تبصرہ

Расширенный режим Обычный режим