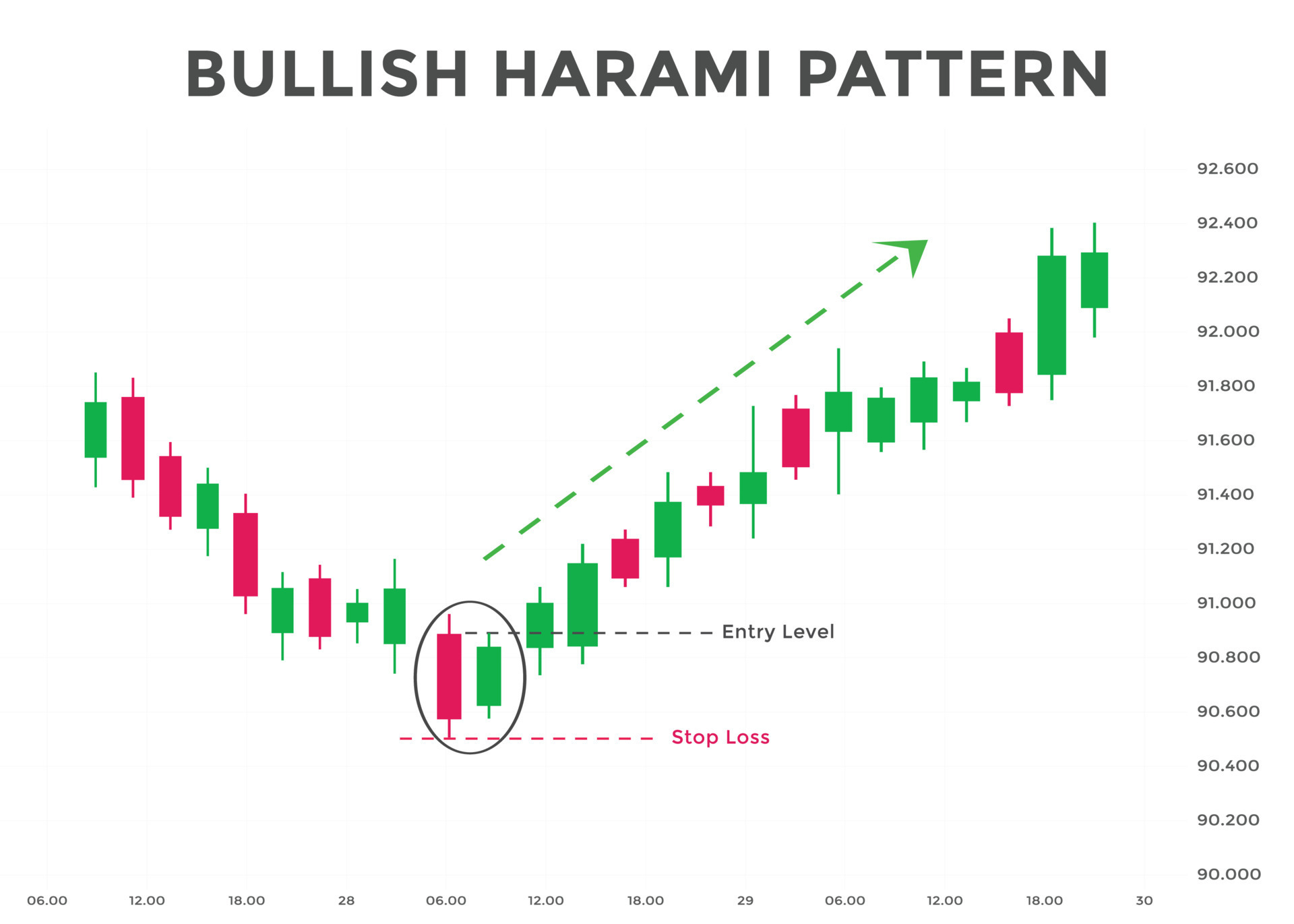

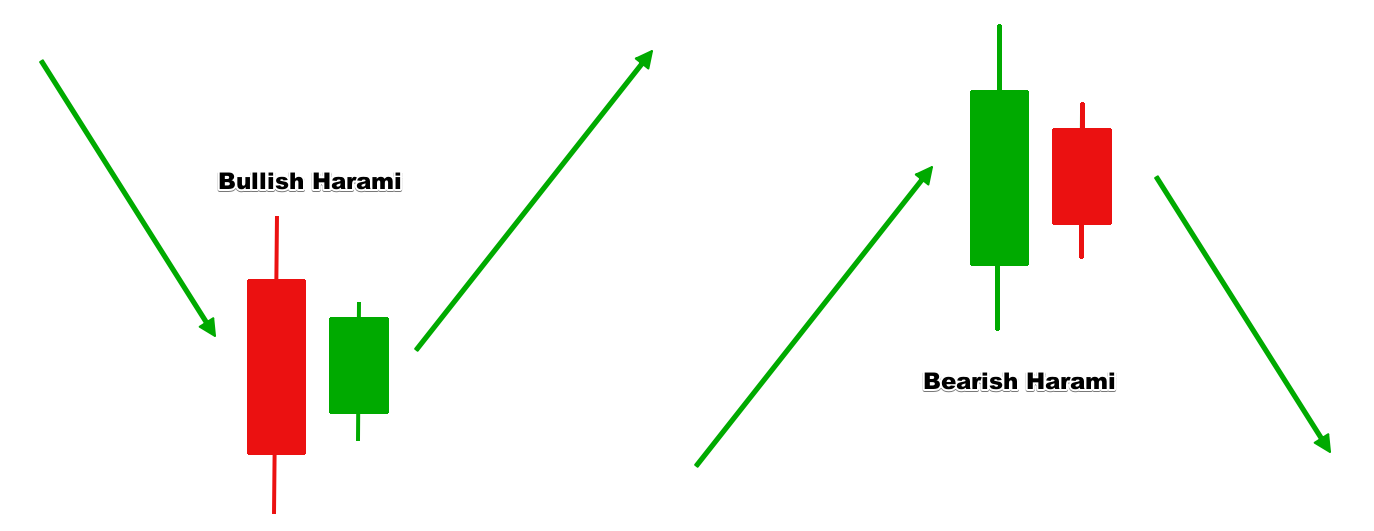

Forex trading mein, mHarami, Japanese candlestick charts par adharit ek reversal pattern hai. Iska naam 'pregnant' ya 'expecting' se aata hai, kyun ki is pattern mein ek bada candle ek chhota candle ke andar chhupa hota hai, jaise ek maa apne bacche ko godi mein liye hotehla Candle: Harami pattern ka pehla part hota hai ek lamba aur mazboot candle, jo market mein ek strong trend ko usra Candle: Dusra part ek chhota candle hota hai jo pehle candle ke andar fit hota hai. Is candle ki body pehle candle ki body keekin range choti hoti hai.hla candle beariarket trends ko samajhne aur reversals ko identify karne ke liye traders ne kayi tarah ke technical analysis tools ka istemal kiya hai. Ek aise zaroori aur aham candlestick pattern hai jo market mein hone wale reversals ko indicate karta hai, jise hum 'Harami' kehte hain. Is article mein, hum Harami candlestick pattern ke bare mein baat karenge aur samjhenge ke ye kis tarah se kaam karta hai.

Harami Candlestick Pattern Kya Hai?

sh hota hai aur doosra caroori hai. Harami pattern ke case mein, stop loss ko carefully place karna chahiye, taki nuksan se bacha sitisition size ko control mein rakhna bhi risk management ka hissa hai. Small aur controlled positions lekar trading se bachne ke liye position size management ka istemal kiya jatHarami candlestick pattern, market trends ko samajhne aur reversals ko anticipate karne ka ek zaroori tool hai. Lekin, har kisi pattern ki tarah, ye bhi 100% perfect nahi hota. Traders ko hamesha apne risk tolerance ke mutabiq aur market conditionsandle bullish hota haihain. Yeh market mein bearish trend ko indicate karta hai aur possible reversal ko dikhata hai.ar pehla candle bullish hota hai aur doosra candle bearish hota hai, to ise bearish harami kehte hain. Yeh market mein bullish trend ko indicate karta hai aur possible reversal rami Pattern Ka Is pattern market mein hone wale trend reversal ko indicate karta hai. Agar ek strong trend ke baad harami pattern aata hai, to traders expect karte hain ke market direction chanmi pattern ko support aur resistance levels ke saath dekha jata hai. Agar ye levels ke qareeb banta hai, to iski tasdeeq hoti ding volume ka analysis bhi harami pattern ki tasdeeq ke liye important hai. Agar harami ke sath acha volume hota hai, to iska impact ami Pattetop Lar trade mein stop loss ka istemal karna bohot z ke hisab se trading karna chahiye. Harami pattern ko sahi tarah se samajh kar aur doosre technical indicators ke saath mila kar traders apne trading strategy ko aur bhi mazboot bana sakte hain.

تبصرہ

Расширенный режим Обычный режим