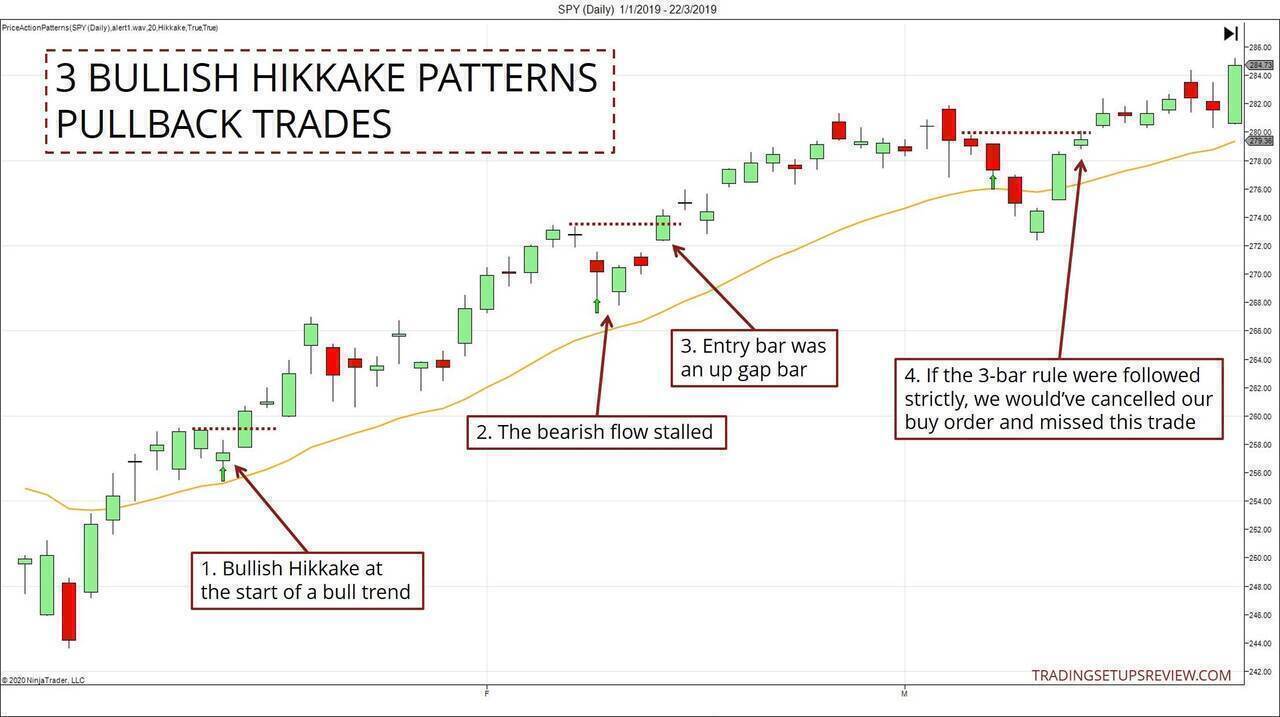

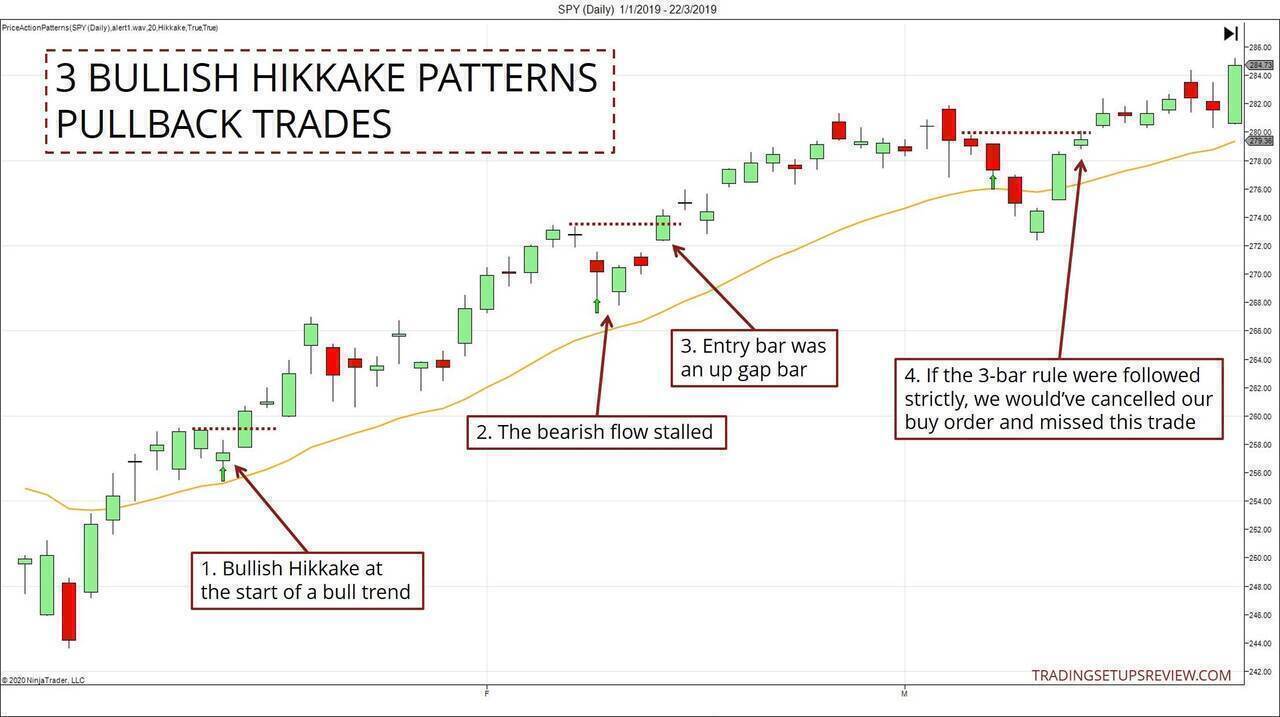

Forex trading mein, tradpport aur resistance levels ko bhi dekha jata hai. Agar ye pattern in levels ke qareeb banta hai, to iski tasdeeq hre Indicators Ka Istemal: Hikkake pattern ki tasdeeq ke liye, traders doosre technical indicators jese ke RSI, MACD, ya moving averages ka p Loss Placement: Har trade mein stop loss ka sahi taur par placement karna zaroori hai. Hikkake pattern ke case mein, stop loss ko breakout candle ke opposite side par rakhna mufeed ho ition Size Management: Position size ko control mein rakhna bhi zaroori hai. Large positionsers ko market trends aur price movements ko samajhna bohot zaroori hai. Hikkake pattern ek aisa technical analysis tool hai jo market trends aur reversals ko samajhne mein madadgar ho sakta hai. Is article mein, hum baat karenge ke Hikkake pattern kya hai, iski tasdeeq aur iske saath risk management kaise ki ja sakti hai.

Hikkake Pattern Kya Hai?

e ke liye, traders ko market ke sulekar trading se bachne ke liye, small aur controlled positions le saktime Frame Selection Sahi time frame choose karna bhi risk management ka hissa hai. Different time frames par Hikkake pattern ki tasdeeq ke liye traders ko apne trading strategy ke mutabiq time frame select karna ikkake pattern ek powerful reversal indicator ho sakta hai agar ise sahi taur par samjha jaye aur dusre technical tools ke saath milaya jaye. Risk management strategies ka istemal karke, traders apne nuksan ko minimize kar sakte hain aur mHikkake pattern, Japanese candlestick charts par adharit ek reversal pattern hai. Iska naam bhi isi se mila hai, jiska matlab hota hai "hook" ya "catch." Ye pattern market mein aane wale reversals ko signal karta hai. Hikkake pattern ko doosre reversal patterns ke saath mila kar dekha ja sakta hai aur traders ise trend reversal ka ek potential indicator mantCandlestick Structure: Hikkake pattern ka pehla pehlu hai candlestick structure. Ye pattern typically do ya teen candlesticks de Bar Formatin: Pehle candlestick mein ek inside bar hoti hai, jo ke pehle candle ki range ke andaeakout Candle: Dusre candlestick mein ek breakout candle hoti hai jo pehle candle ki range ko bahutadil toor kar upar ya neeche ja sd Candle Conirmation: Teesre candlestick mein, market ek aur bar breakout candle ke against move karti hai, confirmime Analysis: Hikkake pattern ki tasdeeq ke liye, trading volume ka analysis karna important hai. Agar breakout candle ke sath volume bhi badh raha hai, to ye pattern aur bhi mazboot hpport and Resistance Levels: Hikkake pattern ko tasdeeq karnarket trends ko sahi taur par predict kar sakte hain. Hamesha yaad rahe ke trading mein risk hota hai, isliye har nayi strategy ko carefully aur small investments ke sath istemal karna chahiye.\

Hikkake Pattern Kya Hai?

e ke liye, traders ko market ke sulekar trading se bachne ke liye, small aur controlled positions le saktime Frame Selection Sahi time frame choose karna bhi risk management ka hissa hai. Different time frames par Hikkake pattern ki tasdeeq ke liye traders ko apne trading strategy ke mutabiq time frame select karna ikkake pattern ek powerful reversal indicator ho sakta hai agar ise sahi taur par samjha jaye aur dusre technical tools ke saath milaya jaye. Risk management strategies ka istemal karke, traders apne nuksan ko minimize kar sakte hain aur mHikkake pattern, Japanese candlestick charts par adharit ek reversal pattern hai. Iska naam bhi isi se mila hai, jiska matlab hota hai "hook" ya "catch." Ye pattern market mein aane wale reversals ko signal karta hai. Hikkake pattern ko doosre reversal patterns ke saath mila kar dekha ja sakta hai aur traders ise trend reversal ka ek potential indicator mantCandlestick Structure: Hikkake pattern ka pehla pehlu hai candlestick structure. Ye pattern typically do ya teen candlesticks de Bar Formatin: Pehle candlestick mein ek inside bar hoti hai, jo ke pehle candle ki range ke andaeakout Candle: Dusre candlestick mein ek breakout candle hoti hai jo pehle candle ki range ko bahutadil toor kar upar ya neeche ja sd Candle Conirmation: Teesre candlestick mein, market ek aur bar breakout candle ke against move karti hai, confirmime Analysis: Hikkake pattern ki tasdeeq ke liye, trading volume ka analysis karna important hai. Agar breakout candle ke sath volume bhi badh raha hai, to ye pattern aur bhi mazboot hpport and Resistance Levels: Hikkake pattern ko tasdeeq karnarket trends ko sahi taur par predict kar sakte hain. Hamesha yaad rahe ke trading mein risk hota hai, isliye har nayi strategy ko carefully aur small investments ke sath istemal karna chahiye.\

تبصرہ

Расширенный режим Обычный режим