Elliot Wave Theory.

Elliot Wave Theory ek technical analysis tool hai jo forex traders ke liye kaafi useful hai. Is theory ke zariye traders market ki trends aur price movements ko predict kar sakte hain. Is article mein Elliot Wave Theory ke bare mein baat ki jayegi aur ye explain kiya jayega ke forex mein is ka kya importance hai.

Elliot Wave Theory ka naam us ke creator Ralph Nelson Elliot ke naam par rakha gaya hai. Ye theory un ke observations aur analysis par based hai jo unho ne 1930s mein kiye the. Elliot ne market ke trends aur price movements ko study kiya aur is ke patterns ko identify kiya.

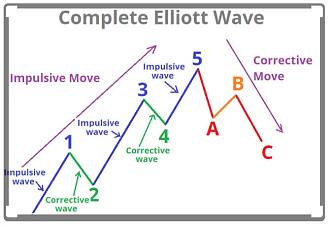

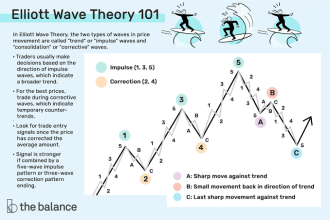

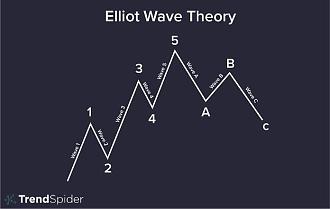

Elliot Wave Theory ka matlab hai ke market ki trends aur price movements ke patterns repetitive hote hain. Ye patterns ko Elliot ne wave patterns ke naam se identify kiya. Is theory ke zariye traders market ki trends aur price movements ko predict kar sakte hain.

Elliot Wave Theory Rules.

Elliot Wave Theory ke kuch basic rules hain jin ko traders ko follow karna chahiye. Ye rules hain:

1. Wave 2 cannot retrace more than 100% of Wave 1

2. Wave 3 cannot be the shortest wave

3. Wave 4 cannot overlap Wave 1

4. Wave 5 cannot be shorter than Wave 3

Elliot Wave Theory Benefits.

Elliot Wave Theory ke kuch benefits hain jin se traders ko faida hota hai. Ye benefits hain:

1. Predict market trends and price movements

2. Identify potential entry and exit points

3. Helps traders to manage risks

4. Can be used in combination with other technical analysis tools

Elliot Wave Theory forex traders ke liye kaafi useful hai. Is theory ke zariye traders market ki trends aur price movements ko predict kar sakte hain. Ye theory ke basic rules ko follow kar ke traders apne trades ko manage kar sakte hain aur risks ko kam kar sakte hain. Is theory ke saath other technical analysis tools ko bhi use kiya ja sakta hai.

Elliot Wave Theory ek technical analysis tool hai jo forex traders ke liye kaafi useful hai. Is theory ke zariye traders market ki trends aur price movements ko predict kar sakte hain. Is article mein Elliot Wave Theory ke bare mein baat ki jayegi aur ye explain kiya jayega ke forex mein is ka kya importance hai.

Elliot Wave Theory ka naam us ke creator Ralph Nelson Elliot ke naam par rakha gaya hai. Ye theory un ke observations aur analysis par based hai jo unho ne 1930s mein kiye the. Elliot ne market ke trends aur price movements ko study kiya aur is ke patterns ko identify kiya.

Elliot Wave Theory ka matlab hai ke market ki trends aur price movements ke patterns repetitive hote hain. Ye patterns ko Elliot ne wave patterns ke naam se identify kiya. Is theory ke zariye traders market ki trends aur price movements ko predict kar sakte hain.

Elliot Wave Theory Rules.

Elliot Wave Theory ke kuch basic rules hain jin ko traders ko follow karna chahiye. Ye rules hain:

1. Wave 2 cannot retrace more than 100% of Wave 1

2. Wave 3 cannot be the shortest wave

3. Wave 4 cannot overlap Wave 1

4. Wave 5 cannot be shorter than Wave 3

Elliot Wave Theory Benefits.

Elliot Wave Theory ke kuch benefits hain jin se traders ko faida hota hai. Ye benefits hain:

1. Predict market trends and price movements

2. Identify potential entry and exit points

3. Helps traders to manage risks

4. Can be used in combination with other technical analysis tools

Elliot Wave Theory forex traders ke liye kaafi useful hai. Is theory ke zariye traders market ki trends aur price movements ko predict kar sakte hain. Ye theory ke basic rules ko follow kar ke traders apne trades ko manage kar sakte hain aur risks ko kam kar sakte hain. Is theory ke saath other technical analysis tools ko bhi use kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим