Money Flow Index (MFI) ek technical analysis indicator hai jo market ki strength or weakness ko measure karta hai. Yeh indicator primarily volume or price data ka use karta hai, jisse traders ko market trend aur potential reversals ka pata chalta hai. MFI, Welles Wilder ne develop kiya tha, jo ke renowned technical analyst the.

MFI ka basic concept yeh hai ke jab market mein buying pressure zyada hoti hai, to MFI bhi zyada hota hai, indicating strong bullish trend. Aur jab selling pressure dominate karta hai, to MFI kam hota hai, pointing towards a potential bearish trend.

MFI ka formula simple hai, jisme aapko positive money flow aur negative money flow calculate karna hota hai. Positive money flow, uptick times mein buying pressure ko represent karta hai, jabki negative money flow, downtick times mein selling pressure ko indicate karta hai.

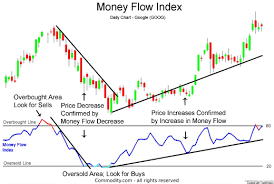

MFI values typically 80 ke upar overbought territory ko signal karte hain, jisse traders ko ye samajh aata hai ke market mein zyada buying activity ho rahi hai, aur ek reversal possible hai. 20 ke neeche ke MFI values, oversold conditions ko indicate karte hain, jisse traders ko ye idea milta hai ke market mein selling pressure hai, aur reversal ho sakta hai.

MFI ka istemal various trading strategies mein hota hai. Kuch traders MFI ko trend confirm karne ke liye istemal karte hain, jabki doosre MFI ko divergence detection ke liye use karte hain. Divergence ka matlab hota hai jab price aur MFI mein opposite movements hote hain, indicating a potential trend reversal.

MFI ke alawa bhi kuch parameters hote hain jinhe traders customize kar sakte hain, jaise ke period length. Longer period length se aapko smoother MFI milta hai, jabki shorter periods volatility ko better capture karte hain

Is indicator ki kuch limitations bhi hain, jaise ke choppy markets mein false signals ka risk hota hai. Isliye, wise hai ke MFI ko aur doosre indicators ke saath combine kiya jaye for more reliable signals.

Final words mein, Money Flow Index ek powerful tool hai jo traders ko market conditions samajhne mein madad karta hai. Lekin, jaise har indicator ka case hota hai, iska bhi cautious istemal karna important hai aur doosre factors ke saath combine karna wise decision hota hai.

MFI ka basic concept yeh hai ke jab market mein buying pressure zyada hoti hai, to MFI bhi zyada hota hai, indicating strong bullish trend. Aur jab selling pressure dominate karta hai, to MFI kam hota hai, pointing towards a potential bearish trend.

MFI ka formula simple hai, jisme aapko positive money flow aur negative money flow calculate karna hota hai. Positive money flow, uptick times mein buying pressure ko represent karta hai, jabki negative money flow, downtick times mein selling pressure ko indicate karta hai.

MFI values typically 80 ke upar overbought territory ko signal karte hain, jisse traders ko ye samajh aata hai ke market mein zyada buying activity ho rahi hai, aur ek reversal possible hai. 20 ke neeche ke MFI values, oversold conditions ko indicate karte hain, jisse traders ko ye idea milta hai ke market mein selling pressure hai, aur reversal ho sakta hai.

MFI ka istemal various trading strategies mein hota hai. Kuch traders MFI ko trend confirm karne ke liye istemal karte hain, jabki doosre MFI ko divergence detection ke liye use karte hain. Divergence ka matlab hota hai jab price aur MFI mein opposite movements hote hain, indicating a potential trend reversal.

MFI ke alawa bhi kuch parameters hote hain jinhe traders customize kar sakte hain, jaise ke period length. Longer period length se aapko smoother MFI milta hai, jabki shorter periods volatility ko better capture karte hain

Is indicator ki kuch limitations bhi hain, jaise ke choppy markets mein false signals ka risk hota hai. Isliye, wise hai ke MFI ko aur doosre indicators ke saath combine kiya jaye for more reliable signals.

Final words mein, Money Flow Index ek powerful tool hai jo traders ko market conditions samajhne mein madad karta hai. Lekin, jaise har indicator ka case hota hai, iska bhi cautious istemal karna important hai aur doosre factors ke saath combine karna wise decision hota hai.

تبصرہ

Расширенный режим Обычный режим