Bearish Harami ek technical analysis mein istemal hone wala double candle pattern hai. Bearish harami aam taur par ek bullish rally ke ant mein banta hai aur neeche ki taraf murne ki mumkin nishaani deta hai. Ye pattern tab banta hai jab khareedne wale thak chuke hote hain aur bechne wale jald hi khareedne walo ko peechay chhodne wale hote hain.

Traders aksar is pattern ke banne ke baad apne long positions ko book karna ya naye short positions banane ka faisla karna pasand karte hain. Bearish harami pattern khud mein kaafi asar andaz nahi hota. Isliye traders iske further confirmation ke liye RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) jaise aur technical tools ka istemal karte hain.

Bearish Harami Ki example:

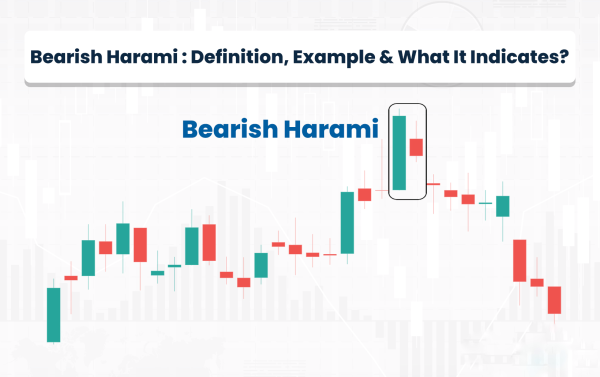

Bearish harami candlestick pattern aam taur par price chart ke top par banta hai. Niche ek aisa misal hai bearish harami candlestick pattern ki:

Upar di gayi tasveer mein aap dekh sakte hain ke ek bullish rally ke baad chart ke top par bearish harami candlestick pattern ban raha hai. Bearish harami pattern banne ke baad price mein significant giravat dikhai de rahi hai. Bearish harami candlestick pattern ke banne ke baad price mein saaf bearish trend dikhai de rahi hai.

Bearish Harami Aur Bullish Harami Ke Darmiyan Farq:

Bearish Harami Kya Dikhata Hai:

Bearish harami candlestick pattern ek mumkin trend shift ko darust karta hai, jo bullish se bearish market ki taraf hota hai. Bearish harami pattern ye bhi dikhata hai ke buyers ka momentum ghat raha hai aur sellers ko muka mil sakta hai.

Isme do candles hote hain. Pehli candle lambi green candle hoti hai jise ek choti red candle follow karta hai. Ye double candle structure tab banta hai jab market thak chuki hoti hai aur jald hi neeche murne wali hai.

Traders bearish harami pattern banne ke baad apne long positions ko book karna ya market mein naye short positions lena pasand karte hain. Lekin dhyan rakhein ke ye pattern khud mein kaafi effective nahi hota aur kabhi-kabhi galat trading signals bhi de sakta hai.

Traders is candlestick pattern ki effectiveness ko barhane ke liye RSI (Relative Strength Index) aur MACD jaise additional technical tools ka istemal karte hain.

Bearish Harami Pattern Ki Kuch Key Characteristics:

Traders aksar is pattern ke banne ke baad apne long positions ko book karna ya naye short positions banane ka faisla karna pasand karte hain. Bearish harami pattern khud mein kaafi asar andaz nahi hota. Isliye traders iske further confirmation ke liye RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) jaise aur technical tools ka istemal karte hain.

Bearish Harami Ki example:

Bearish harami candlestick pattern aam taur par price chart ke top par banta hai. Niche ek aisa misal hai bearish harami candlestick pattern ki:

Upar di gayi tasveer mein aap dekh sakte hain ke ek bullish rally ke baad chart ke top par bearish harami candlestick pattern ban raha hai. Bearish harami pattern banne ke baad price mein significant giravat dikhai de rahi hai. Bearish harami candlestick pattern ke banne ke baad price mein saaf bearish trend dikhai de rahi hai.

Bearish Harami Aur Bullish Harami Ke Darmiyan Farq:

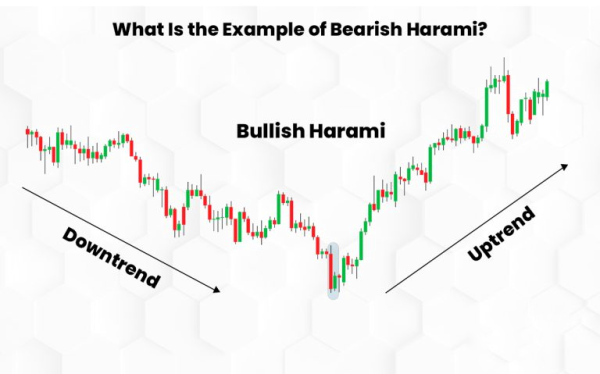

- Bullish harami pattern chart ke neeche banta hai jabki bearish harami pattern chart ke top par banta hai.

- Bullish harami pattern ek potential trend reversal ko darust karta hai jo bearish se bullish market ki taraf hota hai, jabki bearish harami pattern bullish se bearish market ki taraf ishara karta hai.

Bearish Harami Kya Dikhata Hai:

Bearish harami candlestick pattern ek mumkin trend shift ko darust karta hai, jo bullish se bearish market ki taraf hota hai. Bearish harami pattern ye bhi dikhata hai ke buyers ka momentum ghat raha hai aur sellers ko muka mil sakta hai.

Isme do candles hote hain. Pehli candle lambi green candle hoti hai jise ek choti red candle follow karta hai. Ye double candle structure tab banta hai jab market thak chuki hoti hai aur jald hi neeche murne wali hai.

Traders bearish harami pattern banne ke baad apne long positions ko book karna ya market mein naye short positions lena pasand karte hain. Lekin dhyan rakhein ke ye pattern khud mein kaafi effective nahi hota aur kabhi-kabhi galat trading signals bhi de sakta hai.

Traders is candlestick pattern ki effectiveness ko barhane ke liye RSI (Relative Strength Index) aur MACD jaise additional technical tools ka istemal karte hain.

Bearish Harami Pattern Ki Kuch Key Characteristics:

- Bearish harami candlestick pattern do candles se banta hai. Pehli candle lambi green candle hoti hai jise ek choti red candle follow karta hai.

- Bearish harami pattern chart ke top par banta hai. Ye tab banta hai jab buyers thak chuke hote hain aur sellers unhe peechay chhod rahe hote hain. Aam taur par ye pattern ek bullish rally ke ant mein banne ki tendency rakhta hai.

- Strong green candle ke baad aane wali short red candle dikhata hai ke buyers apne influence ko market par kho rahe hain aur market is point se neeche ja sakta hai.

- Traders is pattern ko stock mein potential trend reversal ki alamat samajhte hain.

- Traders is candlestick pattern ko bullish positions book karne ya market mein naye short positions lene ka indication samajhte hain.

تبصرہ

Расширенный режим Обычный режим