-:HIGH VOLATILITY BREAKOUT:-

"High volatility breakout" ek trading strategy ko refer karta hai jo is par mabni hota hai ke jab kisi cheez ka qeemat ek maqami had se bahir nikal kar ziada shorat ke sath badh jati hai, to phir aap usmein trade karte hain. Traders aksar is baat par tawajju dete hain ke keemat mein ziada izafay ke sath sath buland trading volumes bhi hon, kyun ke ye dikhata hai ke market mein tawajju aur momentum hai.

-:HIGH VOLATILITY BREAKOUT K KEY POINTS:-

"High volatility breakout" ek trading strategy ko refer karta hai jo is par mabni hota hai ke jab kisi cheez ka qeemat ek maqami had se bahir nikal kar ziada shorat ke sath badh jati hai, to phir aap usmein trade karte hain. Traders aksar is baat par tawajju dete hain ke keemat mein ziada izafay ke sath sath buland trading volumes bhi hon, kyun ke ye dikhata hai ke market mein tawajju aur momentum hai.

-:HIGH VOLATILITY BREAKOUT K KEY POINTS:-

- Trading Range Pehchanain:

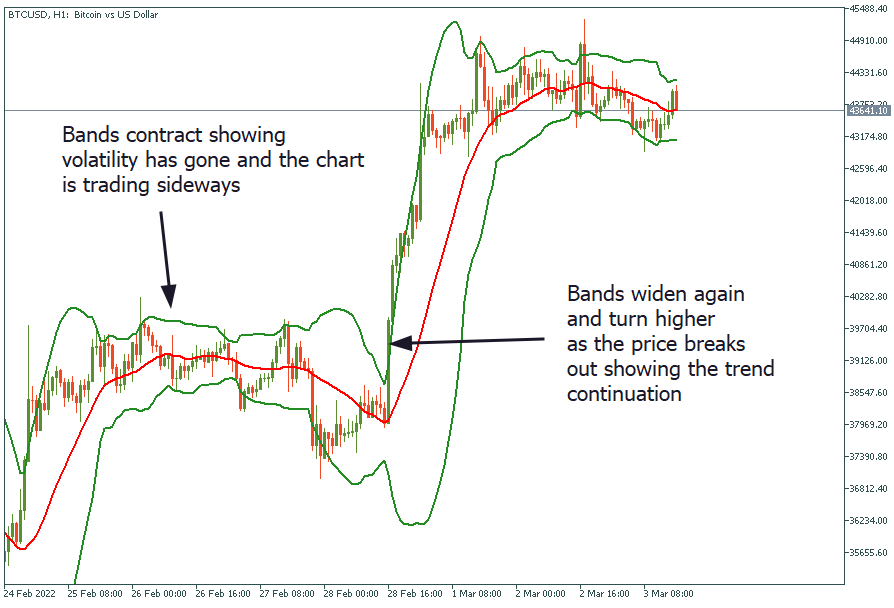

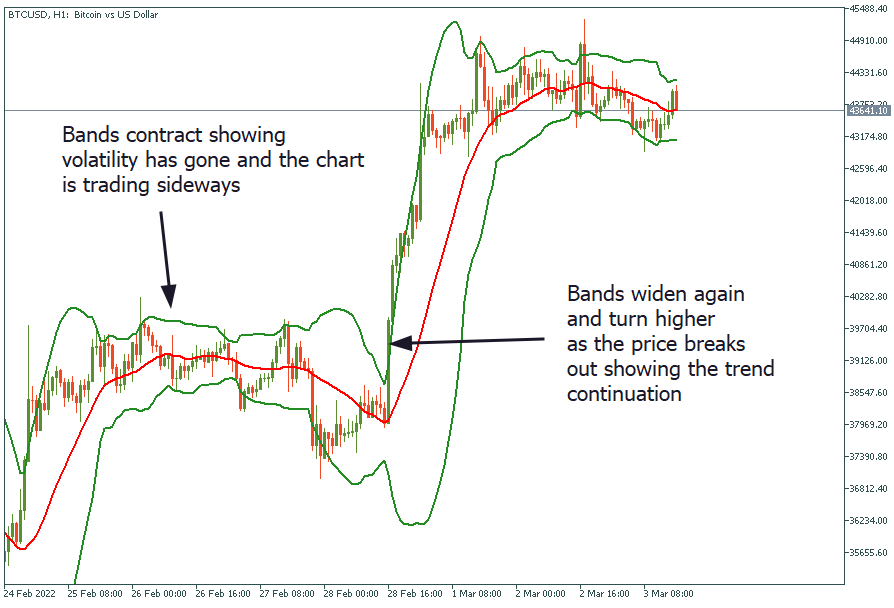

Aik dor ko pehchanain jahan kisi cheez ki keemat ek maqami had ke andar ghoom rahi ho. Isay support aur resistance levels ya technical indicators jese ke Bollinger Bands ke zariye pehchanaya ja sakta hai. - Volatility Tasdeeq:

Is se pehle ke aap breakout ko daryaft karen, market mein is waqt ziada volatility hone ko tasdeeq karen. Aisa karne ke liye Average True Range (ATR) ya Bollinger Bands jese volatility indicators istemal kiye ja sakte hain. - Breakout ka Intezar Karein:

Jab aapne range pehchani aur volatility ki tasdeeq kar li, to phir ek saaf breakout ka intezar karen. Is waqt keemat range ke andar se bahir ja rahi hoti hai. - Volume ki Tasdeeq:

Breakout ko barah-e-karam taqatwar trading volume ke sath tasdeeq karen. Breakout ke doran buland volume ka hona dikhata hai ke market mein taqatwar hissa le raha hai, aur ye bharpoor harkat hone ke imkanat ko barhata hai. - Risk Management:

Stop-loss set karen aur apne trading plan ke mutabiq risk ko manage karen. - Trading Range Pehchanain:

Ek dor ko pehchanen jahan asset ki keemat maqami had ke andar ghoom rahi ho. Isko support aur resistance levels ya technical indicators jese ke Bollinger Bands ke zariye daryaft kia ja sakta hai. - Volatility Tasdeeq:

Volatility ke indicators jese ke Average True Range (ATR) ya Bollinger Bands istemal karen takay tasdeeq ho ke market is waqt maqami se ziada ghairat mehsoos kar raha hai. - Breakout ka Intezar Karein:

Jab aap range daryaft kar lete hain aur volatility tasdeeq kar lete hain, to phir saaf breakout ka intezar karen. Breakout waqt keemat maqami had se bahir move karti hai. - Volume ki Tasdeeq:

Breakout ko confirm karen barah-e-karam trading volume ke sath. Buland volume ka hona dikhata hai ke market mein taqatwar interest hai, jo ke ek mustaqil harkat hone ke imkanat ko barha deta hai. - Risk Management:

Apne trading plan ke mutabiq stop-loss set karen. Ye aapko nuksan se bachane mein madad karega aur aapki trading ko behtar taur par manage karega.

تبصرہ

Расширенный режим Обычный режим