Explanation.

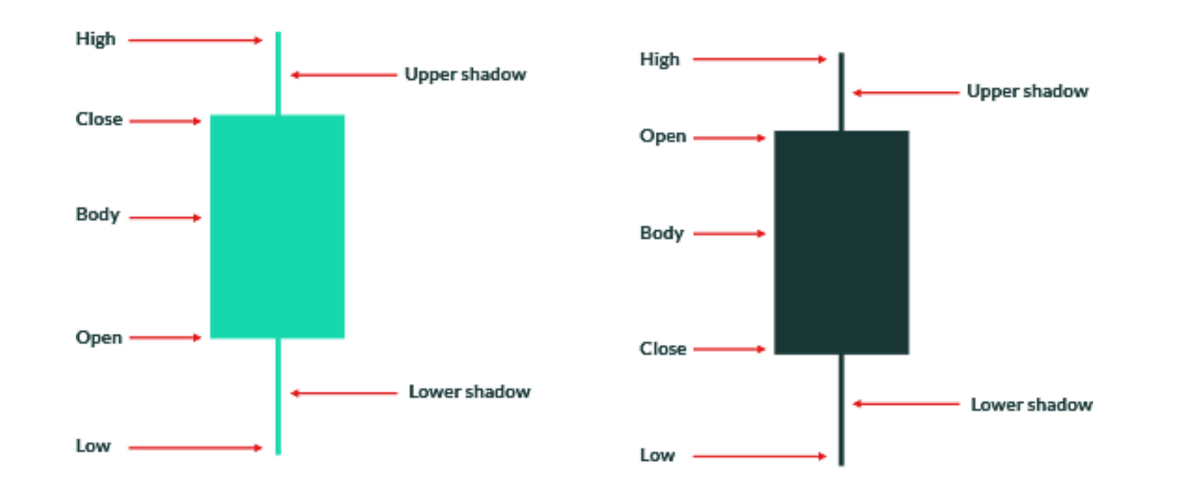

Forex trading mein lower shadows ka matlab hota hai kisi candlestick chart mein woh hissa jis mein candle ki bottom wali line se neechay wali shadow dikhayi deti hai.

Ye shadow candle ki bottom wali line se neechay jaati hai aur iska matlab hota hai ki market mein selling pressure hai aur price down ja raha hai.

Lower Shadows.

Lower shadows, candlestick charts ke liye bohat important hote hain kyunki ye market ki movement aur trend ko indicate karte hain. Agar lower shadows zyada hain to iska matlab hai ki market mein selling pressure zyada hai aur price down jaane ki possibility hai. Jabke agar lower shadows kam hain to iska matlab hai ki market mein buying pressure zyada hai aur price up hone ki possibility hai.

Lower Shadows Uses.

Forex traders lower shadows ka istemaal kar ke trading strategies develop karte hain. Agar lower shadows zyada hain to traders selling ki position mein enter ho sakte hain aur profit earn kar sakte hain.

Jabke agar lower shadows kam hain to traders buying ki position mein enter ho sakte hain aur profit earn kar sakte hain.

Upper Shadows.

Upper shadows ka istemaal Forex trading mein bohat important hai kyunki is se market ki movement aur trend ko predict kiya jaa sakta hai. Traders lower shadows ki help se apni positions ko plan kar sakte hain aur profit earn kar sakte hain.

Upper shadows k sath or bhi different strategies and technical help say trading useful sabit hoti hay is liye indicators ka use mamool k mutabiq kertay rehna chahiye or market k trend ko find ker lenay k baad hi koi bhi trade open kerni chahiye is terha loss ki ratio kamm hoti hay.

Forex trading mein lower shadows ka matlab hota hai kisi candlestick chart mein woh hissa jis mein candle ki bottom wali line se neechay wali shadow dikhayi deti hai.

Ye shadow candle ki bottom wali line se neechay jaati hai aur iska matlab hota hai ki market mein selling pressure hai aur price down ja raha hai.

Lower Shadows.

Lower shadows, candlestick charts ke liye bohat important hote hain kyunki ye market ki movement aur trend ko indicate karte hain. Agar lower shadows zyada hain to iska matlab hai ki market mein selling pressure zyada hai aur price down jaane ki possibility hai. Jabke agar lower shadows kam hain to iska matlab hai ki market mein buying pressure zyada hai aur price up hone ki possibility hai.

Lower Shadows Uses.

Forex traders lower shadows ka istemaal kar ke trading strategies develop karte hain. Agar lower shadows zyada hain to traders selling ki position mein enter ho sakte hain aur profit earn kar sakte hain.

Jabke agar lower shadows kam hain to traders buying ki position mein enter ho sakte hain aur profit earn kar sakte hain.

Upper Shadows.

Upper shadows ka istemaal Forex trading mein bohat important hai kyunki is se market ki movement aur trend ko predict kiya jaa sakta hai. Traders lower shadows ki help se apni positions ko plan kar sakte hain aur profit earn kar sakte hain.

Upper shadows k sath or bhi different strategies and technical help say trading useful sabit hoti hay is liye indicators ka use mamool k mutabiq kertay rehna chahiye or market k trend ko find ker lenay k baad hi koi bhi trade open kerni chahiye is terha loss ki ratio kamm hoti hay.

:max_bytes(150000):strip_icc()/bullishhammer-229555e84b7743d4b43f1e6da88c1dd1.jpg)

تبصرہ

Расширенный режим Обычный режим