CCI Index in Forex Trading:

1. Purpose

cci record ka maqsad tanzeemon ko zaroorat se ziyada kharidi hui ya ziyada farokht shuda sharait ko tasleem karne mein madad karna hai aur mumkina intehai ahem mawaqay ki nigrani karna hai. yeh aik patteren ki yakjahti ka taayun karne aur ulat jane ke ibtidayi intibahi alamaat faraham karne ki tawaqqa karta hai .

2. Calculation:

si si aayi ki report ki tashkhees do ya teen marahil ko yakja karti hai : a. mayaari maliyat ka andaza lagayen, jo ke aik muqarara muddat ke liye qabil zikar, kam aur qareebi qeematon mein mushtarik hai. bay aik taqabli muddat ke douran mamool ke akhrajaat ki zaroori harkat aam ( sma ) par kaam karen. c ost inhiraf talaash karen, jo mutawaqqa waqt ke frame par sma aur aam akhrajaat ke darmiyan ost majmoi farq hai. d tarkeeb ko istemaal karte hue, cci ki fehrist tayyar karen : cci = ( ost laagat - sma ) / ( mustahkam * ost inhiraf )

3. Interpretation

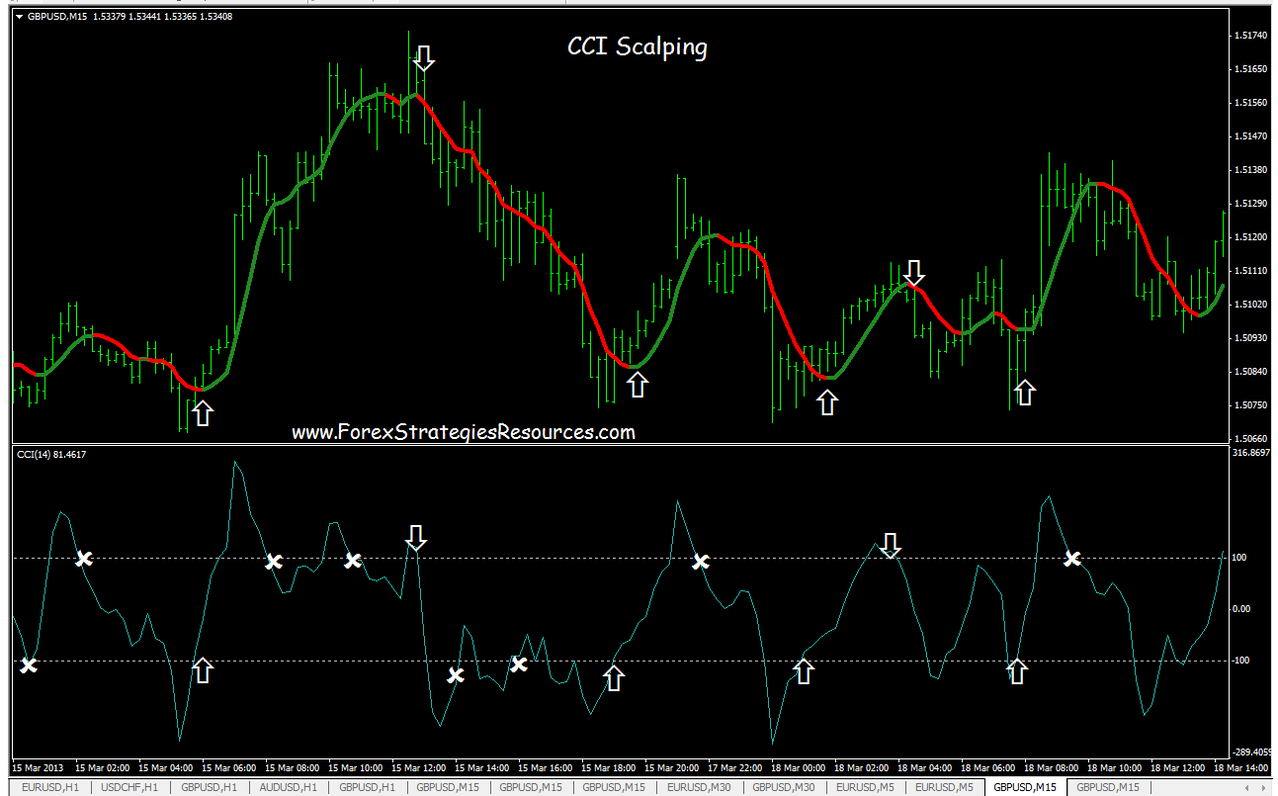

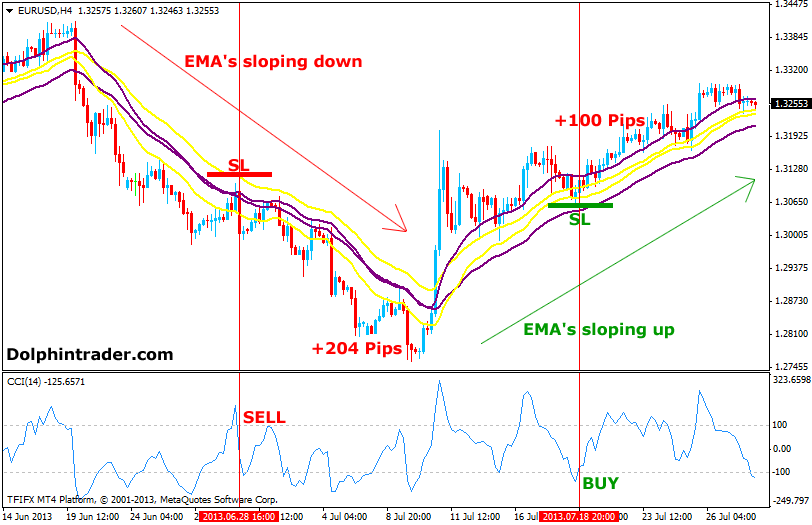

cci file zero linon ke oopar aur neechay دوہراتی hai. baichnay walay aam tor par is ke sath jane ki tashreeh karte hain : a. zaroorat se ziyada kharidari ki sharait : is waqt jab cci ki fehrist + 100 se oopar jati hai, is ka matlab yeh hai ke wasail ziyada khareeday gaye hain, jis ka matlab yeh ho sakta hai ke qeemat kam ho jaye gi ya kam ho jaye gi. dilron ko baichnay ya fawaid lainay ki jaanch karni chahiye. bay over sealed ki sharait : asasa is waqt ziyada farokht hota hai jab cci dastaweez - 100 se neechay ajati hai, jo ke mumkina qabil qader wapsi ko taizi se dekhata hai ya amoodi tor par ulat jata hai. dealers ko sochna chahiye ke aaya khareedna hai ya lambi position lena hai. c mukhalfat : infiradiat is waqt hoti hai jab wasail ki laagat aik wahid surkhi mein muntaqil hoti hai jabkay cci fehrist mutabadil tareeqay se muntaqil hoti hai. yeh rujhan mein tabdeeli ki nishandahi kar sakta hai. d design ki mazbooti : cci record isi terhan model ki taaqat ko zahir kar sakta hai. misbet aur manfi khususiyaat aisi misaal ki tajweez karti hain jo ziyada bunyaad par ho, halaank kam eqdaar aisi misaal dukhati hain jo ziyada be difaa hai .

4. Timeframe and Parameters:

cci report ke liye time frame aur hudood ko infiradi tabadlay ki takni aur rujhanaat ke baray mein sochte hue dobarah banaya ja sakta hai. is ke bawajood, chunkay difalt time period musalsal 20 par set kya jata hai, is liye cci ko 20 se ziyada time period ka istemaal karte hue hal kya jata hai .

5. Limitations

yeh yaad rakhnay ke liye bunyadi baat hai kECC aayi ka record, kisi aur khaas markr ki terhan, baghair kisi qisam ke nahi hai aur usay deegar shrton ke sath istemaal kya jana chahiye jo cheifs ki hikmat amlyon aur imtihani gijts ke sath munsalik ho. gumraah kin nishanain ho sakti hain, aur tabadlay ke intikhab ki pairwi karte hue aam maliyati halaat, models aur markazi tashkhees par ghhor karna zaroori hai .

si si aayi list forex trading mein aik mashhoor maahir nishaan hai jo brokrz ko patteren ki mazbooti, ziyada kharidi hui aur ziyada farokht honay wali sharait, aur mutawaqqa ulat ka taayun karne mein madad karti hai. kisi bhi soorat mein, surkhi ko qaail karne ke liye usay mukhtalif gijts aur tshkhisi تکنیکوں ke sath mila kar istemaal kya jana chahiye .

1. Purpose

cci record ka maqsad tanzeemon ko zaroorat se ziyada kharidi hui ya ziyada farokht shuda sharait ko tasleem karne mein madad karna hai aur mumkina intehai ahem mawaqay ki nigrani karna hai. yeh aik patteren ki yakjahti ka taayun karne aur ulat jane ke ibtidayi intibahi alamaat faraham karne ki tawaqqa karta hai .

2. Calculation:

si si aayi ki report ki tashkhees do ya teen marahil ko yakja karti hai : a. mayaari maliyat ka andaza lagayen, jo ke aik muqarara muddat ke liye qabil zikar, kam aur qareebi qeematon mein mushtarik hai. bay aik taqabli muddat ke douran mamool ke akhrajaat ki zaroori harkat aam ( sma ) par kaam karen. c ost inhiraf talaash karen, jo mutawaqqa waqt ke frame par sma aur aam akhrajaat ke darmiyan ost majmoi farq hai. d tarkeeb ko istemaal karte hue, cci ki fehrist tayyar karen : cci = ( ost laagat - sma ) / ( mustahkam * ost inhiraf )

3. Interpretation

cci file zero linon ke oopar aur neechay دوہراتی hai. baichnay walay aam tor par is ke sath jane ki tashreeh karte hain : a. zaroorat se ziyada kharidari ki sharait : is waqt jab cci ki fehrist + 100 se oopar jati hai, is ka matlab yeh hai ke wasail ziyada khareeday gaye hain, jis ka matlab yeh ho sakta hai ke qeemat kam ho jaye gi ya kam ho jaye gi. dilron ko baichnay ya fawaid lainay ki jaanch karni chahiye. bay over sealed ki sharait : asasa is waqt ziyada farokht hota hai jab cci dastaweez - 100 se neechay ajati hai, jo ke mumkina qabil qader wapsi ko taizi se dekhata hai ya amoodi tor par ulat jata hai. dealers ko sochna chahiye ke aaya khareedna hai ya lambi position lena hai. c mukhalfat : infiradiat is waqt hoti hai jab wasail ki laagat aik wahid surkhi mein muntaqil hoti hai jabkay cci fehrist mutabadil tareeqay se muntaqil hoti hai. yeh rujhan mein tabdeeli ki nishandahi kar sakta hai. d design ki mazbooti : cci record isi terhan model ki taaqat ko zahir kar sakta hai. misbet aur manfi khususiyaat aisi misaal ki tajweez karti hain jo ziyada bunyaad par ho, halaank kam eqdaar aisi misaal dukhati hain jo ziyada be difaa hai .

4. Timeframe and Parameters:

cci report ke liye time frame aur hudood ko infiradi tabadlay ki takni aur rujhanaat ke baray mein sochte hue dobarah banaya ja sakta hai. is ke bawajood, chunkay difalt time period musalsal 20 par set kya jata hai, is liye cci ko 20 se ziyada time period ka istemaal karte hue hal kya jata hai .

5. Limitations

yeh yaad rakhnay ke liye bunyadi baat hai kECC aayi ka record, kisi aur khaas markr ki terhan, baghair kisi qisam ke nahi hai aur usay deegar shrton ke sath istemaal kya jana chahiye jo cheifs ki hikmat amlyon aur imtihani gijts ke sath munsalik ho. gumraah kin nishanain ho sakti hain, aur tabadlay ke intikhab ki pairwi karte hue aam maliyati halaat, models aur markazi tashkhees par ghhor karna zaroori hai .

si si aayi list forex trading mein aik mashhoor maahir nishaan hai jo brokrz ko patteren ki mazbooti, ziyada kharidi hui aur ziyada farokht honay wali sharait, aur mutawaqqa ulat ka taayun karne mein madad karti hai. kisi bhi soorat mein, surkhi ko qaail karne ke liye usay mukhtalif gijts aur tshkhisi تکنیکوں ke sath mila kar istemaal kya jana chahiye .

تبصرہ

Расширенный режим Обычный режим