Pennant Chart Pattern, ya tawajju ki pehchaan ka aik ahem zariya hai jise technical analysis mein istemal hota hai. Yeh ek price action pattern hai jo market mein hone wale mukhtalif trends ko samajhne mein madad karta hai. Pennant pattern ek trading chart par aik chhoti si flag ya pennant ki shakal mein dikhai deta hai, jiska matlab hota hai ke market mein ek mukhtalif movement hone wala hai.

Is chart pattern ki pehchan karne ke liye, traders ko market ke movement ko closely observe karna parta hai. Pennant usually market mein hone wale aik strong uptrend ya downtrend ke baad aata hai. Jab market mein aik tawajju paida karnay wala movement hota hai, to price mein aik consolidation phase shuru ho jata hai, jise hum pennant kehte hain.

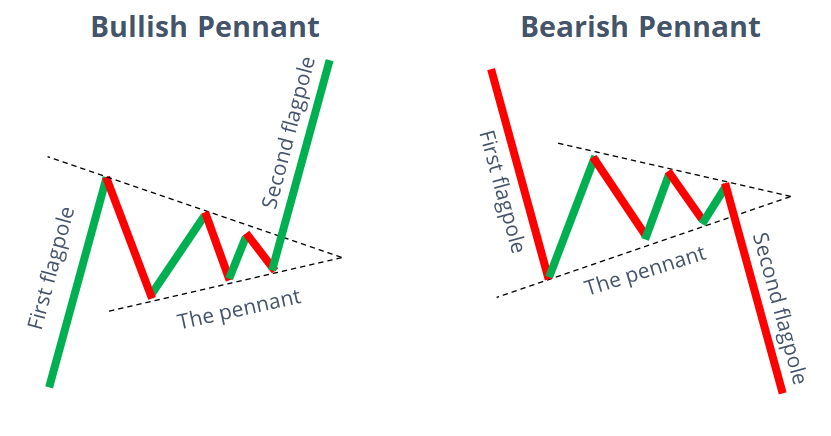

Pennant pattern kaafi similar hota hai symmetrical triangle pattern ke saath, lekin iska ek khaas tareeqa hota hai. Pennant mein price ke do trend lines hoti hain, ek neeche aur doosri oopar, jo ke ek flag ya pennant ki shakal banati hain. Yeh lines usually converging hoti hain, iska matlab hai ke price range kam hota jata hai aur market ek tight range mein consolidate hota hai.

Is chart pattern ka sabse ahem hissa hota hai breakout. Jab price range mein hone wala consolidation pura ho jata hai, aur market ready hota hai for a new move, to ek breakout hota hai. Breakout ka matlab hota hai ke price ek specific range ko cross karta hai aur naya trend shuru hota hai.

Agar pennant pattern uptrend ke baad aata hai, to traders ko expect karna chahiye ke breakout ke baad bhi uptrend hi continue hoga. Wahi agar downtrend ke baad pennant aata hai, to breakout ke baad bhi market mein downtrend hi jari rahega.

Traders ko pennant pattern ke signals par amal karne ke liye tawajju aur savdhanai se kaam karna chahiye. Is pattern ka istemal kar ke, woh market ke potential future movements ko predict kar sakte hain. Lekin yaad rahe ke kisi bhi technical analysis tool ya pattern ka 100% guarantee nahi hota aur market mein hamesha khatra rehta hai

Pennant chart pattern ek powerful technical analysis tool hai jo traders ko market ke future movements ke bare mein malumat faraham karta hai. Iska istemal kar ke, traders apne trading strategies ko aur behtar bana sakte hain aur market ke mukhtalif trends ko samajhne mein asani hasil kar sakte hain.

Is chart pattern ki pehchan karne ke liye, traders ko market ke movement ko closely observe karna parta hai. Pennant usually market mein hone wale aik strong uptrend ya downtrend ke baad aata hai. Jab market mein aik tawajju paida karnay wala movement hota hai, to price mein aik consolidation phase shuru ho jata hai, jise hum pennant kehte hain.

Pennant pattern kaafi similar hota hai symmetrical triangle pattern ke saath, lekin iska ek khaas tareeqa hota hai. Pennant mein price ke do trend lines hoti hain, ek neeche aur doosri oopar, jo ke ek flag ya pennant ki shakal banati hain. Yeh lines usually converging hoti hain, iska matlab hai ke price range kam hota jata hai aur market ek tight range mein consolidate hota hai.

Is chart pattern ka sabse ahem hissa hota hai breakout. Jab price range mein hone wala consolidation pura ho jata hai, aur market ready hota hai for a new move, to ek breakout hota hai. Breakout ka matlab hota hai ke price ek specific range ko cross karta hai aur naya trend shuru hota hai.

Agar pennant pattern uptrend ke baad aata hai, to traders ko expect karna chahiye ke breakout ke baad bhi uptrend hi continue hoga. Wahi agar downtrend ke baad pennant aata hai, to breakout ke baad bhi market mein downtrend hi jari rahega.

Traders ko pennant pattern ke signals par amal karne ke liye tawajju aur savdhanai se kaam karna chahiye. Is pattern ka istemal kar ke, woh market ke potential future movements ko predict kar sakte hain. Lekin yaad rahe ke kisi bhi technical analysis tool ya pattern ka 100% guarantee nahi hota aur market mein hamesha khatra rehta hai

Pennant chart pattern ek powerful technical analysis tool hai jo traders ko market ke future movements ke bare mein malumat faraham karta hai. Iska istemal kar ke, traders apne trading strategies ko aur behtar bana sakte hain aur market ke mukhtalif trends ko samajhne mein asani hasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим