Scalping as a Primary Trading Style kai hai

Scalping ek trading strategy hai jisme traders chhote time frames par market movements ka faida uthate hain. Scalpers apne trades ko kuch seconds se lekar kuch minutes tak open rakhte hain, aur unka goal hota hai chhote price movements se chhota sa profit nikalna. Yeh ek bahut hi active aur short-term trading approach hai. Yahan kuch key points hain jo scalping ke as a primary trading style hone par mahatvapurna hain:

Scalping ek trading strategy hai jisme traders chhote time frames par market movements ka faida uthate hain. Scalpers apne trades ko kuch seconds se lekar kuch minutes tak open rakhte hain, aur unka goal hota hai chhote price movements se chhota sa profit nikalna. Yeh ek bahut hi active aur short-term trading approach hai. Yahan kuch key points hain jo scalping ke as a primary trading style hone par mahatvapurna hain:

- Chhote Time Frames:

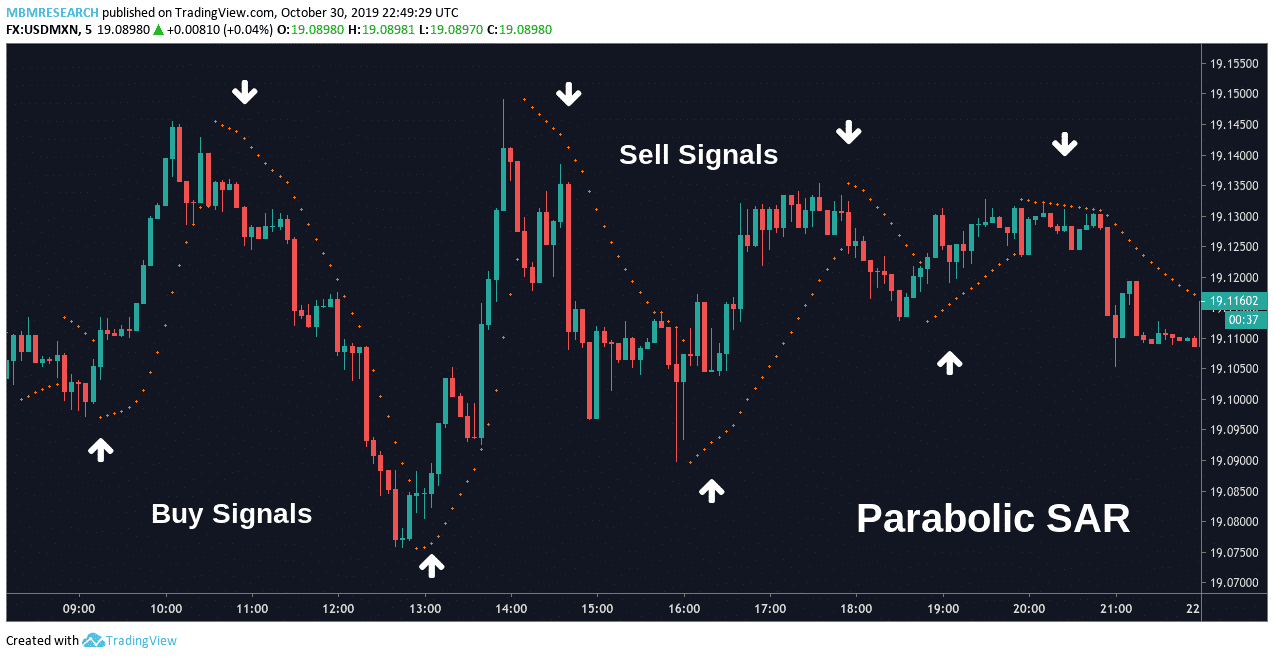

- Scalping ke liye traders chhote time frames, jaise ke 1-minute aur 5-minute charts, ka istemal karte hain. Isme price movements ko closely monitor kiya jata hai.

- High Frequency Trading:

- Scalping mein trades ko kuch seconds ya minutes tak open rakha jata hai, isliye yeh high-frequency trading ka ek form hai. Scalpers multiple trades ek din mein execute karte hain.

- Small Profit Margins:

- Scalping mein har trade se kam profit margin hota hai, lekin kyunki scalpers multiple trades karte hain, toh in small profits se overall gain ho sakta hai.

- Tight Stop Loss:

- Scalping mein tight stop-loss orders ka istemal hota hai taaki losses ko minimize kiya ja sake. Scalpers market volatility aur quick price changes ko anticipate karke apne trades ko manage karte hain.

- Instant Decision Making:

- Scalping mein traders ko instant decision-making ki zarurat hoti hai. Price movements ke chhote intervals mein, traders ko jaldi aur sahi faislay lene ke liye tayyar rehna padta hai.

- Focus on Technical Analysis:

- Technical analysis scalping mein bahut mahatvapurna hoti hai. Traders technical indicators aur price patterns ka istemal karke entry aur exit points decide karte hain.

- Low Risk per Trade:

- Scalping mein har trade par kam risk hota hai, lekin kyunki trades bahut frequent hote hain, toh overall risk bhi badh jata hai. Scalpers apne risk management ko carefully monitor karte hain.

- Fast Execution Platforms:

- Scalping ke liye fast execution platforms aur advanced trading tools ka hona zaroori hai. Scalpers kaam karne ke liye high-speed internet connection aur reliable trading platform ka istemal karte hain.

- Emotional Control:

- Scalping mein traders ko apne emotions ko control mein rakhna zaroori hai. Rapid price movements aur frequent trades ke bawajood, discipline aur control maintain karna critical hai.

- Market Understanding:

- Scalping mein market ka acche se understanding hona chahiye. Scalpers ko market structure, liquidity conditions, aur key support/resistance levels ka acche se pata hona zaroori hai.

Scalping bahut active aur challenging trading style hai, aur isme jyada monitoring aur time dedication ki zarurat hoti hai. Ye strategy experienced traders ke liye suitable hoti hai, jo market ke dynamics ko samajhne mein mahir hain.

تبصرہ

Расширенный режим Обычный режим