Forex (foreign exchange) mein technical analysis

Forex (foreign exchange) mein technical analysis ka istemal price charts aur trading volumes ki tafseelat ka jayezah lene mein hota hai taake future price movements ka andaza lagaya ja sake. Traders jo technical analysis ka istemal karte hain, unko yeh khyal hai ke peechli market movements aur price patterns future price trends ke liye insights provide kar sakte hain. Forex ki technical analysis ke asool aur tools mein shamil hain.

Forex (foreign exchange) mein technical analysis K Asool:-

Forex (foreign exchange) mein technical analysis ka istemal price charts aur trading volumes ki tafseelat ka jayezah lene mein hota hai taake future price movements ka andaza lagaya ja sake. Traders jo technical analysis ka istemal karte hain, unko yeh khyal hai ke peechli market movements aur price patterns future price trends ke liye insights provide kar sakte hain. Forex ki technical analysis ke asool aur tools mein shamil hain.

Forex (foreign exchange) mein technical analysis K Asool:-

- Charts: Technical analysts alag alag qisam ke charts ka istemal karte hain, jese ke line charts, bar charts, aur candlestick charts, taake price movements ko waqt ke saath visualize kiya ja sake.

- Trends: Trends ka concept technical analysis mein bohot ahem hai. Traders identify karte hain ke market ka trend upward (bullish), downward (bearish), ya sideways (neutral) hai. Amooman iska maqsad prevailing trend ke direction mein trade karna hota hai.

- Support aur Resistance: Support aur resistance levels horizontal price levels hote hain jahan currency pair historically move karna mushkil samjha jata hai. Yeh levels entry aur exit points ke liye identify karne mein istemal hote hain.

- Indicators aur Oscillators: Technical analysts alag alag indicators aur oscillators ka istemal karte hain, jese ke Moving Averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), aur Stochastic Oscillator, taake market ke health aur momentum ko samajh sakein.

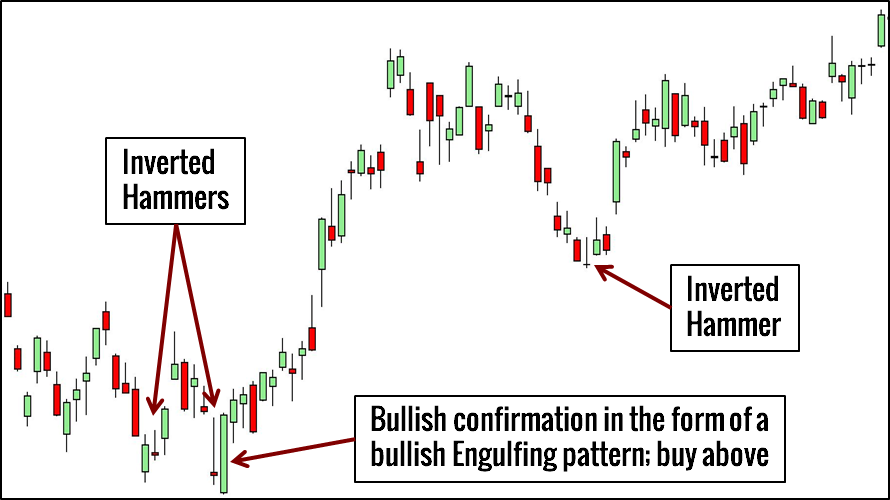

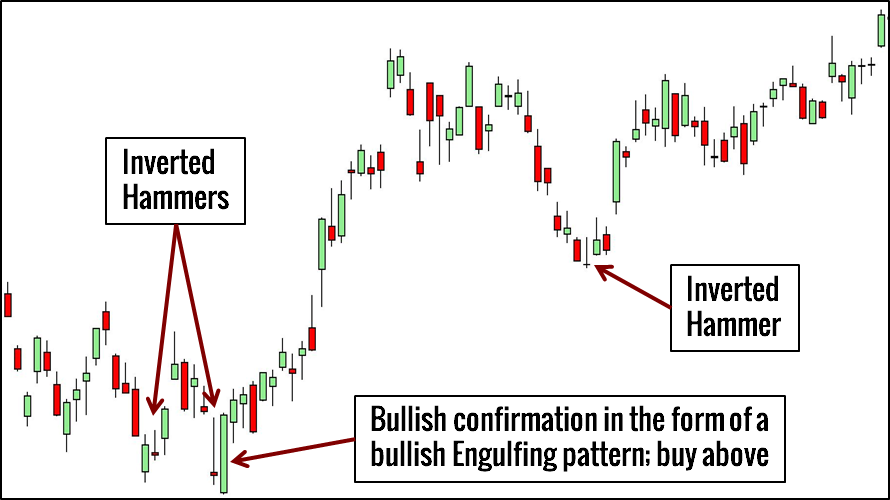

- Candlestick Patterns: Candlestick charts mein specific patterns, jese ke dojis, hammers, aur engulfing patterns, ka istemal kiya jata hai. In patterns se traders price reversals aur trend changes anticipate karte hain.

- Moving Averages: Moving averages, jese ke simple moving averages (SMA) aur exponential moving averages (EMA), price trends ko smooth karne aur trend direction ko identify karne ke liye istemal hote hain.

- Relative Strength Index (RSI): RSI market mein overbought ya oversold conditions ko indicate karta hai. Yeh traders ko batata hai ke market mein kisi currency pair ki kimat zyada ya kam ho sakti hai, aur isse trend reversal ki possibility samajhne mein madad milti hai.

- Fibonacci Retracements: Fibonacci retracements ko use karke traders price movements ke retracement levels aur potential reversal points ko identify karte hain. Yeh ek mathematical concept hai jo natural market retracements ko highlight karta hai.

- MACD (Moving Average Convergence Divergence): MACD trend strength aur trend reversal ko measure karne mein istemal hota hai. Isme moving averages ka difference aur unka signal line shamil hota hai.

- Support and Resistance Zones: Traders support aur resistance levels ke saath saath specific zones ko bhi dekhte hain, jo multiple technical indicators ki convergence point hote hain.

- Volume Analysis: Trading volumes ka analysis karke traders determine karte hain ke market movement kitni strong hai. High volume ke saath hone wala price movement often significant hota hai.

- Chart Patterns: Chart patterns, jese ke head and shoulders, triangles, aur rectangles, traders ko future price movements ke liye clues provide karte hain.

Yeh sabhi tools aur concepts milke traders ko market ke movement ko analyze karne mein madad karte hain. Har ek trader apne trading strategy ke hisab se in tools ko customize karta hai.

تبصرہ

Расширенный режим Обычный режим