ATR Indicator.

Forex trading mein ATR indicators ka istemal bahut ahem hai. ATR indicators market volatility ko measure karte hain aur traders ko trading decisions lene mein madad karte hain. Is article mein hum ATR indicators ke bare mein roman urdu mein batayenge.

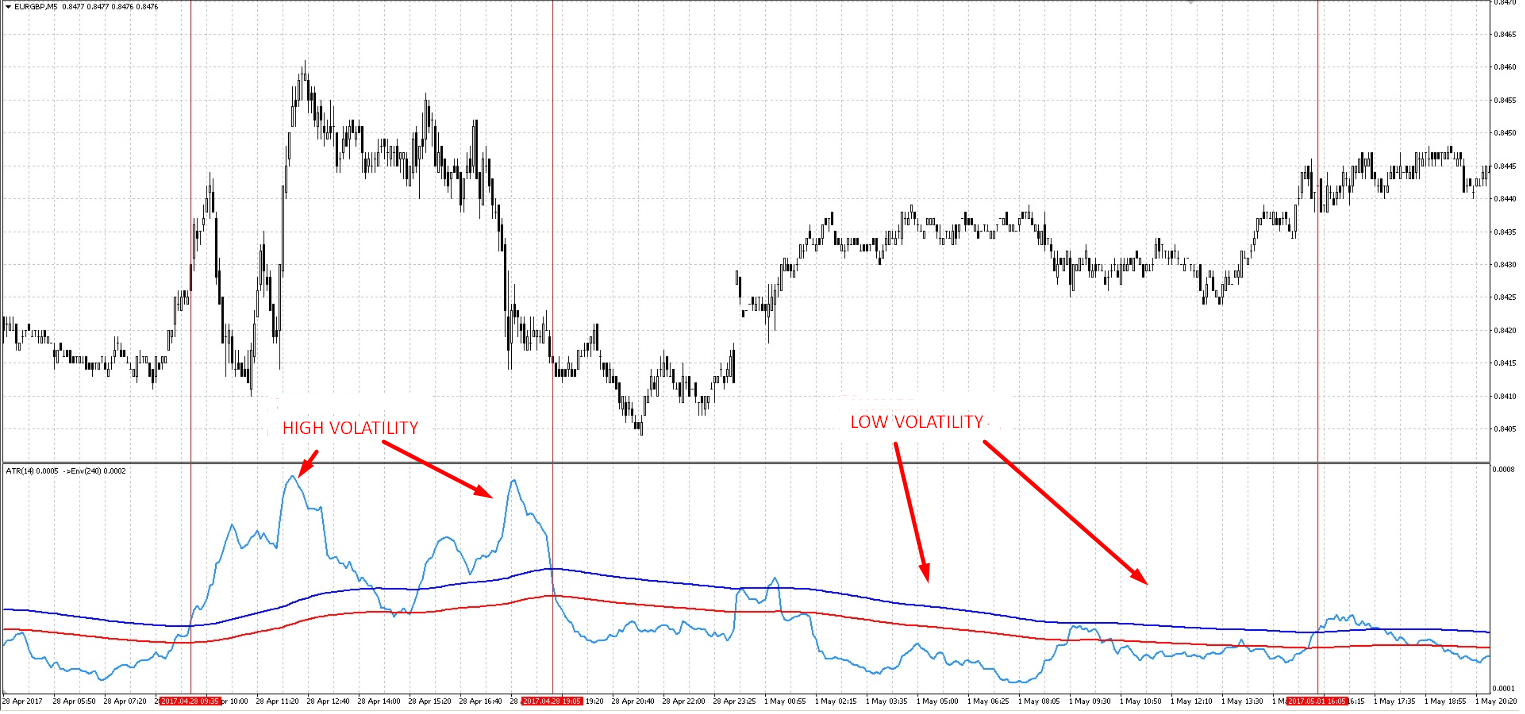

ATR ka matlab "Average True Range" hai. Ye indicator market volatility ko measure karta hai. ATR indicator ka formula market ki high, low aur close prices se calculate kiya jata hai.

ATR Indicator Working.

ATR indicator ki value pip mein hoti hai. Ye value market volatility ko measure karta hai. Agar market volatile hai to ATR value high hogi aur agar market stable hai to ATR value low hoti hay Indicator ki help say trading kerna best hota hay is say trend finding may bhi achi help mil jati hay.

ATR Indicator Uses.

ATR indicator ko istemal karne ke liye traders iska value calculate karte hain aur uske according trading decisions lete hain. Agar ATR value high hai to traders apni stop loss aur take profit levels ko adjust karte hain. Agar ATR value low hai to traders apni positions ko hold karte hain.

ATR Indicator Benefits

ATR indicator traders ko market volatility ko measure karne mein madad karta hai. Isse traders apni positions ko manage karne mein asani hoti hai. ATR indicator ki value ke according traders apni stop loss aur take profit levels ko adjust karte hain.

ATR indicators forex trading mein bahut ahem hai. Ye indicator market volatility ko measure karta hai aur traders ko trading decisions lene mein madad karta hai. ATR indicator ka istemal karne se traders apni positions ko manage karne mein asani hoti hai.

Forex trading mein ATR indicators ka istemal bahut ahem hai. ATR indicators market volatility ko measure karte hain aur traders ko trading decisions lene mein madad karte hain. Is article mein hum ATR indicators ke bare mein roman urdu mein batayenge.

ATR ka matlab "Average True Range" hai. Ye indicator market volatility ko measure karta hai. ATR indicator ka formula market ki high, low aur close prices se calculate kiya jata hai.

ATR Indicator Working.

ATR indicator ki value pip mein hoti hai. Ye value market volatility ko measure karta hai. Agar market volatile hai to ATR value high hogi aur agar market stable hai to ATR value low hoti hay Indicator ki help say trading kerna best hota hay is say trend finding may bhi achi help mil jati hay.

ATR Indicator Uses.

ATR indicator ko istemal karne ke liye traders iska value calculate karte hain aur uske according trading decisions lete hain. Agar ATR value high hai to traders apni stop loss aur take profit levels ko adjust karte hain. Agar ATR value low hai to traders apni positions ko hold karte hain.

ATR Indicator Benefits

ATR indicator traders ko market volatility ko measure karne mein madad karta hai. Isse traders apni positions ko manage karne mein asani hoti hai. ATR indicator ki value ke according traders apni stop loss aur take profit levels ko adjust karte hain.

ATR indicators forex trading mein bahut ahem hai. Ye indicator market volatility ko measure karta hai aur traders ko trading decisions lene mein madad karta hai. ATR indicator ka istemal karne se traders apni positions ko manage karne mein asani hoti hai.

تبصرہ

Расширенный режим Обычный режим